Top 690 Investments Quotes & Sayings - Page 12

Explore popular Investments quotes.

Last updated on November 8, 2024.

A young financial writer once brought ridicule upon himself by stating that a certain company had nothing to commend it except excellent earnings. Well, there are companies whose earnings are excellent but whose stocks I would never recommend. In selecting investments, I attach prime importance to the men behind them. I'd rather buy brains and character than earnings. Earnings can be good one year and poor the next. But if you put your money into securities run by men combining conspicuous brains and unimpeachable character, the likelihood is that the financial results will prove satisfactory.

In fact, Clinton-era publications of the US Space Command describe control over space as a parallel to control over the oceans a century ago. Then, countries built navies to protect and enhance their power in commercial and strategic interests. Today, the militarization of space is intended to protect US investments and commercial interest and US hegemony around the world.

Canadians expect their government to make sure we're helping the people who need the help and growing the economy, and that's exactly what we're committed to do, not just with our historic investments into infrastructure that are going to create jobs while the others are focusing on cuts, but by lowering payroll taxes, by lowering EI premiums from $1.88 to $1.65, at the same time as we make sure that the people who need help are getting the help that they paid into, because they're not getting it under Stephen Harper. That's what Canadians expect from their government.

American envoys came to see me before the crisis in Iraq and asked me to say that there were nuclear weapons in Iraq. I refused. They even told me that things would go well for Belarus in terms of investments, etc. All I had to do was to support them. I told them that I couldn't do it because I knew that there were no nuclear weapons there.

Our capitalistic scheme in the latter years of the 20th century seems to have lost its way. We've had a "pathalogical change" from traditional owners capitalism where most of the rewards have gone to those who make the investments and assume the risks to a new and deeply flawed system of managers capitalism where the managers of our corporations our investment system, and our mutual funds are simply take too large a share of the returns generated by our corporations and mutual funds leaving the last line investors - pension beneficiaries and mutual fund owners at the bottom of the food chain.

In a typical 401k plan, when you first become eligible you get a big pile of forms and you're told, fill out these forms if you want to join. Tell us how much amount you've saved and how you want to invest the money. In, under automatic enrollment you get that same pile of forms but the top page says, if you don't fill out these forms, we're going to enroll you anyway and we're going to enroll you at this saving rate and in these investments.

Softly and kindly remind yourself, ''I cannot own anything.'' It is a valuable thought to keep in mind as you struggle to improve your financial picture, worry about investments, and plan how to acquire more and more. It is a universal principle which you are part of. You must release everything when you truly awaken. Are you letting your life go by in frustration and worry over not having enough? If so, relax and remember that you only get what you have for a short period of time. When you awaken you will see the folly of being attached to anything.

The inflow of capital from the developed countries is the prerequisite for the establishment of economic dependence. This inflow takes various forms: loans granted on onerous terms; investments that place a given country in the power of the investors; almost total technological subordination of the dependent country to the developed country; control of a country's foreign trade by the big international monopolies; and in extreme cases, the use of force as an economic weapon in support of the other forms of exploitation.

Through our government's updated science, technology and innovation strategy, we are making the record investments necessary to push the boundaries of knowledge, create jobs and opportunities, and improve the quality of life of Canadians. Our government's Canada Research Chairs Program develops, attracts and retains top talent researchers in Canada whose research, in turn, creates long-term social and economic benefits while training the next generation of students and researchers in Canada.

Charlie and I decided long ago that in an investment lifetime, it's too hard to make hundreds of smart decisions. That judgment became ever more compelling as Berkshire's capital mushroomed and the universe of investments that could significantly affect our results shrank dramatically. Therefore, we adopted a strategy that required our being smart and not too smart at that, only a very few times. Indeed, we now settle for one good idea a year.

I report the assault on nature evidenced in coal mining that tears the tops off mountains and dumps them into rivers, sacrificing the health and lives of those in the river valleys to short-term profit, and I see a link between that process and the stock-market frenzy which scorns long-term investments-genuine savings-in favor of quick turnovers and speculative bubbles whose inevitable bursting leaves insiders with stuffed pockets and millions of small stockholders, pensioners, and employees out of work, out of luck, and out of hope.

In general, I'm pretty busy with the other things I charted ... I bought a piece of a sports-tech company. We do a lot of work with at the Clippers. I think that'll be great. We're really looking at the possibility of extending and building a real over-the-top distribution channel with value-added services for the Clippers, that could lead to other partnerships and investments. But most of the stuff I'm looking at isn't because I say, "Hey, I want to invest." It sort of comes around from the work we're doing with the Clippers.

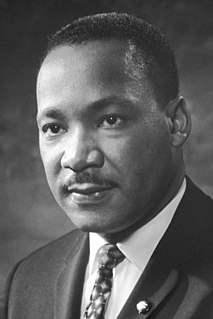

A nation that will keep people in slavery for 244 years will "thingify" them and make them things. And therefore, they will exploit them and poor people generally economically. And a nation that will exploit economically will have to have foreign investments and everything else, and it will have to use its military might to protect them. All of these problems are tied together. What I'm saying today is that we must go from this convention and say, "America, you must be born again!"

Oil now, as a result of the Saudi production, is priced so low that there are not going to be new fracking investments made. A lot of companies that have gone into fracking are heavily debt-leveraged, and are beginning to default on their loans. The next wave of defaults that banks are talking about is probably going to be in the fracking industry. When the costs of production are so much more than they can end up getting for the oil, they just stop producing and stop paying their loans.

