Top 72 IMF Quotes & Sayings

Explore popular IMF quotes.

Last updated on April 14, 2025.

We must work to repeal trade agreements that impede access to affordable generic drugs. We must work to cause the IMF and the World Bank to reduce and eventually eliminate the debt that takes poor nations' resources away from crises like AIDS. We must focus America's leadership on addressing and ending this epidemic.

One by one, these governments came undone, and were forced into IMF tutelage (and national illegitimacy) by the careening oil prices, the debt imbroglio, and falling terms of trade. The last of these governments to fall were the Communist regimes of eastern Europe, which have now gone the way of other Third World countries. The second in the cascade of bifurcations is thus symbolized by 1989.

China's accumulation of reserves is a result of the IMF's mismanagement of the Asian financial crisis a decade or so ago. If countries know they can't rely on the IMF to help them, their best defense is their own reserve cushion. In a time of spreading global recession, too much emphasis on savings in surplus countries like China can impede prospects for global growth.

With all that IMF money, the Thailand's and Mexico's are spared the consequences of their fiscal incompetence, and Wall Street's heavy hitters are spared the consequences of their stupid investments. The global economy is a rigged game, rigged so Third World politicians, rich investors and global corporations win - and U.S. taxpayers lose.

Too many politicians seem to reach for 'infrastructure' as the default answer to investment, as if roads and bridges were the answer to everything. Even the IMF and the World Bank seem to mainly offer infrastructure spending as an alternative to austerity, although they are right to focus on the need for investment.

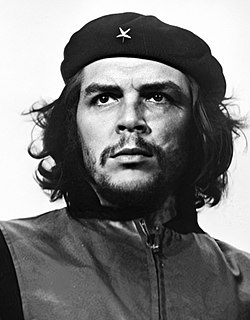

If it is an element of liberation for Latin America, I believe that it should have demonstrated that. Until now, I have not been aware of any such demonstration. The IMF performs an entirely different function: precisely that of ensuring that capital based outside of Latin America controls all of Latin America.

The United States is pushing as policy division of the world into rival currency camps - the dollar area on the one hand, and the Russia-Chinese-Shanghai Cooperation Organization group on the other, especially now that the IMF has changed its rules. People think that if there are rival currency groupings and national currencies are going bust, we might as well use gold as a safe haven.

The IMF and the World Bank, the most opaque and secretive entities, put millions into NGOs who fight against "corruption" and for "transparency." They want the Rule of Law - as long as they make the laws. They want transparency in order to standardise a situation, so that global capital can flow without any impediment.

It seems evident that the IMF has learned nothing from its inequality-inducing policies during the 1980s debt crises in Latin America nor from its recession-deepening response to the East Asian crisis of the late 1990s. In both regions, the IMF has become synonymous with making bad situations worse.

The United States has given frequent and enthusiastic support to the overthrow of democracy in favor of "investor friendly" regimes. The World Bank, IMF, and private banks have consistently lavished huge sums on terror regimes, following their displacement of democratic governments, and a number of quantitative studies have shown a systematic positive relationship between U.S. and IMF / World Bank aid to countries and their violations of human rights.

The IMF is a more complicated issue. I think there is a broad sentiment among both the left and the right that the IMF may be doing more harm than good. On the right, there's the view that it represents a form of corporate welfare that is counter to the IMF's own ideology of markets. But anybody who has watched government from the inside recognizes that governments need institutions, need ways to respond to crises. If the IMF weren't there, it would probably be reinvented. So the issue is fundamentally reform.