Top 892 Investors Quotes & Sayings - Page 15

Explore popular Investors quotes.

Last updated on December 11, 2024.

The idea that you try to time purchases based on what you think business is going to do in the next year or two, I think that's the greatest mistake that investors make because it's always uncertain. People say it's a time of uncertainty. It was uncertain on September 10th, 2001, people just didn't know it. It's uncertain every single day. So take uncertainty as part of being involved in investment at all. But uncertainty can be your friend. I mean, when people are scared, they pay less for things. We try to price. We don't try to time at all.

The thing that's confusing for investors is that founders don't know how to be CEO. I didn't know how to do the job when I was a CEO. Founder CEOs don't know how to be CEOs, but it doesn't mean they can't learn. The question is... can the founder learn that job and can they tolerate all mistakes they will make doing it?

Our capitalistic scheme in the latter years of the 20th century seems to have lost its way. We've had a "pathalogical change" from traditional owners capitalism where most of the rewards have gone to those who make the investments and assume the risks to a new and deeply flawed system of managers capitalism where the managers of our corporations our investment system, and our mutual funds are simply take too large a share of the returns generated by our corporations and mutual funds leaving the last line investors - pension beneficiaries and mutual fund owners at the bottom of the food chain.

Investors are trying to work out some risk premiere that have some correspondence with actual risks. But they don't, they're not, they can't go very far that way, because the actual correspondence isn't really there in a lot of cases. So once people stop believing in these stories, and then the crash can come very, very quickly. They believe that house prices are correctly priced for some time and then suddenly they realized there's no real basis for that. But what is the correct price? We don't know that either. It's just that everything swings.

Still, I figure we shouldn't' discourage fans of actively managed funds. With all their buying and selling, active investors ensure the market is reasonably efficient. That makes it possible for the rest of us to do the sensible thing, which is to index. Want to join me in this parasitic behavior? To build a well-diversified portfolio, you might stash 70 percent of your stock portfolio into a Wilshire 5000-index fund and the remaining 30 percent in an international-index fund.

Long ago, Sir Isaac Newton gave us three laws of motion, which were the work of genius. But Sir Isaac's talents didn't extend to investing: He lost a bundle in the South Sea Bubble, explaining later, 'I can calculate the movement of the stars, but not the madness of men.' If he had not been traumatized by this loss, Sir Isaac might well have gone on to discover the Fourth Law of Motion: For investors as a whole, returns decrease as motion increases.

Investors, monarchies, and parliamentarians devised methods to control the processes of wealth accumulation and the power that came with it, but the ideology behind gold fever mobilized settlers to cross the Atlantic to an unknown fate. Subjugating entire societies and civilizations, enslaving whole countries, and slaughtering people village by village did not seem too high a price to pay, nor did it appear inhumane. The systems of colonization were modern and rational, but its ideological basis was madness.

Near the top of the market, investors are extraordinarily optimistic because they've seen mostly higher prices for a year or two. The sell-offs witnessed during that span were usually brief. Even when they were severe, the market bounced back quickly and always rose to loftier levels. At the top, optimism is king, speculation is running wild, stocks carry high price/earnings ratios, and liquidity has evaporated. A small rise in interest rates can easily be the catalyst for triggering a bear market at that point.

It can be shown that maximum diversification is achieved by holding each stock in proportion to its value to the entire market (italics added)... Hindsight plays tricks on our minds... often distorts the past and encourages us to play hunches and outguess other investors, who in turn are playing the same game. For most of us, trying to beat the market leads to disastrous results... our actions lead to much lower returns than can be achieved by just staying in the market.

Seeds not planted or tended by choice tend to be weeds, so at least for me, it's very helpful to consciously and periodically choose which seeds I want to water, and to think through what I expect to happen from that watering. Investors can spend a lot of time and energy reacting to the latest bits of news and trying to predict the next surprise, rather than choosing a consistent set of daily actions that they can carry out as things develop, regardless of how they develop.

