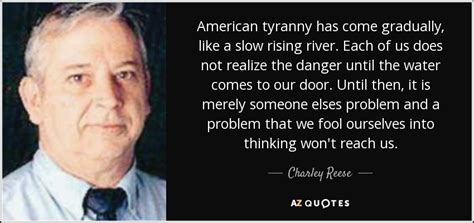

Top 564 Inflation Quotes & Sayings - Page 7

Explore popular Inflation quotes.

Last updated on April 20, 2025.

The consequences of inflation are malinvestment, waste, a wanton redistribution of wealth and income, the growth of speculation and gambling, immorality and corruption, disillusionment, social resentment, discontent, upheaval and riots, bankruptcy, increased government controls, and eventual collapse.

Modern conservatism was forged in the crucible of the 1970s inflation crisis, and in the aftermath of the 2008 financial crash many conservatives were convinced that there was nothing the Federal Reserve could do about the vast army of the unemployed without touching off a similar inflationary spiral.

Whoever controls the volume of money in our country is absolute master of all industry and commerce...when you realize that the entire system is very easily controlled, one way or another, by a few powerful men at the top, you will not have to be told how periods of inflation and depression originate.

The liberation of women from exclusive domesticity did not originate in feminist books, or a war, or a big inflation, although they contributed to its progress. The rising enrollment of women in the paid labor force is a straightforward consequence of the industrial revolution of two hundred years ago.

Deficit financing proper is rather the process whereby a Government spends more money that it withdraws from the economy by taxation, borrowing, running down reserves, etc.; thereby causing in most circumstances, and very acutely in ours, monetary inflation and severe pressure on the balance of payments.