Top 660 Insider Trading Quotes & Sayings - Page 11

Explore popular Insider Trading quotes.

Last updated on April 16, 2025.

The agnostic does not simply say, "l do not know." He goes another step, and he says, with great emphasis, that you do not know. He insists that you are trading on the ignorance of others, and on the fear of others. He is not satisfied with saying that you do not know, -- he demonstrates that you do not know, and he drives you from the field of fact -- he drives you from the realm of reason -- he drives you from the light, into the darkness of conjecture -- into the world of dreams and shadows, and he compels you to say, at last, that your faith has no foundation in fact.

In trading with each other cities can't be in too different stages of development, and they can't copy one another. Backward cities, or younger cities, or newly forming cities in supply regions, have to develop to a great extent on one another's shoulders. This is one of the terrible things about empires. Empires want them only to trade with the empire, which doesn't help them at all. It's just a way of exploiting them.

My off-the-cuff remarks at the University of Virginia were with regard to global macro traders, who are on-call 24/7 and of whom there are likely only a few thousand successful practitioners in the world today. Macro trading requires a high degree of skill, focus and repetition. Life events, such as birth, divorce, death of a loved one and other emotional highs and lows are obstacles to success in this specific field of finance.

Despite the Internet 's origin in the late 1960s as a government sponsored means of communication between the Department of Defense, private industry, and academia, it has been at its best and generated the greatest economic, social, and technological benefits since it was 'liberated' by the hordes of 'geeks' who were originally hired to run it by employers who were not themselves conversant with computers, and couldn't tell when their employees were exchanging official traffic or trading dirty jokes and recipes for marijuana brownies.

He saw merchants trading, princes hunting, mourners wailing for their dead, whores offering themselves, physicians trying to help the sick, priests determining the most suitable day for seeding, lovers loving, mothers nursing their children—and all of this was not worthy of one look from his eye, it all lied, it all stank, it all stank of lies, it all pretended to be meaningful and joyful and beautiful, and it all was just concealed putrefaction. The world tasted bitter. Life was torture

It's my guess that something like 5% of GDP goes to money management and itsattendant friction. I define it broadly - annuities, incentive pay, all trading, etc. Nobody else has used figures that high, but that's my guess. Worst of all, the people doing this are among the best and the brightest. Hundreds and thousands of engineers, etc. are going into hedge funds and investment banking. That is not an intelligent allocation of the brainpower of the civilization.

A great man is a gift, in some measure a revelation of God. A great man, living for high ends, is the divinest thing that can be seen on earth. The value and interest of history are derived chiefly from the lives and services of the eminent men whom it commemorates. Indeed, without these, there would be no such thing as history, and the progress of a nation would be little worth recording, as the march of a trading caravan across a desert.

Almost all of the demand for oil that suddenly pushed prices up was speculative demand. People began to speculate not only in stocks and bonds and real estate, but also in commodities. The market went up for old tankers, which were used simply to store oil in. A lot of the oil was simply being stored for trading, not used.

I think that a true economics thinker or a Marxist thinker would make nonsense of my argument, although I have given massive seminars and no one has demolished it so far. I did think that this idea from an artisanal and trading perception of the auratic quality of goods when they are given character and inscription, made the stories of phantasmic wealth read more powerfully in the 18th and 19th centuries than the stories of Cinderella's wealth, because they are conjured out of nothing by these magic means.

