Top 564 Inflation Quotes & Sayings - Page 9

Explore popular Inflation quotes.

Last updated on April 21, 2025.

Hyperinflation is not going to happen in this country, will never happen... The Fed putting so much money into the system is not going to create the risk of hyperinflation in the future. We have a strong independent Federal Reserve with a very strong mandate from the Congress, and they will do what's necessary to keep inflation low and stable over time.

In a free enterprise system, with an honest and stable money, there is dominantly a close link between effort and productivity, on the one hand, and economic reward on the other. Inflation severs this link. Reward comes to depend less and less on effort and production, and more and more on successful gambling and luck.

The intelligence community is so vast that more people have top secret clearance than live in Washington. The U.S. will spend more on the war in Afghanistan this year, adjusting for inflation, than we spent on the Revolutionary War, the War of 1812, the Mexican-American War, the Civil War and the Spanish-American War combined.

Cash - in savings accounts, short-term CDs or money market deposits - is great for an emergency fund. But to fulfill a long-term investment goal like funding your retirement, consider buying stocks. The more distant your financial target, the longer inflation will gnaw at the purchasing power of your money.

Thanksgiving. It proved you had survived another year with its wars, inflation, unemployment, smog, presidents. It was a grand neurotic gathering of clans: loud drunks, grandmothers, sisters, aunts, screaming children, would-be suicides. And don't forget indigestion. I wasn't different from anyone else: There sat the 18-pound bird on my sink, dead, plucked, totally disemboweled. Iris would roast it for me.

You can look at history of these things, and Social Security wasn't devised to be a system that supported you for a 30-year retirement after a 25-year career... So there will be things that, you know, the retirement age has to be changed, maybe some of the benefits have to be affected, maybe some of the inflation adjustments have to be revised.

The most sinister of all taxes is the inflation tax and it is the most regressive. It hits the poor and the middle class. When you destroy a currency by creating money out of thin air to pay the bills, the value of the dollar goes down, and people get hit with a higher cost of living. It's the middle class that's being wiped out. It is most evil of all taxes.

In essence, the stock market represents three separate categories of business. They are, adjusted for inflation, those with shrinking intrinsic value, those with approximately stable intrinsic value, and those with steadily growing intrinsic value. The preference, always, would be to buy a long-term franchise at a substantial discount from growing intrinsic value.

Because of rampant inflation, living standards have been dropping for the great majority of the population. The people are poorer because standards of health and education have fallen. And conditions in the rural areas are worse off than they have ever been. So, you cannot equate the so-called open-market economy adopted by the SLORC with any real development that benefits people.

A realistic definition of risk recognizes the potential loss of capital through inflation and taxes, and would include at least the following two factors: The probability that the investment you chose will preserve your capital over the time you intend to invest your funds. The probability the investments you select will outperform alternative investments for this period.

In the popular mind, if Hoyle is remembered it is as the prime mover of the discredited Steady State theory of the universe. "Everybody knows" that the rival Big Bang theory won the battle of the cosmologies, but few (not even astronomers) appreciate that the mathematical formalism of the now-favoured version of Big Bang, called inflation, is identical to Hoyle's version of the Steady State model.

A strong currency means that American consumers and businesses can buy imported goods and services more cheaply and that inflation and interest rates will be lower, ... It also puts pressure on American industry to increase productivity and competitiveness. These benefits can feed on themselves as foreign capital flows in more readily because of greater confidence in our currency. A weak dollar would have the contrary effects.

For equity markets, the combination of low interest rates, strong economic growth and low inflation has proved very beneficial, with global share markets rising solidly in each of the past three years. This has been underpinned by strong growth in profits so that, notwithstanding the rise in share prices, P/E ratios have been declining on average.

We believe that our truly urgent need is to make our nation secure, our economy strong and our dollar sound. For every American this matter of the sound dollar is crucial. Without a sound dollar, every American family would face a renewal of inflation, an ever-increasing cost of living, the withering away of savings and life insurance policies.

Mr. Greenspan did a very good job in the early 1990's. But recently he's fallen prey to this crazy theory that prosperity causes inflation. So they're trying to slow the economy down by raising interest rates. It's like a doctor saying you're in great health, so we have to make you sick a little bit. It's a bizarre theory. It's going to hurt our economy.

If this is the degree of inflation planned for in advance, the real outcome is indeed likely to be such that most of those who will retire at the end of the century will be dependent on the charity of the younger generation. And ultimately not morals but the fact that the young supply the police and the army will decide the issue: concentration camps for the aged unable to maintain themselves are likely to be the fate of an old generation whose income is entirely dependent on coercing the young.

The reality is that business and investment spending are the true leading indicators of the economy and the stock market. If you want to know where the stock market is headed, forget about consumer spending and retail sales figures. Look to business spending, price inflation, interest rates, and productivity gains.

Never forget that no government has wealth of its own to spend. The money has to come from taxation, monetary inflation, or debt expansion that must be paid later. And government's spending choices will always be uneconomic relative to how society would use that wealth. That is to say, the money will be wasted.