The major asset in this category is gold, currently a huge favorite of investors who fear almost all other assets, especially paper money (of whose value, as noted, they are right to be fearful). Gold, however, has two significant shortcomings, being neither of much use nor procreative. True, gold has some industrial and decorative utility, but the demand for these purposes is both limited and incapable of soaking up new production. Meanwhile, if you own one ounce of gold for an eternity, you will still own one ounce at its end.

As value investors, our business is to buy bargains that financial market theory says do not exist. We've delivered great returns to our clients for a quarter century-a dollar invested at inception in our largest fund is now worth over 94 dollars, a 20% net compound return. We have achieved this not by incurring high risk as financial theory would suggest, but by deliberately avoiding or hedging the risks that we identified.

I don't mean to imply that we are in imminent danger of being wiped off the face of the earth - at least, not on account of global warming. But climate change does confront us with profound new realities. We face these new realities as a nation, as members of the world community, as consumers, as producers, and as investors. And unless we do a better job of adjusting to these new realities, we will pay a heavy price. We may not suffer the fate of the dinosaurs. But there will be a toll on our environment and on our economy, and the toll will rise higher with each new generation.

When excesses such as lax lending standards become widespread and persist for some time, people are lulled into a false sense of security, creating an even more dangerous situation. In some cases, excesses migrate beyond regional or national borders, raising the ante for investors and governments. These excesses will eventually end, triggering a crisis at least in proportion to the degree of the excesses. Correlations between asset classes may be surprisingly high when leverage rapidly unwinds.

Frequent comparative ranking can only reinforce a short-term investment perspective. It is understandably difficult to maintain a long-term view when, faced with the penalties for poor short-term performance, the long-term view may well be from the unemployment line ... Relative-performance-oriented investors really act as speculators. Rather than making sensible judgments about the attractiveness of specific stocks and bonds, they try to guess what others are going to do and then do it first.

One measure for promoting both stability and fairness across financial market segments is a small sales tax on all financial transactions - what has come to be known as a Robin Hood Tax. This tax would raise the costs of short-term speculative trading and therefore discourage speculation. At the same time, the tax will not discourage "patient" investors who intend to hold their assets for longer time periods, since, unlike the speculators, they will be trading infrequently.

We are going to rebuild our infrastructure. I would say at least double her numbers and - and you`re gonna really need more than that. We have bridges that are falling down. People,investors, people would put money into the fund. The citizens would put money into the fund, and we will rebuild our infrastructure with that fund.

If you want to talk further about a relationship with Russia, look no further than the Clintons. As we've said time and time again, Bill Clinton was paid half a million dollars to give a speech to a Russian bank, and was personally thanked by Putin for it. Hillary Clinton allowed one-fifth of America's uranium to - reserve to be sold to a Russian firm whose investors were Clinton Foundation donors. And the Clinton campaign chairman's brother lobbied against sanctions on Russia's largest bank and failed to report it. If you want to talk about having relations, look no further than there.

Senator, we are groping for understanding, the knowledge you assume I possess doesn't exist' - 'The only effective regulation lies in the propensity of customers to choose alternatives, of investors to move their funds elsewhere and of labour to acquire technical skills' - 'Senator, if I seem clear to you, you must have misunderstood me' - 'Unfortunately, Senator, nobody knows where the next innovative idea is coming from. Political decisions are never random and will always lose out to innovative alternatives

There's no denying that a collapse in stock prices today would pose serious macroeconomic challenges for the United States. Consumer spending would slow, and the U.S. economy would become less of a magnet for foreign investors. Economic growth, which in any case has recently been at unsustainable levels, would decline somewhat. History proves, however, that a smart central bank can protect the economy and the financial sector from the nastier side effects of a stock market collapse.