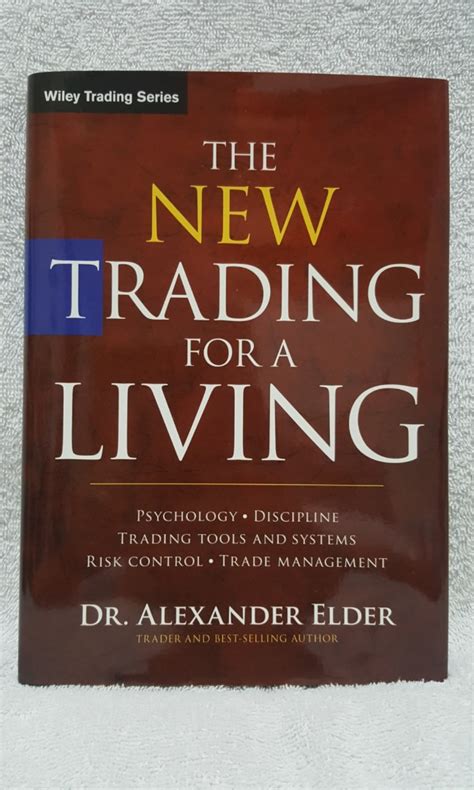

Having observed his market calls real time over the years, I can say that Jason Perl's application of the DeMark Indicators distinguishes his work from industry peers when it comes to market timing. This book demonstrates how traders can benefit from his insight, using the studies to identify the exhaustion of established trends or the onset of new ones. Whether you're fundamentally or technically inclined, Perl's DeMark Indicators is an invaluable trading resource.

Offering 'comprehensive' reform usually means years of arguing and horse-trading among pressure groups to get anything done. By the time all the special interests are appeased or bought off, the resulting elephantine legislation typically looks nothing like what was intended. In short, big-government medicine usually doesn't work on big-government sickness. If President Obama wants 'comprehensive' change, it would be better simply not to spend any more money we don't have.

Every class of society has its cant of lamentation, which is understood or regarded by none but themselves; and every part of life has its uneasiness, which those who do not feel them will not commiserate. An event which spreads distraction over half the commercial world, assembles the trading companies in councils and committees, and shakes the nerves of a thousand stockjobbers, is read by the landlord and the farmer with frigid indifference.

You have to turn over a lot of rocks to find those little anomalies. You have to find the companies that are off the map - way off the map. You may find local companies that have nothing wrong with them at all. A company that I found, Western Insurance Securities, was trading for $3/share when it was earning $20/share!! I tried to buy up as much of it as possible. No one will tell you about these businesses. You have to find them.

The investor is neither smart not richer when he buys in an advancing market and the market continues to rise. That is true even when he cashes in a goodly profit, unless either (a) he is definitely through with buying stocks an unlikely story or (b) he is determined to reinvest only at considerably lower levels. In a continuous program no market profit is fully realized until the later reinvestment has actually taken place, and the true measure of the trading profit is the difference between the previous selling level and the new buying level.

Tachyon OPC+ is a natural extension of our market-winning Tachyon platform, giving customers a clear path to minimizing the OPC error budget and producing better-performing circuits sooner and faster. Until now, customers have had to deal with a delicate balance of compromises when producing advanced OPC-enabled circuits, including trading accuracy for speed. Tachyon OPC+ breaks free from these compromises.

At the moment we are hard-wired into the European markets - 50% of our exports go to Europe - and that has not been good for the UK. So I'm not saying "make Britain entirely dependent on China". I'm saying "let's diversify a bit". When I became chancellor, China was our ninth largest trading partner. This is the world's second biggest economy. China was doing more business with Belgium than it was with Britain.

Here's the analogy. If my body were a car, I'd be thinking about trading it in around now. I would like to upgrade. I would be actually on the lot somewhere and some guy with a loud sports jacket would be sizing me up...kinda lookin' around goin--maybe kickin my knees. Looking behind me going: That looks a little bashed in back there...Yeah. You mind if I check under the hood?" 'Well yes I do! Thank you very much.

Most private traders on a losing streak keep trying to trade their way out of a hole. A loser thinks a successful trade is just around the corner, and that his luck is about to turn. He keeps putting on more trades and increases his size, all the while digging himself a deeper hole in the ice. The sensible thing to do would be to reduce your trading size and then stop and review your system.

In this world, there is no absolute good, no absolute evil," the man said. "Good and evil are not fixed, stable entities, but are continually trading places. A good may be transformed into an evil in the next second. And vice versa. Such was the way of the world that Dostoevsky depicted in The Brothers Karamazov. The most important thing is to maintain the balance between the constantly moving good and evil. If you lean too much in either direction, it becomes difficult to maintain actual morals. Indeed, balance itself is the good.

Investors, of course, can, by their own behavior make stock ownership highly risky. And many do. Active trading, attempts to "time" market movements, inadequate diversification, the payment of high and unnecessary fees to managers and advisors, and the use of borrowed money can destroy the decent returns that a life-long owner of equities would otherwise enjoy. Indeed, borrowed money has no place in the investor's tool kit.

