Top 660 Insider Trading Quotes & Sayings

Explore popular Insider Trading quotes.

Last updated on April 14, 2025.

In my former life I was in insider, as much as anybody else. And I knew what it's like, and I still know what it's like to be an insider. It's not bad, it's not bad. Now I'm being punished for leaving the special club and revealing to you the terrible things that are going on having to do with America. Because I used to be part of the club, I'm the only one that can fix it.

China has been trading technology and systems with Iraq, Iran, Syria, Libya, Pakistan, North Korea now for years and years. Indigenously? No they're not going to have one. But they're getting dangerously close to having one. We can all have reason to suspect. Why would they not if they're trading with these countries?

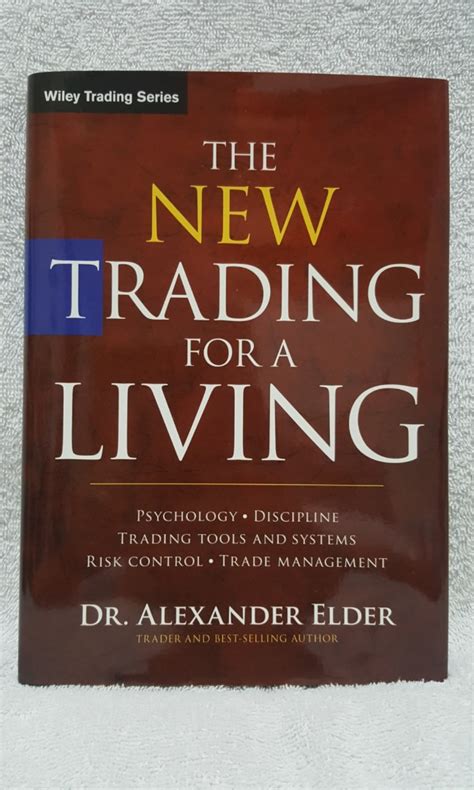

Successful trading depends on the 3M`s - Mind, Method and Money. Beginners focus on analysis, but professionals operate in a three dimensional space. They are aware of trading psychology their own feelings and the mass psychology of the markets. Each trader needs to have a method for choosing specific stocks, options or futures as well as firm rules for pulling the trigger - deciding when to buy and sell. Money refers to how you manage your trading capital.

Don’t ever average losers. Decrease your trading volume when you are trading poorly; increase your volume when you are trading well. Never trade in situations where you don’t have control. For example, I don’t risk significant amounts of money in front of key reports, since that is gambling, not trading.

I got all the respect in the world for the front-runners in this race, but ask yourself: If we replace a Democratic insider with a Republican insider, you think we're really going to change Washington, D.C.? You don't have to settle for Washington and Wall Street insiders who supported the Wall Street bailout and the Obamacare individual mandate.

The way the textbook works is you have gains from trade that should be distributed across all the trading partners. As soon as one bad actor like China massively cheats, they win at the expense of us; they win at the expense of Europe, and over time, it threatens the entire integrity of the global financial system and the global trading system.

Gossip is certainly one of the things that language is useful for, because it's always handy to know who needs a favor, who can offer a favor, who's available, who's under the protection of a jealous spouse. And being the first to get a piece of gossip is like engaging in insider trading: You can capitalize on an opportunity before anyone else can.

The key to trading success is emotional discipline. If intelligence were the key, there would be a lot more people making money trading… I know this will sound like a cliché, but the single most important reason that people lose money in the financial markets is that they don't cut their losses short.

I think (fantasy football) has become something that needs to be looked at in terms of regulation. Effectively, it's day trading without any regulation at all. When you have insider information, which has apparently been the case, when you have people who use that information, use big data to try and take advantage of it, there has to be some regulation. If they can't regulate themselves, then the NFL needs to look at moving away from them a little bit, and there should be some regulation.

I think one of the dirty little secrets that I try to reveal here is that Washington is not hopelessly divided. It's very interconnected. We're talking about people sort of feeding from the same insider trough, where if you are known as an insider, you are going to get paid and do very, very, very well.

I'm not an insider. I'm not on the board. I'm an outsider. That implies a certain kind of separation ... because the company can't, without an appropriate nondisclosure and trading rules, share confidential data with me that it would not share with any other shareholder. You could say that implies a certain kind of separation.

As a society, we have this perception that women are emotional. The research, however, tells us that, on trading floors, that poor risk rises and falls with testosterone levels, and these trading floors are 85 percent, 90 percent male, and these gentlemen tend, under periods of stress, to show off for each other. That's dangerous.

You must fully understand, strongly believe in, and be totally committed to your trading philosophy. In order to achieve that mental state, you have to do a great deal of independent research. A trading philosophy is something that cannot just be transferred from one person to another; it's something that you have to acquire yourself through time and effort.