Top 1200 Lower Taxes Quotes & Sayings - Page 5

Explore popular Lower Taxes quotes.

Last updated on December 5, 2024.

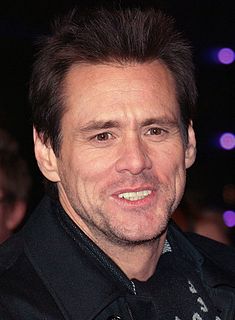

When one becomes a liberal, he or she pretends to advocate tolerance, equality and peace, but hilariously, they’re doing so for purely selfish reasons. It’s the human equivalent of a puppy dog’s face: an evolutionary tool designed to enhance survival, reproductive value and status. In short, liberalism is based on one central desire: to look cool in front of others in order to get love. Preaching tolerance makes you look cooler, than saying something like, 'please lower my taxes.'

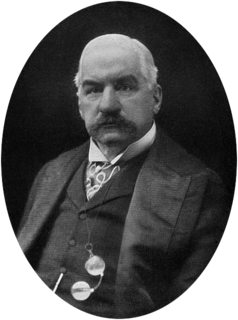

Anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the treasury. There is not even a patriotic duty to increase one's taxes. Over and over again the Courts have said that there is nothing sinister in so arranging affairs as to keep taxes as low as possible. Everyone does it, rich and poor alike and all do right, for nobody owes any public duty to pay more than the law demands.

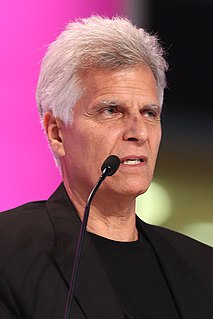

We in Germany could, for example, lower taxes. And who is against that? The Social Democrats.

We could also mobilize more private investments for public infrastructure projects liken the construction of highways. But the Social Democrats also reject this, even though they are at times similar to others abroad in their carping about the surplus. Incidentally, some of the consequences of the good economic situation are strong increases in wages, rising pensions and a strong labor market.

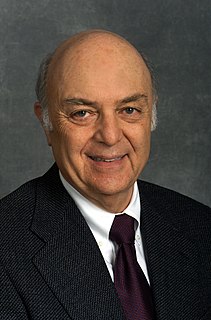

I think the reason that the Trump economic agenda is beneficial is, he is doing the right things. He wants to see growth, he wants to see to lower taxes, he wants to see this cash pile sitting outside the US return to the US. All of these things I think will be good for the US economy, and as I've said, if the US economy grows, the global economy benefits hugely.

In those countries where income taxes are lower than in the United States, the ability to defer the payment of U.S. tax by retaining income in the subsidiary companies provides a tax advantage for companies operating through overseas subsidiaries that is not available to companies operating solely in the United States. Many American investors properly made use of this deferral in the conduct of their foreign investment.

If Uber is lower-priced, then more people will want it. And if more people want it and can afford it, then you have more cars on the road. And if you have more cars on the road, then your pickup times are lower, your reliability is better. The lower-cost product ends up being more luxurious than the high-end one.