From the public's perspective, they like to see guys that go out there and stand. Now, if you happen to be one of those two athletes that are standing out there and trading with each other, afterwards you would disagree with those people. The spectators are not on the receiving end of all those strikes. I have young guys who say, "I like to stand and trade." I say, "Really? Then you are not a very intelligent fighter."

I will love you like God, because of God, mighted by the power of God. I will stop expecting your love, demanding your love, trading for your love, gaming for your love. I will simply love. I am giving myself to you, and tomorrow I will do it again. I suppose the clock itself will wear thin its time before I am ended at this altar of dying and dying again. God risked Himself on me. I will risk myself on you. And together, we will learn to love, and perhaps then, and only then, understand this gravity that drew Him, unto us.

We have more information than ever before, and it is harder to avoid actually seeing what the other side is saying. Yes, we in Business insider focus on publications that we feel speak to us, but that is the same way it was 20 or 100 years ago. In the US, two million people have subscribed to the New York Times and many more millions think it is a terrible, liberal paper they would never read. We can choose to put ourselves in a bubble of only people who agree with us, but in the digital world there are many more ways of saying "Hey, here is something you might want to consider".

I love Maude Pearson character from Agel. I love that she walls her son up because he has a girlfriend! In fact, I have that clip on my reel - her walling him up and saying, "What are you going to do about that streetwalker now? You belong to me! What are you going to do?" And did you know the ghost mom has her own Angel trading card?

The tax that was supposed to soak the rich has instead soaked America. The beneficiary of the income tax has not been the poor, but big government. The income tax has given us a government bureaucracy that outnumbers the manufacturing work force. It has created welfare dependencies that have entrapped millions of Americans in an underclass that is forced to live a sordid existence of trading votes for government handouts.

The president who did the most for black Americans in 20th century history was Lyndon Johnson, and he got his hands dirty by dealing with Southern senators, Southern congressmen, horse trading with them, cajoling them, learning what not to talk about. And he got civil rights passed and Great Society programs. That should be the model. Get over yourself.

This is not really currency that circulates. It's like the old joke about expensive vintage wine. Wine prices will go up and once in a while somebody will buy a 50-year-old bottle of wine and say, "Wait a minute. This has gone bad." The answer is, "Well, that wine isn't for drinking; that's for trading." These $100 bills aren't meant to circulate. They're not to spend on goods and services. They're a store of value. They're a form of saving.

The Middle East would always be an important trading partner in just a market sense, like America is a big market for us, Asia is a big market, Europe is a big market. You are going to have hundreds of millions of consumers there, from just a standard market point of view, from a very narrow American point of view.

I'm always very grateful for stories about the great coffeehouse wits in Vienna at the turn of the last century. People would wait for a chance to stand near the table where the great wits were trading witticisms as a spectator sport because it was that good. They were that on fire and there was no product. They didn't write anything down. It was just the pleasure of engagement with the moment. I think that's my kind of ideal of how I live.

It's CNN who really should hold Trump accountable. And because they are trading the short-term fix of increased ratings by focusing on Trump drama - and I'm not saying they shouldn't cover the Russian investigations, of course they should - but the blanket coverage, it's not about news values. It is about ratings. And it comes at a tremendous cost because Trump supporters are fully defended against this. As far as they're concerned, this is a vast conspiracy, it's fake news, it doesn't impact their daily lives, it makes them see Trump as a victim, which he wants to be seen as.

If the resources of different nations are treated as exclusive properties of these nations as wholes, if international economic relations, instead of being relations between individuals, become increasingly relations between whole nations organized as trading bodies, they inevitably become the source of friction and envy between whole nations.

Take most people, they are crazy about cars. They worry if they get a little scratch on them, they are always talking about have many miles they get to a gallon, and if they get a brand new car already they start thinking about trading it in for one that is even newer. I do not even like old cars. . . . I'd rather have a horse. A horse is at least human, for God's sake.

Fundamentals might be good for the first third or first 50 or 60 percent of a move, but the last third of a great bull market is typically a blow-off, whereas the mania runs wild and prices go parabolic... There is no training, classroom or otherwise, that can prepare for trading the last third of a move, whether it's the end of a bull market or the end of a bear market.

