Top 83 Liquidity Quotes & Sayings

Explore popular Liquidity quotes.

Last updated on April 14, 2025.

The Central Bank should have a permanent window for discounting high quality securities where banks could go and discount these. It gives peace of mind to the banks. In the absence of this facility, what banks tend to do is to keep a liquidity cushion for emergency requirements. This is a very expensive way of managing liquidity.

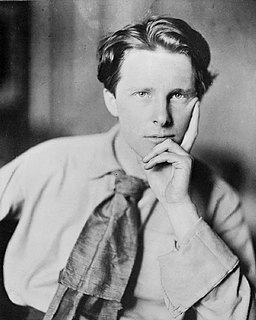

Of the maxims of orthodox finance none, surely, is more anti-social than the fetish of liquidity, the doctrine of that it is a positive virtue on the part of investment institutions to concentrate their resources upon the holding of 'liquid' securities. It forgets that there is no such thing as liquidity of investment for the community as a whole.

Why, just a couple of economic seasons ago, was idle cash considered an indication of bad management or lazy management? Because it meant that management didn't have this money out at work ... Now look. Presto! A new fashion! Cash is back in! Denigrating liquidity has dropped quicker than hemlines. A management is now saluted if it has some cash, some liquidity, doesn't have to go to the money market at huge interest rates to get the wherewithal to keep going and growing. Along with Ben Franklin, my father and your father would understand and applaud this new economic fashion.

Regulatory changes have forced banks to closely examine their liquidity planning and to internalize the costs of liquidity provision. The costs of committed liquidity facilities will be passed on to clearing members. These costs are perhaps highest in clearing Treasury securities, where liquidity needs can be especially large.