Top 1001 Managers Quotes & Sayings - Page 16

Explore popular Managers quotes.

Last updated on April 20, 2025.

Lack of opportunity breeds dreams of escape. But professionals and managers who have invested in their careers do not leave the work force as frequently as discouraged workers in lower status occupations. Instead, they keep working, but they escape emotionally by defining achievement in professional, not company, terms. ... Thus, the potential for being stuck as career uncertainty grows takes its toll in weakening attachment to any particular employer.

The modern joint stock firm is the outcome of innumerable decisions made by individual entrepreneurs, owners and managers. For these decision makers the choices among alternatives were limited and the outcomes uncertain, but almost always there were choices. Despite the variability of these individual decisions, taken cumulatively they produced clear patterns of institutional change

The Big Music Project gives young people access to producers, managers, set designers, artists and a load of other industry insiders who are at top of their game. It can be difficult to know where to start and this project gives young people who are passionate about music, knowledge and hands on experience.

I agree with a lot of the points in Taleb's book, but I don't agree with many of his conclusions. It seems to me that he rightly points out that risk managers miss a lot of the risks, but the conclusion is that he draws, is that we should abandon risk management, whereas my conclusion is we should improve it.

I think that many managers we meet do take their roles as leaders very seriously and do a lot for their people. And they try to hone their skills by reading books and attending training. But then again, the number one problem is we get busy. We tend to forget that collectively we can accomplish more than we could ever do alone, and we need our people to feel a part of a positive, productive culture.

Few relationships are as critical to the business enterprise as the relationship to the government. Managers have responsibility for this relationship as part of their responsibility to the enterprise itself. It is an area of social impact of the business. To a large extent the relationship to government results from what businesses do or fail to do.

We need to reorganize our entire system of retirement plan investing and to develop federal standards of fiduciary duty for pension trustees and fund managers. These require "top down" intervention. But we also need investors to look after their own economic interests, a bottom up approach to our problems that is well within our individual power to undertake.

After Pixar's 2006 merger with the Walt Disney Company, its CEO, Bob Iger, asked me, chief creative officer John Lasseter, and other Pixar senior managers to help him revive Disney Animation Studios. The success of our efforts prompted me to share my thinking on how to build a sustainable creative organization.

Boxing has a problem - a big one. Think of it as a monster that's hiding under the bed. Eventually, the monster is going to come out and take a big chunk out of the sport. Fighters, trainers, managers, promoters, even government regulators can legally bet on fights. They can also bet on fights they're involved with.

The world of the 90s and beyond will belong to managers or those who make the numbers dance, as we used to say, or those who are conversant with all the business jargon we used to sound smart. The world will belong to passionate, driven leaders -- people who not only have an enormous amount of energy but who can energize those whom they lead.

If you're watching a film on your television, is it no longer a film because you're not watching it in a theatre? If you watch a TV show on your iPad, is it no longer a TV show? The device and the length are irrelevant; the labels are useless, except perhaps to agents and managers and lawyers, who use these labels to conduct business deals.

Perhaps women are lied to more often because managers think they're not going to push back. If you're told, "We don't have the budget right now" and have no access to the budget to prove otherwise, there's not much you can do, but there's no reason why you can't ask if you can reassess in six months. Then, spend those six months chronicling every good thing you do so you return with a stack of data that proves you need that raise.

Land mines, torture equipment, cluster bombs, chemical weapons are weapons designed to inflict pain and death on human beings. Most victims are civilians, women and children. How can arms manufacturers, weapons designers, plant managers, politicians, who have families of their own whom they love, be so insensitive when it comes to the suffering of other human beings?

Millions of mutual-fund investors sleep well at night, serene in the belief that superior outcomes result from pooling funds with like-minded investors and engaging high-quality investment managers to provide professional insight. The conventional wisdom ends up hopelessly unwise, as evidence shows an overwhelming rate of failure by mutual funds to deliver on promises.

The fund scandals shined the spotlight on the fact that mutual fund managers were putting their interests ahead of the fund shareholders who trusted them, which had much more substantial consequences in the form of excessive fees and the promotion - as the market moved into the stratosphere - of technology funds and new economy funds which were soon to collapse.

While our managers debated what steps to take to address the sales and cash-flow crisis, I began to lead week-long employee seminars in what we called Philosophies. We'd take a busload at a time to places like Yosemite or the Marin Headlands above San Francisco, camp out, and gather under the trees to talk. The goal was to teach every employee in the company our business and environmental ethics and values.

