Top 1200 Lower Taxes Quotes & Sayings - Page 3

Explore popular Lower Taxes quotes.

Last updated on December 4, 2024.

The benefits of a modest warming would outweigh the costs - by $8.4 billion a year in 1990 dollars by the year 2060, according to Robert Mendelsohn at Yale University - thanks to longer growing seasons, more wood fiber production, lower construction costs, lower mortality rates, and lower rates of morbidity (illness).

To lay taxes to provide for the general welfare of the United States, that is to say, 'to lay taxes for the purpose of providing for the general welfare.' For the laying of taxes is the power, and the general welfare the purpose for which the power is to be exercised. They are not to lay taxes ad libitum for any purpose they please; but only to pay the debts or provide for the welfare of the Union.

What we won't become is a 'Democratic Party lite!' We are a party that wants smaller government and lower taxes. Obama and the Democrats do not. We are a party that wants to encourage small business. We are a party that has a large constituent group that believes in a social agenda and we will not abandon them.

You could not possibly maintain the current level of government taxation without the taxes being hidden, and they are hidden in two very different ways. They are hidden through withholding, but they are also hidden by being imposed on business, supposedly on business, when really, of course, business can't pay taxes, only people can pay taxes.

The Trump administration's economic agenda is the right agenda. Corporate taxes have been driving capital and brains and companies overseas for a decade. It has caused huge damage in investment and jobs and productivity. It was a mistake. We have to fix it. Counterintuitively, that usually helps middle-class wages, and lower-class wages, and job formation.

It's why we oppose Citizens United from that right-wing Supreme Court. In 2012, I also said the Tea Party "acted like terrorists" and called a donut shop manager in Milwaukee who wanted lower taxes a "smartass." And I said the number one issue is a three-letter word, J-O-B-S." I'm proud of who I am.

You can be totally committed to conservative principles - to individual liberty, a market economy, entrepreneurship and lower taxes - and still be a Green Conservative. You can believe that with the sound use of science and technology and the right incentives to encourage entrepreneurs, conservatism can provide a better solution for the health of our planet than can liberalism.

Corporate tax reform is nice in theory but tough in practice. It most likely requires lower tax rates and the closing of loopholes, which many companies are sure to fight. And whatever new, lower tax rate is determined, there will probably be another country willing to lower its rate further, creating a sad race to zero.

Texas has no income tax, which is a big draw for corporate executives who do business there. But it's hardly tax-free. The property taxes are high for a Southern state. The sales taxes are high. One study found that the bottom 20 percent of the Texas population pays 12 percent of its income in state and local taxes.

The contented and economically comfortable have a very discriminating view of government. Nobody is ever indignant about bailing out failed banks and failed savings and loans associations... But when taxes must be paid for the lower middle class and poor, the government assumes an aspect of wickedness.

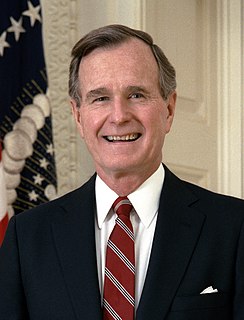

I'm the one who will not raise taxes. My opponent now says he'll raise them as a last resort, or a third resort. But when a politician talks like that, you know that's one resort he'll be checking into. My opponent, my opponent won't rule out raising taxes. But I will. And The Congress will push me to raise taxes and I'll say no. And they'll push, and I'll say no, and they'll push again, and I'll say, to them, Read my lips: no new taxes.

With a congressional mandate to run the deficit up as high as need be, there is no reason to raise taxes now and risk aggravating the depression. Instead, Obama will follow the opposite of the Reagan strategy. Reagan cut taxes and increased the deficit so that liberals could not increase spending. Obama will raise spending and increase the deficit so that conservatives cannot cut taxes. And, when the economy is restored, he will raise taxes with impunity, since the only people who will have to pay them would be rich Republicans.

I think everybody in this generation, and I'm the leading edge of the baby boom - I was born in 1946 - has benefitted from a 30-year explosion of debt, which created temporary but unsustainable economic prosperity and a financialization of the system through lower, and lower, and lower interest rates that has created massive rewards to speculation but not real investments so I benefitted from it. Almost everyone who has been in the market has benefitted but they didn't earn it.