Top 1200 Income Quotes & Sayings

Explore popular Income quotes.

Last updated on December 21, 2024.

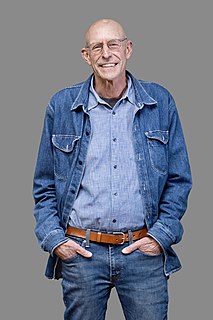

If you look at the performance of the zero-income-tax-rate states and the highest-income-tax-rate states, I believe a large amount of their difference is due to taxes. Not only is it true of the last decade, but I took these numbers back 50 years. And, there's not one year in the last 50 where the zero-income-tax-rate states have not outperformed the highest-income-tax-rate states.

Let's take the nine states that have no income tax and compare them with the nine states with the highest income tax rates in the nation. If you look at the economic metrics over the last decade for both groups, the zero-income-tax-rate states outperform the highest-income-tax-rate states by a fairly sizable amount.

Three-fifths to two-thirds of the federal budget consists of taking property from one American and giving it to another. Were a private person to do the same thing, we'd call it theft. When government does it, we euphemistically call it income redistribution, but that's exactly what thieves do - redistribute income. Income redistribution not only betrays the founders' vision, it's a sin in the eyes of God.

Remember life insurance is intended as income replacement to help dependents and or/spouse pay for things that your income would have covered. When you get to the point that you're dependents (Your kids mostly) aren't dependent on your income, you could reduce the amount of life insurance you are carrying.

The only beneficiaries of income taxation are the politicians, for it not only gives them the means by which they can increase their emoluments, but it also enables them to improve their importance. The have-nots who support the politicians in the demand for income taxation do so only because they hate the haves; . . . the sum of all the arguments for income taxation comes to political ambition and the sin of covetousness.

If I'm owed money, but I say, 'Don't pay me, pay my cousin. Don't pay me, pay my charity,' you can do that, but then the IRS requires that you pay income tax on that. It's your income if you earned it and you directed where it went. If you exercised control over where the money went, you have to pay income tax on that.

When women earn the money for the family, everyone in the family benefits. We also know that when women have an income, everyone wins because women dedicate 90% of the income to health, education, to food security, to the children, to the family, or to the community, so when women have an income, everybody wins.

It makes no difference to a widow with her savings in a 5 percent passbook account whether she pays 100 percent income tax on her interest income during a period of zero inflation or pays no income tax during years of 5 percent inflation. Either way, she is 'taxed' in a manner that leaves her no real income whatsoever. Any money she spends comes right out of capital. She would find outrageous a 100 percent income tax but doesn't seem to notice that 5 percent inflation is the economic equivalent.

I agree that income disparity is the great issue of our time. It is even broader and more difficult than the civil rights issues of the 1960s. The '99 percent' is not just a slogan. The disparity in income has left the middle class with lowered, not rising, income, and the poor unable to reach the middle class.

There is the general belief that the corporation income tax is a tax on the "rich" and on the "fat cats." But with pension funds owning 30% of American large business-and soon to own 50%-the corporation income tax, in effect, eases the load on those in top income brackets and penalizes the beneficiaries of pension funds.

Is it just a coincidence that as the portion of our income spent on food has declined, spending on health care has soared? In 1960 Americans spent 17.5 percent of their income on food and 5.2 percent of national income on health care. Since then, those numbers have flipped: Spending on food has fallen to 9.9 percent, while spending on heath care has climbed to 16 percent of national income. I have to think that by spending a little more on healthier food we could reduce the amount we have to spend on heath care.

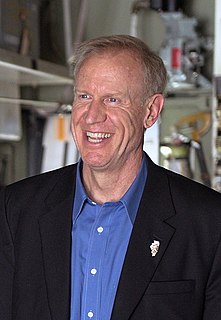

The people who are having the hard time right now are middle-income Americans. Under the president's policies, middle-income Americans have been buried. They're just being crushed. Middle-income Americans have seen their income come down by $4,300. This is a tax in and of itself. I'll call it the economy tax. It's been crushing.

Our federal income tax law defines the tax y to be paid in terms of the income x; it does so in a clumsy enough way by pasting several linear functions together, each valid in another interval or bracket of income. An archeologist who, five thousand years from now, shall unearth some of our income tax returns together with relics of engineering works and mathematical books, will probably date them a couple of centuries earlier, certainly before Galileo and Vieta.

Your income is a direct reward for the quality and quantity of the services you render to your world. Whatever field you are in, if you want to double your income, you simply have to double the quality and quantity of what you do for that income. Or you have to change activities and occupations so that what you are doing is worth twice as much.

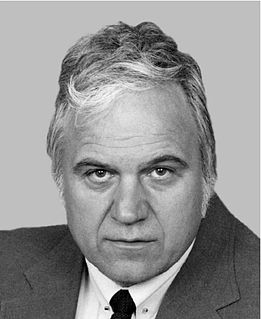

It was not until the Abraham Lincoln administration that an income tax was imposed on Americans. Its stated purpose was to finance the war, but it took until 1872 for it to be repealed. During the Grover Cleveland administration, Congress enacted the Income Tax Act of 1894. The U.S. Supreme Court ruled it unconstitutional in 1895. It took the Sixteenth Amendment (1913) to make permanent what the Framers feared -- today's income tax.

In 1848, Karl Marx said, a progressive income tax is needed to transfer wealth and power to the state. Thus, Marx's Communist Manifesto had as its major economic tenet a progressive income tax. ... I say it is time to replace the progressive income tax with a national retail sales tax, and it is time to abolish the IRS.