There are signs that the age of petroleum has passed its zenith. Adjusted for inflation, a barrel of crude oil now sells for three times its long-run average. The large western oil companies, which cartellised the industry for much of the 20th century, are now selling more oil than they find, and are thus in the throes of liquidation.

You may have noticed that society is rapidly going downhill. Inflation, lack of fuel and even war cast deep shadows over the world. And the most serious part of this is that drugs, both medical and street drugs, have disabled a majority of those who could have handled it, including the political leaders, and have even paralyzed the coming generations.

Inflation, especially a slow steady rise in prices, encourages producers, because it means that they can commit themselves to costs of production on one price level and then, later, offer the finished product for sale at a somewhat higher price level. This situation encourages production because it gives confidence of an almost certain profit margin.

The President's policy proposal, known as 'chained CPI,' would re-calculate the cost of living for Social Security beneficiaries. That new number won't keep up with inflation on things like food and health care -- the basics that we need to live. In short, 'chained CPI' is just a fancy way to say 'cut benefits for seniors, the permanently disabled, and orphans.'

The time will come, and probably during 2009, that the only way the U.S. will be able to fund its deficits is to create money by printing it. The Treasury will have to sell bonds, and, in the absence of foreign buyers, the Fed will have to print the money to buy them. The consequence will be runaway inflation, increasing interest rates, recession, and inevitable tax increases on all Americans.

When my family moved from Ireland in the 70s, Britain was such a difficult place to be Irish. It was a decade of real social and economic upheaval in Britain. There were strikes, the three-day week, the oil crises, huge inflation, the winter of discontent and, what was it, four Prime Ministers? And relations between Britain and Ireland at that time were at an all-time low. I was born in the year of Bloody Sunday and of course the pub bombings happened in the mid-1970s.

Higher education is the place where people who had big plans in high school get stuck in fierce rivalries with equally smart peers over conventional careers like management consulting and investment banking. For the privilege of being turned into conformists, students (or their families) pay hundreds of thousands of dollars in skyrocketing tuition that continues to outpace inflation. Why are we doing this to ourselves?

In the North, neither greenbacks, taxes, nor war bonds were enough to finance the war. So a national banking system was created to convert government bonds into fiat money, and the people lost over half of their monetary assets to the hidden tax of inflation. In the South, printing presses accomplished the same effect, and the monetary loss was total.

If you're a poor worker - this is for new workers coming into the workplace - your benefits will increase at the current rate of increase. If you're a wealthier worker, your benefits would increase at the rate of inflation. And those changes would affect positively the unfunded liabilities inherent in Social Security.

With old inflation riding the headlines, I have read till I am bleary-eyed, and I can't get head from tails of the whole thing. ... Now we are living in an age of explanations-and plenty of 'em, too-but no two things that's been done to us have been explained twice the same way, by even the same man. It's and age of in one ear and out the other.

To reverse the trend and reduce the role of government in our lives, and thus alleviate the government deficit and inflation pressures, is a giant educational task. The social and economic ideas that gave birth to the transfer system must be discredited and replaced with old values of individual independence and self-reliance. The social philosophy of individual freedom and unhampered private property must again be our guiding light.

What we also have to recognize is that the deficit levels that I'm inheriting, over a trillion dollars, coming out of last year, that that is unsustainable. At a certain point, other countries stop buying our debt, at a certain point, we'd end up having to raise interest rates, and it would end up creating more economic chaos and potentially inflation.

Kelso's proposals do promise to free us from our morbid dependency on economic health through armament manufacture; they promise a way out of the welfare mess, out of foodstamps and ship subsidies, out of perpetual inflation, and they suggest a means of doing these things without being too disruptive of the wealth of five percent of the population who own the rest of us.

It was shameful that, after Haiti, Colombia was the second most unequal country in Latin America. But we've achieved some things; the inequality is coming down, and coming down fast. The growing economy has provided us with the funds to finance a very progressive social policy that has reduced extreme poverty. We have the lowest inflation rate of all Latin-America countries and the highest growth rate.

Monetary reform, if it is to be genuine and successful, must sever money and banking from politics. That's why a modern gold standard must have: no central bank; no fixed rations between gold and silver; no bail-outs; no suspension of gold payments or other bank frauds; no monetization of debt; and no inflation of the money supply, all of which have proved so disastrous in the past.

The theory of economic shock therapy relies in part on the roleof expectations on feeding an inflationary process. Reining in inflation requires not only changing monetary policy but also changing the behavior of consumers, employers and workers. The role of a sudden, jarring policy shift is that it quickly alters expectations, signaling to the public that the rules of the game have changed dramatically - prices will not keep rising, nor will wages.

Between 1965 (the beginning of LBJ's "Great Society") and 1994, welfare spending has cost the taxpayers $5.4 trillion in constant 1993 dollars. The War on Poverty has cost us 70 % more than the total price tag for defeating both Germany and Japan in World War II, after adjusting for inflation. Many believe that Welfare has destroyed millions of families and cost a huge portion of our national wealth in the process.

Lenin is said to have declared that the best way to destroy the Capitalist System was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth.

