Top 564 Inflation Quotes & Sayings - Page 10

Explore popular Inflation quotes.

Last updated on April 15, 2025.

Back in 1960, the paper dollar and the silver dollar both were the same value. They circulated next to each other. Today? The paper dollar has lost 95% of its value, while the silver dollar is worth $34, and produced a 2-3 times rise in real value. Since we left the gold standard in 1971, both gold and silver have become superior inflation hedges.

It is a sobering fact that the prominence of central banks in this century has coincided with a general tendency towards more inflation, not less. [I]f the overriding objective is price stability, we did better with the nineteenth-century gold standard and passive central banks, with currency boards, or even with 'free banking.' The truly unique power of a central bank, after all, is the power to create money, and ultimately the power to create is the power to destroy.

The Fed is pushing a variety of workarounds that would inject trillions in new money into the economy while bypassing the banking system altogether. Time will tell whether or not this will succeed. Meanwhile, a serious danger lurks around the corner. Once the recession is over, the lending will start again. With fractional-reserve banking and limitless supplies of cash on hand, we will likely see the overall price trends reversed, from deflation to inflation to possible hyperinflation.

Because it is a monopoly, government brings inefficiency and stagnation to most things it runs; government agencies pursue the inflation of their budgets rather than the service of their customers; pressure groups form an unholy alliance with agencies to extract more money from taxpayers for their members. Yet despite all this, most clever people still call for government to run more things and assume that if it did so, it would somehow be more perfect, more selfless, next time.

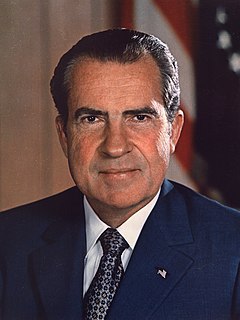

Inflation is not a Robin Hood, taking from the rich to give to the poor. Rather, it deals most cruelly with those who can least protect themselves. It strikes hardest those millions of our citizens whose incomes do not quickly rise with the cost of living. When prices soar, the pensioner and the widow see their security undermined, the man of thrift sees his savings melt away; the white collar worker, the minister, and the teacher see their standards of living dragged down.

The average net worth of the lower half of the distribution, representing 62 million households, was $11,000 in 2013. About one-fourth of these families reported zero wealth or negative net worth, and a significant fraction of those said they were "underwater" on their home mortgages, owing more than the value of the home. This $11,000 average is 50 percent lower than the average wealth of the lower half of families in 1989, adjusted for inflation.

It is not wise for us to permit a few people on the Federal Reserve Board to have life and death power over our economy. My recommendation for reducing some of that power is to repeal legal tender laws and eliminate all taxes on gold, silver and platinum transactions. That way there would be money substitutes and the government money monopoly would be reduced and hence the ability to tax - some people would say steal from - us through inflation.

Supporters of this fundamental change in immigration policy say we need to import more well-educated talent if we're to stay competitive. But exactly whose competitiveness are we talking about? Not the competitiveness of, say, American-born computer engineers. Adjusted for inflation, their earnings haven't gone anywhere in years. That's in part because American companies have been sending so much of their high-tech work abroad. Bringing more foreign-born engineers here under an expanded H1-B visa program, or a point system for that matter, will just depress wages even further.

Tax reduction has an almost irresistible appeal to the politician, and it is no doubt also gratifying to the citizen. It means more dollars in his pocket, dollars that he can spend if inflation doesn't consume them first. But dollars in his pocket won't buy him clean streets or an adequate police force or good schools or clean air and water. Handing money back to the private sector in tax cuts and starving the public sector is a formula for producing richer and richer consumers in filthier and filthier communities. If we stick to that formula we shall end up in affluent misery.

Any money the government spends must be taxed, borrowed or conjured out of thin air by the Federal Reserve, and that will reduce sound private investment. Obama has no real wealth to inject into the economy. He can only move around existing money while inflation robs us of purchasing power. Meanwhile, private investors who might have produced a better engine, battery, computer, cancer treatment or other wealth-creating and life-enhancing innovations hold back for fear that big government will undermine productive efforts.

