Top 1200 Interest Rate Quotes & Sayings

Explore popular Interest Rate quotes.

Last updated on April 16, 2025.

What central banks can control is a base and one way they can control the base is via manipulating a particular interest rate, such as a Federal Funds rate, the overnight rate at which banks lend to one another. But they use that control to control what happens to the quantity of money. There is no disagreement.

Remember that accumulated knowledge, like accumulated capital, increases at compound interest: but it differs from the accumulation of capital in this; that the increase of knowledge produces a more rapid rate of progress, whilst the accumulation of capital leads to a lower rate of interest. Capital thus checks it own accumulation: knowledge thus accelerates its own advance. Each generation, therefore, to deserve comparison with its predecessor, is bound to add much more largely to the common stock than that which it immediately succeeds.

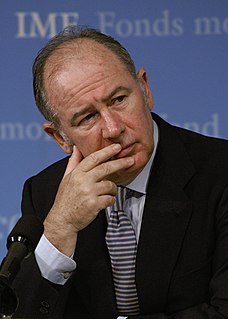

The IMF insisted that both Russia and Brazil maintain their currency at over-valued levels. Who are you protecting when you try to maintain that exchange rate by having high interest rates? You're protecting domestic and foreign firms that have gambled on the exchange rate. And who is paying the price? The small businesses that did not gamble [and no longer can afford loans], the workers who are going to be put out of jobs.

There is a third silent party to all our bargains. The nature and soul of things takes on itself the guaranty of the fulfillment of every contract, so that honest service cannot come to loss. If you serve an ungrateful master, serve him the more. Put God in your debt. Every stroke shall be repaid. The longer the payment is withholden, the better for you; for compound interest on compound interest is the rate and usage of this exchequer.

There is no self-interest completely unrelated to others' interests. Due to the fundamental interconnectedness which lies at the heart of reality, your interest is also my interest. From this it becomes clear that "my" interest and "your" interest are intimately connected. In a deep sense, they converge.

If you look at the balance sheet, the US is heavily in debt. If you look at the income account - the amount of interest the US pays abroad - it is almost exactly equal to the amount of interest that it receives from abroad. American assets held abroad are earning a higher rate of return than foreign assets held here.

As you know, you go to war with the army you have, not the army you might want or wish to have at a later time. Since the Iraq conflict began, the Army has been pressing ahead to produce the armor necessary at a rate that they believe - it's a greatly expanded rate from what existed previously, but a rate that they believe is the rate that is all that can be accomplished at this moment.

Knowledge and productivity are like compound interest. The more you know, the more you learn; the more you learn, the more you can do; the more you can do, the more the opportunity. I don`t want to give you a rate, but it is a very high rate. Given two people with exactly the same ability, the one person who manages day in and day out to get in one more hour of thinking will be tremendously more productive over a lifetime.

Let's start with the euro. What on earth were we thinking? How could anyone with the faintest grasp of economics have believed it was anything other than sheer insanity to yoke together diverse national economies such as Greece, Ireland, Germany and Finland under a single exchange rate and a single interest rate?

If a country is an attractive place for foreigners to invest their funds, then that country will have a relatively high exchange rate. If it's an unattractive place, it will have a relatively low exchange rate. Those are the fundamentals that determine the exchange rate in a floating exchange rate system.

A higher IOER rate encourages banks to raise the interest rates they charge, putting upward pressure on market interest rates regardless of the level of reserves in the banking sector. While adjusting the IOER rate is an effective way to move market interest rates when reserves are plentiful, federal funds have generally traded below this rate.