In the stock market (as in much of life), the beginning of wisdom is admitting your ignorance. One of the many things you cannot know about stocks is exactly when they will up or go down. Over the long term, stocks generally rise at a nice pace. History shows they double in value every seven years or so. But in the short term, stocks are just plain wild. Over periods of days, weeks and months, no one has any idea what they will do. Still, nearly all investors think they are smart enough to divine such short-term movements. This hubris frequently gets them into trouble.

Partnerships can be very big. The relationships you cultivate can help. If you put together a business plan that makes sense and that you can present to other people, they may be able to help you out, especially if you're short of cash. Angel investors, perhaps, may help. You may not have to go through a traditional bank. If you're not able to secure funding, you can get up under someone who has experience, learn from that person, and work your way up.

While no one wishes to incur losses, you couldn't prove it from an examination of the behavior of most investors and speculators. The speculative urge that lies within most of us is strong; the prospect of a free lunch can be compelling, especially when others have already seemingly partaken. It can be hard to concentrate on potential losses while others are greedily reaching for gains and your broker is on the phone offering shares in the latest "hot" initial public offering. Yet the avoidance of loss is the surest way to ensure a profitable outcome.

Logic is the subject that has helped me most in picking stocks, if only because it taught me to identify the peculiar illogic of Wall Street. Actually Wall Street thinks just as the Greeks did. The early Greeks used to sit around for days and debate how many teeth a horse has. They thought they could figure it out just by sitting there, instead of checking the horse. A lot of investors sit around and debate whether a stock is going up, as if the financial muse will give them the answer, instead of checking the company.

I used to think that good short-sellers could be trained like long-focused value investors because it should be the same skill set; you’re tearing into the numbers, you’re valuing the businesses, you’re assigning a consolidated value, and hopefully you’re seeing something the market doesn’t see.But now I’ve learned that there’s a big difference between a long-focused value investor and a good short-seller. That difference is psychological and I think it falls into the realm of behavioral finance.

Technology enables consumers and investors to have extraordinary choice and ease of switching, which, in turn, stimulates much fiercer competition than ever before, which, in turn, makes it imperative for every institution to innovate like mad. That innovation is powering our economy these days, and it requires companies to find and utilize creative workers. That's the most important syllogism going; technology is embedded in that syllogism, but it's not as if we're seeing these productivity gains because of the technology.

Index funds are... tax friendly, allowing investors to defer the realization of capital gains or avoid them completely if the shares are later bequeathed. To the extent that the long-run uptrend in stock prices continues, switching from security to security involves realizing capital gains that are subject to tax. Taxes are a crucially important financial consideration because the earlier realization of capital gains will substantially reduce net returns.

Warren Buffett likes to say that the first rule of investing is "Don't lose money," and the second rule is, "Never forget the first rule." I too believe that avoiding loss should be the primary goal of every investor. This does not mean that investors should never incur the risk of any loss at all. Rather "don't lose money" means that over several years an investment portfolio should not be exposed to appreciable loss of principal.

Perhaps more to the point for TBTF (Too Big To Fail bank), if a SIFI (Systemically Important Financial Institution) does fail I have little doubt that private investors will in fact bear the losses-even if this leads to an outcome that is messier and more costly to society than we would ideally like. Dodd-Frank is very clear in saying that the Federal Reserve and other regulators cannot use their emergency authorities to bail out an individual failing institution

Nowhere does it say that investors should strive to make every last dollar of potential profit; consideration of risk must never take a backseat to return. Conservative positioning entering a crisis is crucial: it enables one to maintain long-term oriented, clear thinking, and to focus on new opportunities while others are distracted or even forced to sell. Portfolio hedges must be in place before a crisis hits. One cannot reliably or affordably increase or replace hedges that are rolling off during a financial crisis.

The inflow of capital from the developed countries is the prerequisite for the establishment of economic dependence. This inflow takes various forms: loans granted on onerous terms; investments that place a given country in the power of the investors; almost total technological subordination of the dependent country to the developed country; control of a country's foreign trade by the big international monopolies; and in extreme cases, the use of force as an economic weapon in support of the other forms of exploitation.