I genuinely did not expect more than half our nation to choose to walk away from our long-term allies into the arms of our new friends Vladimir Putin, Marine Le Pen and Donald Trump. Or that they would do so without an economic plan, a trading strategy, or a credible leader, making the average Briton's future more uncertain than any time since the Blitz.

When I get hurt in the market, I get the hell out. It doesn't matter at all where the market is trading. I just get out, because I believe that once you're hurt in the market, your decisions are going to be far less objective than they are when you're doing well If you stick around when the market is severely against you, sooner or later they are going to carry you out.

If a betting game among a certain number of participants I played long enough, eventually one player will have all the money. If there is any skill involved, it will accelerate the process of concentrating all the stakes in a few hands. Something like this happens in the market. There is a persistent overall tendency for equity to flow from the many to the few. In the long run, the majority loses. The implication for the trader is that to win you have to act like the minority. If you bring normal human habits and tendencies to trading, you'll gravitate toward the majority and inevitably lose.

They have a policy in China for their big companies called "Go abroad." It's a rational thing for both the company and the country to say, "We want big, successful companies." Particularly in areas where they need it: agriculture, energy, technology. I think banking, too. One or two have bought a trading house. Some have already begun expanding around the world. Of course they're going to have those ambitions. Why wouldn't they? They're just doing it methodically. It's a logical strategy and, well-executed, they will succeed.

...and every Wednesday the perfumed young lady slips me a hundred-crown note to leave her alone with the convict. And by Thursday the hundred crowns are already gone in so much beer. And when the visiting hour is over, the young lady comes out with the stink of jail in her elegant clothes; and the prisoner goes back to his cell with the lady's perfume in his jailbird's suit. And I'm left with the smell of beer. Life is nothing but trading smells.

We have to recognize that the reason that the global order that we've enjoyed and almost take for granted over the last several years exists is that after World War II, the United States and its allies tried to build an antidote to what they had seen between World War I and World War II. There, they'd seen protectionism, beggar-thy-neighbor trading policies, so they said, we'll build an open international economy. And they did that.

Where you want to be is always in control, never wishing, always trading, and always first and foremost protecting your ass. That's why most people lose money as individual investors or traders because they're not focusing on losing money. They need to focus on the money that they have at risk and how much capital is at risk in any single investment they have. If everyone spent 90 percent of their time on that, not 90 percent of the time on pie-in-the-sky ideas on how much money they're going to make, then they will be incredibly successful investors.

We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake. Therefore at any price, at any cost, the central banks had to quell the gold price, manage it. It was very difficult to get the gold price under control but we have now succeeded. The US Fed was very active in getting the gold price down. So was the U.K.

It's got to be hard to be a band that's trading on your 40-year-old hits, where there's a certain thing that's expected of you. But that's why I admire Bob Dylan's live performances - he's steadfast about mixing up the songs, not just sticking to his greatest hits, and reinterpreting them to the extent that you really can't recognize them until halfway through. It's like, I DARE you to sing along.

We've said from the beginning when we traded Richie (Sexson), we're trading home runs for doubles and the ability to manufacture runs... Doubles are almost better. I mean, home runs are great, but when you've got guys who smack those doubles, you're in good shape, you've got a lot of guys in scoring position.

The recent trading environment has felt something like walking into a place and having a sense that something is wrong and dangerous but not knowing exactly what will happen or when. “QE Infinity” has so distorted the prices of stocks and bonds that nobody can possibly determine what the investing landscape would look like, or what the condition of the economy and financial system would be, in the absence of Fed bond-buying.

I also think you have to be very careful. I mean, the heritage of our company is very strong, and building some of these businesses into leading players is extremely tough. You and I can both build a trading business, and it looks like you're doing OK, and it looks like I'm doing OK. But, really, I am, and you aren't. It comes down to the quality of clients, quality of systems, quality of risk controls.

Christian's family lived under the shadow cast by his parents. They had purposely become Striogi, trading thier magic and mortality to become immortal and subsist on killing others. His parents were dead now, but that didn't stop people from not trusting him. They seemed to think he'd go Strigoi at any moment and take everyone else with him. His abrasiveness and dark sence of humor didn't really help things, either.