I am surprised at the number of Puerto Ricans that are moving out of Puerto Rico still. I thought that, by now, the immigration of Puerto Ricans had decreased a little bit. But, no, with a hurricane, it has increased even more. So, I see the financial institutions, especially the hedge funds, moving into Puerto Rico with all the - with all the force, knowing that their investments towards the future are going to be multiplied or probably elevated to quantities beyond any notion of how capital works.

We in Germany could, for example, lower taxes. And who is against that? The Social Democrats.

We could also mobilize more private investments for public infrastructure projects liken the construction of highways. But the Social Democrats also reject this, even though they are at times similar to others abroad in their carping about the surplus. Incidentally, some of the consequences of the good economic situation are strong increases in wages, rising pensions and a strong labor market.

If we [American nation] are only thinking about tomorrow or the next day and not thinking about 10 years from now, we're not going to control our own economic future, because China, Germany - they're making these [clean energy] investments. And I'm not going to cede those jobs of the future to those countries. I expect those new energy sources to be built right here in the United States.

The most common mistakes were investing in money market funds by people who were so scared at the prospect of managing their own funds that they picked the most conservative option, and their investments did not keep up with inflation. The second major mistake was being too heavily invested in their own company's stock, and buying when it was high and there was a lot of optimism about the company, and then having to sell it low when the company got in trouble.

Being a good private equity investor is more complicated than it seems. I would say that there are a few characteristics that are important. If you look at the skill set that you need to ultimately be a successful private equity investor, at least at the senior level, you have to be, in this business, a good investor. You have to be able to help companies perform and you have to have judgment around exiting investments. If you look at the skill sets there, they include some things you can teach and some that you can't.

[Donald] Trump and all the Republicans believe in the theory of trickle down economics which is a theory discredited even by the author himself David Stockton. The theory suggests that if we take care of the people at the top, if we cut taxes for the wealthy, if we make sure they are doing really well, then the investments that they make in the economy and the jobs that will create, will make everything grow and it will have a trickle down effect on the rest of us.

If we want to make the best products, we also have to invest in the best ideas... Every dollar we invested to map the human genome returned $140 to our economy... Today, our scientists are mapping the human brain to unlock the answers to Alzheimer's... Now is not the time to gut these job-creating investments in science and innovation. Now is the time to reach a level of research and development not seen since the height of the Space Race.

I've always believed that a speculative bubble need not lead to a recession, as long as interest rates are cut quickly enough to stimulate alternative investments. But I had to face the fact that speculative bubbles usually are followed by recessions. My excuse has been that this was because the policy makers moved too slowly - that central banks were typically too slow to cut interest rates in the face of a burst bubble, giving the downturn time to build up a lot of momentum.

Avoid debt that doesn’t pay you. Make it a rule that you never use debt that won’t make you money. I borrowed money for a car only because I knew it could increase my income. Rich people use debt to leverage investments and grow cash flows. Poor people use debt to buy things that make rich people richer.

The government also has to get the public rules right. That means putting a price on carbon, so the cleaner forms of energy become more competitive. As soon as that happens, a tidal wave of new capital, innovation and entrepreneurship will flood into the clean energy space - creating new jobs and opportunities for Americans of all walks of life. We did that for the internet, with public investments in the basic system through the Pentagon, followed by rules that encouraged innovation and competition. And that is why the internet took off in the United States first.

I can say with absolute confidence that the general public of Burma would be very little affected, if at all, by sanctions. So far, the kind of investments that have come in have benefited the public very little indeed. If you have been in Burma long enough, you will be aware of the fact that a small elite has developed that is extremely wealthy. Perhaps they would be affected, but my concern is not with them but with the general public.

Getting the economy back on its feet is properly viewed as an investment in future prosperity. When businesses and consumers confront attractive investment opportunities, often the only way to seize them is by borrowing. The same is true for government. Contrary to the pronouncements of critics of economic stimulus, these investments will not impoverish our grandchildren. Continuing to allow the economy to languish in recession is the surest way to impoverish them.

Capitalism is the best way of organizing economic activity for a lot of reasons. It unlocks a higher fraction of human potential, it balances supply and demand, it's more consistent with higher levels of freedom. But the way we're pursuing it now, focuses on such short-term horizons, that a lot of businesses and investors are tempted to look at investments in terms of what's gonna happen in the next 90 days, what's gonna happen in one year. But the old phrase, "Good things take time," is true of successful businesses as well.

Turbulence is a condition that we all experience during a flight when the plane is bouncing around by competing air currents. By analogy, the economy may bounce around a lot because of competing currents of public moods and investments. One week everyone might be optimistic and then suddenly something happens to turn everyone into pessimists. Investment dries up and investors become risk averse. A sudden piece of good news then turns around the public mood.

James Russell offers a timely and compelling blueprint for a realistic transformation of America's energy consumption by refusing to fall victim to conventional thinking. Accessible?pragmatic even?Russell's proposals speak to goals on the immediate horizon and underscore the role that intelligent design can play now in America. On a longer horizon, his analysis points to a range of issues about land use, transportation, and coordination of public and private investments to which the design professions have an enormous contribution to make. Here design and policy find common ground.

In recent years, we've become enamored with our own past success. Lulled into complacency by the glitter of our own achievements. We've become accustomed to the title of Military Superpower, forgetting the qualities that got us there. We've become accustomed to our economic dominance in the world, forgetting that it wasn't reckless deals and get rich quick schemes that got us where we are, but hard work and smart ideas, quality products and wise investments.