I think the power of the short film is incredibly underrated. It is way easier to get someone to watch a 15-minute film then a full-length feature. In those 15 minutes you have the opportunity to express your voice as an artist and hopefully connect with your audience. If you are trying to be a first time feature director then a short film that demonstrates you have a grasp on the themes and concepts of the movie you want to direct is a no-brainer. Whether they are collaborators or potential investors, filmmaking is a visual art form so you obviously need visuals to show them!

Any money the government spends must be taxed, borrowed or conjured out of thin air by the Federal Reserve, and that will reduce sound private investment. Obama has no real wealth to inject into the economy. He can only move around existing money while inflation robs us of purchasing power. Meanwhile, private investors who might have produced a better engine, battery, computer, cancer treatment or other wealth-creating and life-enhancing innovations hold back for fear that big government will undermine productive efforts.

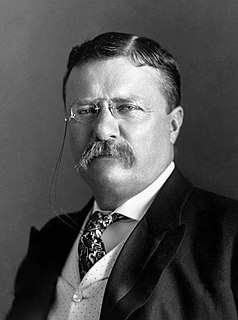

We wish to control big business so as to secure among other things good wages for the wage-workers and reasonable prices for the consumers. Wherever in any business the prosperity of the business man is obtained by lowering the wages of his workmen and charging an excessive price to the consumers we wish to interfere and stop such practices. We will not submit to that kind of prosperity any more than we will submit to prosperity obtained by swindling investors or getting unfair advantages over business rivals.

A global financial cabal engineered a fraudulent housing and debt bubble [2008], illegally shifted vast amounts of capital out of the US; and used 'privatization' as a form of piracy - a pretext to move government assets to private investors at below-market prices and then shift private liabilities back to government at no cost to the private liability holder Clearly, there was a global financial coup d'etat underway.

Capitalism is the best way of organizing economic activity for a lot of reasons. It unlocks a higher fraction of human potential, it balances supply and demand, it's more consistent with higher levels of freedom. But the way we're pursuing it now, focuses on such short-term horizons, that a lot of businesses and investors are tempted to look at investments in terms of what's gonna happen in the next 90 days, what's gonna happen in one year. But the old phrase, "Good things take time," is true of successful businesses as well.

Successful investors like stocks better when they’re going down. When you go to a department store or a supermarket, you like to buy merchandise on sale, but it doesn’t work that way in the stock market. In the stock market, people panic when stocks are going down, so they like them less when they should like them more. When prices go down, you shouldn’t panic, but it’s hard to control your emotions when you’re overextended, when you see your net worth drop in half and you worry that you won’t have enough money to pay for your kids’ college.

The industrial leader of the 20th century was a system-builder. He was a visionary in terms of what could be built; got the capital together; certainly convinced investors that it was possible; and then ran a high-volume production system that would spew out a vast array of almost identical goods and services. They would be changed from time to time; there was research and development, to be sure. But the system was built around production, not innovation.

The government can always rescue the markets or interfere with contract law whenever it deems convenient with little or no apparent cost. (Investors believe this now and, worse still, the government believes it as well. We are probably doomed to a lasting legacy of government tampering with financial markets and the economy, which is likely to create the mother of all moral hazards. The government is blissfully unaware of the wisdom of Friedrich Hayek: "The curious task of economics is to demonstrate to men how little they really know about what they imagine they can design.")

There are a few investment managers, of course, who are very good - though in the short run, it's difficult to determine whether a great record is due to luck or talent. Most advisors, however, are far better at generating high fees than they are at generating high returns. In truth, their core competence is salesmanship. Rather than listen to their siren songs, investors - large and small - should instead read Jack Bogle's The Little Book of Common Sense Investing.

Rip Van Winkle would be the ideal stock market investor: Rip could invest in the market before his nap and when he woke up 20 years later, he'd be happy. He would have been asleep through all the ups and downs in between. But few investors resemble Mr. Van Winkle. The more often an investor counts his money - or looks at the value of his mutual funds in the newspaper - the lower his risk tolerance.

