Top 35 Lender Quotes & Sayings

Explore popular Lender quotes.

Last updated on April 14, 2025.

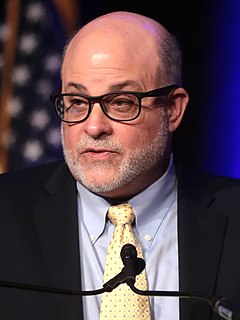

What was to be a relatively innocuous federal government, operating from a defined enumeration of specific grants of power, has become an ever-present and unaccountable force. It is the nation’s largest creditor, debtor, lender, employer, consumer, contractor, grantor, property owner, tenant, insurer, health-care provider, and pension guarantor. Moreover, with aggrandized police powers, what it does not control directly it bans or mandates by regulation.

Unlike national markets, which tend to be supported by domestic regulatory and political institutions, global markets are only 'weakly embedded'. There is no global lender of last resort, no global safety net, and of course, no global democracy. In other words, global markets suffer from weak governance, and are therefore prone to instability, inefficiency, and weak popular legitimacy.

Hudson Taylor and Charles Spurgeon believed that Romans prohibits debt altogether. However, if going into debt is always sin, it's difficult to understand why Scripture gives guidelines about lending and even encourages lending under certain circumstances. Proverbs says "the borrower is servant to the lender." It doesn't absolutely forbid debt, but it's certainly a strong warning.

If two parties, instead of being a bank and an individual, were an individual and an individual, they could not inflate the circulating medium by a loan transaction, for the simple reason that the lender could not lend what he didn't have, as banks can do. Only commercial banks and trust companies can lend money that they manufacture by lending it.

We see the Jew, then, in business, as promoter, money-lender, salesman par excellence, the author and chief instigator of a system of credit by which a nation-wide usury rises like a Golem (a created monster) with a million hands on a million throats, to choke the honor and the freedom-of-movement of a hard-working people.

My life is on loan, like money borrowed from a bank. God is the lender, and He retains the right to call in the loan any time. Though I am responsible for taking care of it, I do not own this life; it is borrowed. Why should I fear its loss or the loss of anything else in this world when I must surrender it all anyway?