People will make worse financial decisions for them if they're choosing from a lot of options than if they're choosing from a few options. If they have more options they're more likely to avoid stocks and put all their money in money market accounts, which doesn't even grow at the rate of inflation.

Here at home, ... while the most likely scenario remains solid growth and low inflation -- subject to the usual ups and downs -- certain sectors have been impacted by the crisis, some because of increased imports and others because of decreased exports. Moreover, problems in the global economy do constitute a risk to all our overall economic well-being.

Having examined the nature of fractional reserve and of central banking, and having seen how the questionable blessings of Central Banking were fastened upon America, it is time to see precisely how the Fed, as presently constituted, carries out its systemic inflation and its control of the American monetary system.

For all the gold and silver stolen and shipped to Spain did not make the Spanish people richer. It gave their kings an edge in the balance of power for a time, a chance to hire more mercenary soldiers for their wars. They ended up losing those wars anyway, and all that was left was a deadly inflation, a starving population, the rich richer, the poor poorer, and a ruined peasant class

If government manages to establish paper tickets or bank credit as money, as equivalent to gold grams or ounces, then the government, as dominant money-supplier, becomes free to create money costlessly and at will. As a result, this 'inflation' of the money supply destroys the value of the dollar or pound, drives up prices, cripples economic calculation, and hobbles and seriously damages the workings of the market economy.

Inflation is certainly low and stable and, measured in unemployment and labour-market slack, the economy has made a lot of progress. The pace of growth is disappointingly slow, mostly because productivity growth has been very slow, which is not really something amenable to monetary policy. It comes from changes in technology, changes in worker skills and a variety of other things, but not monetary policy, in particular.

We used to think that you could spend your way out of a recession and increase employment by cutting taxes and boosting government spending. I tell you in all candour that that option no longer exists, and in so far as it ever did exist, it only worked on each occasion since the war by injecting a bigger dose of inflation into the economy, followed by a higher level of unemployment as the next step.

Modern thinking is that time did not start with the big bang, and that there was a multiverse even before the big bang. In the inflation theory, and in string theory, there were universes before our big bang, and that big bangs are happening all the time. Universes are formed when bubbles collide or fission into smaller bubles.

Synthetic Worlds is a surprisingly profound book about the social, political, and economic issues arising from the emergence of vast multiplayer games on the Internet. What Castronova has realized is that these games, where players contribute considerable labor in exchange for things they value, are not merely like real economies, they are real economies, displaying inflation, fraud, Chinese sweatshops, and some surprising in-game innovations.

Strictly speaking, it probably is not “necessary” for the federal government to tax anyone directly; it could simply print the money it needs. However, that would be too bold a stroke, for it would then be obvious to all what kind of counterfeiting operation the government is running. The present system combining taxation and inflation is akin to watering the milk; too much water and the people catch on.

We need to get the government out of the way. Inflation hits the middle class and the poor the most. Those are the people who are losing it. We don't have enough competition. There's a doctor monopoly out there. We need alternative health care freely available to the people. They ought to be able to make their own choices and not controlled by the FDA preventing them to use some of the medications.

There is an island fantasy A "Someday I'll," we'll never see When recession stops, inflation ceases Our mortgage is paid, our pay increases That Someday I'll where problems end Where every piece of mail is from a friend Where the children are sweet and already grown . . . . Most unhappy people . . . put happiness on "law away" And struggle through a blue today . . . . Life's most important revelation Is that the journey means more than the destination . . .

Salaries haven't kept up with inflation, and there is such anger coming out of Washington about immigrants that I think it has curtailed the ability of local folks here to hire immigrants, .. I really believe it starts from the top, and the policy continues to be one of ignoring people at the bottom, cutting taxes for those on the top and spending a lot of money for a war built on lies.

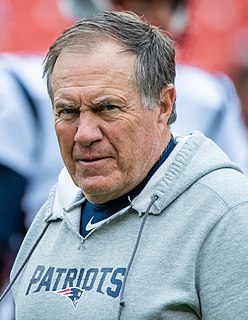

I've learned about the inflation range situation. Obviously with our footballs being inflated to the 12.5-pound range, any deflation would then take us under that specification limit. Knowing that now, in the future we will certainly inflate the footballs above that low level to account for any possible change during the game.

What Medicaid basically does is allows them to choose the two base years that they would calculate current their reimbursement levels on. And they all have per-capita allotments based upon what the states are experiencing today in terms of Medicaid costs. And then those are inflated over the years, the next decade, increased at the rate of inflation. And so they have to figure out how to take those dollars and put them to the best use in the state.

This much I would say: Socialism has failed all over the world. In the eighties, I would hear every day that there is no inflation in the Soviet Union, there is no poverty in the Soviet Union, there is no unemployment in the Soviet Union. And now we find that, due to Socialism, there is no Soviet Union!

Capitalism is going to deal itself out of existence, but before it does that, you're gonna pay $50 for a latte, because inflation is going impoverish all of us before people get pissed off enough to realize that all of the last hundred years of economic progress was actually a shell game to create billionaires, while the great masses of people saw their standard of living eroded and destroyed.