Even fans of actively managed funds often concede that most other investors would be better off in index funds. But buoyed by abundant self-confidence, these folks aren't about to give up on actively managed funds themselves. A tad delusional? I think so. Picking the best-performing funds is 'like trying to predict the dice before you roll them down the craps table,' says an investment adviser in Boca Raton, FL. 'I can't do it. The public can't do it.'

Things that people thought not possible when they were proposed and blown off become enormously successful. There are a lot of ideas that never succeed - but we all know the crazy ideas that did - who would have thought 30 years ago that people would pay $4 for a cup of coffee - but today, we have 20,000 Starbucks stores around the world. A group of prospective investors once remarked that "Google" was the "balloon company." The point is, don't rush to pooh-pooh something you don't understand or aren't willing to try - it could be something that changes the world.

We [US government] have used our taxpayer dollars not only to subsidize these banks but also to subsidize the creditors of those banks and the equity holders in those banks. We could have talked about forcing those investors to take some serious hits on their risky dealings. The idea that taxpayer dollars go in first rather than last - after the equity has been used up - is shocking.

Hedge funds are investment pools that are relatively unconstrained in what they do. They are relatively unregulated (for now), charge very high fees, will not necessarily give you your money back when you want it, and will generally not tell you what they do. They are supposed to make money all the time, and when they fail at this, their investors redeem and go to someone else who has recently been making money. Every three or four years they deliver a one-in-a-hundred year flood. They are generally run for rich people in Geneva, Switzerland, by rich people in Greenwich, Connecticut.

Turbulence is a condition that we all experience during a flight when the plane is bouncing around by competing air currents. By analogy, the economy may bounce around a lot because of competing currents of public moods and investments. One week everyone might be optimistic and then suddenly something happens to turn everyone into pessimists. Investment dries up and investors become risk averse. A sudden piece of good news then turns around the public mood.

If you expect to be a net saver during the next 5 years, should you hope for a higher or lower stock market during that period? Many investors get this one wrong. Even though they are going to be net buyers of stocks for many years to come, they are elated when stock prices rise and depressed when they fall. This reaction makes no sense. Only those who will be sellers of equities in the near future should be happy at seeing stocks rise. Prospective purchasers should much prefer sinking prices.

Below, we itemize some of the quite different lessons investors seem to have learned as of late 2009 - false lessons, we believe. To not only learn but also effectively implement investment lessons requires a disciplined, often contrary, and long-term-oriented investment approach. It requires a resolute focus on risk aversion rather than maximizing immediate returns, as well as an understanding of history, a sense of financial market cycles, and, at times, extraordinary patience.

No matter what level you're starting at, it's about not only utilizing your time, but your resources and network. For me, I started my company with a small amount of savings; I never had investors and I was lucky in the sense that I had models and connections in the fashion industry who were willing to give me advice early on. So really, for anyone starting a new business, it's really important to seek out mentors and knowledge from those who have come before you. And to not let that be discouraging, but to take that advice and really learn from it and mold it to what you're trying to do.

The music business is suffering because fewer artists are being invested in. Labels are putting in less money, taking fewer risks and signing half as many artists as they did 10 years ago. Everything is risk averse right now and there are two ways to deal with a business situation like this: either reduce your risk or increase your return. They're reducing their risk to the bone and looking for ways with their 360 deals to increase their return. They're still not making money. Artists are suffering. Labels, or music investors, are suffering.

Anyone believing the TPP is good for Americans take note: The foreign subsidiaries of U.S.-based corporations could just as easily challenge any U.S. government regulation they claim unfairly diminishes their profits - say, a regulation protecting American consumers from unsafe products or unhealthy foods, investors from fraudulent securities or predatory lending, workers from unsafe working conditions, taxpayers from another bailout of Wall Street, or the environment from toxic emissions.