Top 1200 Interest Rates Quotes & Sayings

Explore popular Interest Rates quotes.

Last updated on April 21, 2025.

Student debt is crushing the lives of millions of Americans. How does it happen that we can get a home mortgage or purchase a car with interest rates half of that being paid for student loans? We must make higher education affordable for all. We must substantially lower interest rates on student loans. This must be a national priority.

The key is if the economic data stays soft, maybe we don't have to worry much about interest rates anymore. Then we need to worry about earnings. What gave us a really strong move in stock prices from late May until about two weeks ago was this heightened optimism that maybe interest rates are at that high. That gave you a relief rally. Now reality is setting in - if we've seen the worst on interest rates then we've seen the best on earnings.

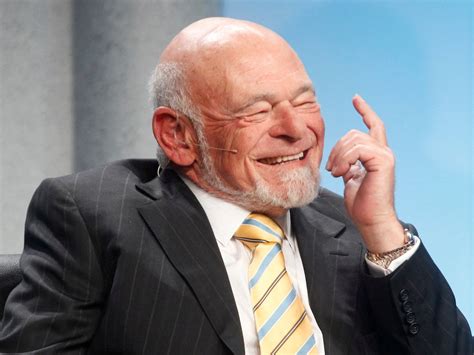

We live in a global market and money's fungible and hedge fund private equity is looking for momentum plays, and there ain't no momentum plays in bonds, right? When the interest rates were spiking up or down, well they never really spike down they do spike up though. Something's got to happen, there's got to be motion, the dice has to be rolling on the board, and if it's not then they're not going to play because they're not going to get the adrenaline rush from looking at... you know, money markets fund interest rates or bond interests or whatever. It's got to be sexy.

Since 2008 you've had the largest bond market rally in history, as the Federal Reserve flooded the economy with quantitative easing to drive down interest rates. Driving down the interest rates creates a boom in the stock market, and also the real estate market. The resulting capital gains not treated as income.

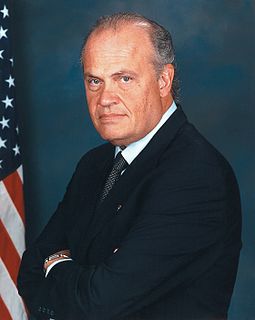

I've always believed that a speculative bubble need not lead to a recession, as long as interest rates are cut quickly enough to stimulate alternative investments. But I had to face the fact that speculative bubbles usually are followed by recessions. My excuse has been that this was because the policy makers moved too slowly - that central banks were typically too slow to cut interest rates in the face of a burst bubble, giving the downturn time to build up a lot of momentum.

I don't think it's possible for the Fed to end its easy-money policies in a trouble-free manner. Recent episodes in which Fed officials hinted at a shift toward higher interest rates have unleashed significant volatility in markets, so there is no reason to suspect that the actual process of boosting rates would be any different. I think that real pressure is going to occur not by the initiation by the Federal Reserve, but by the markets themselves.

A higher IOER rate encourages banks to raise the interest rates they charge, putting upward pressure on market interest rates regardless of the level of reserves in the banking sector. While adjusting the IOER rate is an effective way to move market interest rates when reserves are plentiful, federal funds have generally traded below this rate.

Interest rates are going to go up because employment is going to go up. If employment goes up, then our apartments get filled. And if employment goes up, our office buildings get filled. The reality is that increased economic activity combined with increased interest rates is basically bullish for real estate.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

If you let interest rates be freed, be set by the free market, they would rise dramatically. There would be a lot of broken furniture on Wall Street. It needs to be broken. The back of the speculative bubble would be broken and we could slowly heal the financial system. That's what I think we need to do but it's never going to happen because there's trillions of asset values dependent on the Fed continuing to suppress, repress interest rates and shovel $85 billion a month of liquidity into the market.

The art of banking is always to balance the risk of a run with the reward of a profit. The tantalizing factor in the equation is that riskier borrowers pay higher interest rates. Ultimate safety - a strongbox full of currency - would avail the banker nothing. Maximum risk - a portfolio of loans to prospective bankrupts at usurious interest rates - would invite disaster. A good banker safely and profitably treads the middle ground.

Credit card companies are jacking up interest rates, lowering credit limits, and closing accounts - and people who have made timely payments are not exempt. So even if you pay off your balance - and that's tough when interest rates are insanely high - there's a good chance your credit limit will be slashed, and that will hurt your FICO score.