The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit. In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. Deficit spending is simply a scheme for the hidden confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists' antagonism toward the gold standard.

The most common mistakes were investing in money market funds by people who were so scared at the prospect of managing their own funds that they picked the most conservative option, and their investments did not keep up with inflation. The second major mistake was being too heavily invested in their own company's stock, and buying when it was high and there was a lot of optimism about the company, and then having to sell it low when the company got in trouble.

I think it's time we had a President who will provide the only real economic security: good jobs. A President who will provide middle class payroll tax relief to get money in the pockets of workers who will spend it, not more tax giveaways for those at the top to stimulate the economy in the Cayman Islands and Bermuda. A President who will index the minimum wage to inflation and raise it from a 30 year low, not increase the tax burden on the middle class and those struggling to join it.

Sharp increases in the minimum wage rate are also inflationary. Frequently workers paid more than the minimum gauge their wages relative to it. This is especially true of those workers who are paid by the hour. An increase in the minimum therefore increases their demands for higher wages in order to maintain their place in the structure of wages. And when the increase is as sharp as it is in H.R. 7935, the result is sure to be a fresh surge of inflation.

Much of American wealth is an illusion which is being secretly gnawed away and much of it will be completely wiped out in the near future....So what is the rest of your future? A grisly list of unpleasant events -- exploding inflation, price controls, erosion of your savings (eventually to nothing), a collapse of private as well as government pension programs, and eventually an international monetary holocaust which will sweep all paper currencies down the drain and turn the world upside down.

This law represents a cornerstone in a structure which is being built but is by no means completed--a structure intended to lessen the force of possible future depressions, to act as a protection to future administrations of the Government against the necessity of going deeply into debt to furnish relief to the needy--a law to flatten out the peaks and valleys of deflation and of inflation--in other words, a law that will take care of human needs and at the same time provide for the United States an economic structure of vastly greater soundness.

If we discovered that, you know, space aliens were planning to attack and we needed a massive buildup to counter the space alien threat and really inflation and budget deficits took secondary place to that, this slump would be over in 18 months. ... There was a Twilight Zone episode like this in which scientists fake an alien threat in order to achieve world peace. Well, this time, we don't need it, we need it in order to get some fiscal stimulus.

The most obvious and yet the oldest and most stubborn error on which the appeal of inflation rests is that of confusing ‘money’ with ‘wealth’…Real wealth, of course, consists in what is produced and consumed: the food we eat, the clothes we wear, the houses we live in. It is railways and roads and motor cars; ships and planes and factories; schools and churches and theaters; pianos, paintings and books. Yet so powerful is the verbal ambiguity that confuses money with wealth, that even those who at times recognize the confusion will slide back into it in the course of their reasoning.

The fears of recession in the aftermath of Black Monday have turned to fears of the economy racing ahead too fast, with inflation edging up and a substantial current account deficit... People understandably feel more confident about their future than they've done for decades, but as a result they have been borrowing more and saving less... Coming on top of a massive income investment boom, it's all been just a bit too much of a good thing.

We're living in a funny world kid, a peculiar civilization. The police are playing crooks in it, and the crooks are doing police duty. The politicians are preachers, and the preachers are politicians. The tax collectors collect for themselves. The Bad People want us to have more dough, and the good people are fighting to keep it from us. It's not good for us, know what I mean? If we had all we wanted to eat, we'd eat too much. We'd have inflation in the toilet paper industry. That's the way I understand it. That's about the size of some of the arguments I've heard.

Here's why I think the public service jobs are almost unavoidable: When we have downturns in the economy - and we will, for we haven't repealed the business cycle - unemployment will build, yet we no longer have any safety net. What are we going to do? Unless we decide to pull out all the stops and lower interest rates immediately and risk turning a recession into wild inflation, we're going to have to figure out some way of providing some more, not job security, but employment security.

Just imagine, more than half of the young people in the European Union do not have jobs. How can one explain that? How can one explain that to a working family, that produces goods and services, those who produce the olive oil that is a a main source of food in any European country? They humbly work the land with great effort and then the little resources they had saved in banks have now become dust simply because they did not have the means to withstand inflation produced by the adjustment policies.