We all accuse Vladimir Putin of Cold War nostalgia, but Washington's elites - politicians and intellectuals - miss the old days as well. They wish for the world in which the United States was utterly dominant over its friends, its foes were to be shunned entirely, and the challenges were stark, moral, and vital. Today's world is messy and complicated. China is one of our biggest trading partners and our looming geopolitical rival. Russia is a surly spoiler, but it has a globalized middle class and has created ties in Europe.

You must ignore what everyone else is doing and trade only when you feel the odds are in your favor. In short, trade only when you and you alone are comfortable that the expected return of your trades will be positive. That might mean you'll have to sit out a few parties, but it will also mean that you'll have more profits over the course of your trading career.

As South Korea shows, active participation in international trade does not require free trade. Indeed, had South Korea pursued free trade and not promoted infant industries, it would not have become a major trading nation. It would still be exporting raw materials (e.g., tungsten ore, fish, seaweed) or low-technology, low-price products (e.g., textiles, garments, wigs made with human hair) that used to be its main export items in the 1960s.

Our large trading cities bear to me very nearly the aspect of monastic establishments in which the roar of the mill-wheel and the crane takes the place of other devotional music, and in which the worship of Mammon and Moloch is conducted with a tender reverence and an exact propriety; the merchant rising to his Mammon matins, with the self-denial of an anchorite, and expiating the frivolities into which he maybe beguiled in the course of the day by late attendance at Mammon vespers.

Specifically in reference to Iran, Donald Trump will not be able to renegotiate the nuclear arms pact. His attempt to do so will alienate all the European powers involved and will cost a number of US companies some very lucrative contracts. It is a losing proposition for him and for the US. Much more so than for Iran, who will turn more and more to Russia and China as trading partners.

One day I visited a guy who had made a fortune as a broker. He was sitting in his office with his computer. I hire people from here and make deals from this room, he told me. Then he took me to the trading room. Nobody was talking to anybody else, the place was silent as a tomb, they were all sitting there watching their terminals - a great word, terminal. I tell you, it scares the crap out of me.

Traded him for Alec," Clary said. "Not permanently" "No," said Jace. "Just for a few hours. Unless I don't come back. In which case, maybe he does get to keep Alec. Think of it as a lease with an option to buy." "Mom and Dad won't be pleased if they find out." "That you freed a possible criminal by trading away your brother to a warlock who looks like a gay Sonic the Hedgehog and dresses like the Child Catcher from Chitty Chitty Bang Bang?" Simon inquired. "No, probably not.

If one looks into the genealogies of many 'old families,' one discovers episodes of slave trafficking, bootlegging, gun running, opium trading, falsified land claims, violent acquisition of water and mineral rights, the extermination of indigenous peoples, sales of shoddy and unsafe goods, public funds used for private speculations, crooked deals in government bonds and vouchers, and payoffs for political favors.

The reliance on stereotypes is in part the result of a structural problem within the media. Most newspapers have a business beat, with a number of highly trained journalists who know how to cover companies, trading, the markets and so on. But almost none have labor reporters anymore, and to my knowledge, none have full-time poverty-beat correspondents. And all of this helps to render invisible the lives and the life stories of tens of millions of Americans.

When you see that trading is done, not by consent, but by compulsion - when you see that in order to produce, you need to obtain permission from men who produce nothing - when you see that money is flowing to those who deal, not in goods, but in favors - when you see that men get richer by graft and by pull than by work, and your laws don't protect you against them, but protect them against you - when you see corruption being rewarded and honesty becoming a self-sacrifice - you may know that your society is doomed.

There's a clarity that comes with great ideas: You can [easily and simply] explain why something's a great business, how and why it's cheap, why it's cheap for temporary reasons and how, on a normal basis, it should be trading at a much higher level. You're never sitting there on the 40th page of your spreadsheet, as Buffett would say, agonizing over whether you should buy or not.

We got the Iran sanctions done. We got an agreement by Russia to allow us to use Afghanistan to transit supplies for our forces. We got a Security Council resolution on Libya. We got Russia into the WTO to bring in to it a rules-based trading system. All of those things were in our interest. The point is not whether we should work with Russia. The point is whether we should sacrifice other important interests to do so.