Some people--Samad for example--will tell you not to trust people who overuse the phrase "at the end of the day"--football managers, estate agents, salesmen of all kinds--but Archie's never felt that way about it. Prudent use of said phrase never failed to convince him that his interlocutor was getting to the bottom of things, to the fundamentals.

Modern Australian trade unionism and the unionist that I am doesn't rely on a class war view that somehow that the interests of employees and managers are in two separate spheres and they're irreconcilable. I believe that when people can go to work and be happy, satisfied, engaged, where the employer is getting employees who feel their interests are aligned with the employer, you get productivity. This is the future of Australian workplaces.

But I like to think that a lot of managers and executives trying to solve problems miss the forest for the trees by forgetting to look at their people -- not at how much more they can get from their people or how they can more effectively manage their people. I think they need to look a little more closely at what it's like for their people to come to work there every day.

I have ... spoken to the heads of various Wall Street equity derivatives trading desks and every single one of the senior managers I spoke with told me that Bernie Madoff was a fraud. Of course no one wants to take an undue career risk by sticking their head up ... The fewer people who know who wrote this report the better. I am worried about the personal safety of myself and my family.

The directors of such companies, however, being the managers rather of other people's money than of their own, it cannot well be expected, that they should watch over it with the same anxious vigilance with which the partners in a private copartnery frequently watch over their own.... Negligence and profusion, therefore, must always prevail, more or less, in the management of the affairs of such a company.

After costs, only the top 3% of managers produce a return that indicates they have sufficient skill to just cover their costs, which means that going forward, and despite extraordinary past returns, even the top performers are expected to be only as good as a low-cost passive index fund. The other 97% can be expected to do worse.

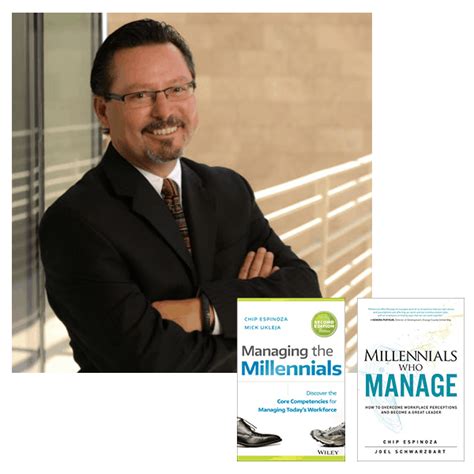

In general, workers under 35 highly value Millennials' ability to relate, be helpful, be open-minded, and be understanding. Employees over 35 appreciated their energy, enthusiasm, open-mindedness, fresh perspective, and understanding of new technologies. It is interesting, in my early research, Millennials entering the workforce reported advantages they claimed to have in the workplace. The advantages turn out to be strengths that are recognized in them as managers.

Often people say they can't base their strategies on customers because customers make unreasonable requests and because customers vary too much. Such opinions reveal serious misconceptions. The truly outside-in company definitely does not try to serve all the needs of its customers. Instead, its managers are clear about what their organization can and should do for customers, and whatever they do they do well. They focus.

My failed corporate career became the fodder for the 'Dilbert' comic. Once it became clear I would not be climbing any higher on the corporate ladder, it freed me to mock managers without worrying that it would stall my career. Most failures create some sort of unplanned freedom. I took full advantage of mine.

If the technology cannot shoulder the entire burden of strategic change, it nevertheless can set into motion a series of dynamicsthat present an important challenge to imperative control and the industrial division of labor. The more blurred the distinction between what workers know and what managers know, the more fragile and pointless any traditional relationships of domination and subordination between them will become.

Yorkie has officially retired about 5 times... The man's a clown... People are going on about the game and agents and directors of football and managers losing their jobs, but we should be worried about people like him... Clowns. That's the last time I'm going to say clown... If he's the vice-president of FIFA, God help us all.

Organizations should be built and managers should be functioning so people can be naturally empowered. If someone's doing their job, if someone's working in one of your warehouses, say, they should know their job better than anybody. They don't need to be 'empowered,' but encouraged and left alone to be able to do what they know best.

Let's acknowledge that men reach for opportunities more quickly and more easily than women. So often as managers, we give the job to whoever starts solving the problem, to whoever jumps in. Since we know men will jump in faster than women in so many circumstances, we have to slow down and encourage more women to sit at more tables.

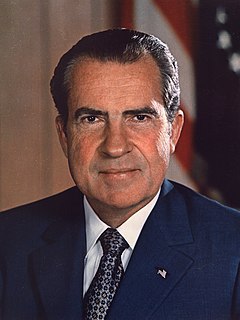

Government has the responsibility to provide the climate in which Americans, all Americans, have an opportunity for good jobs; and not only for good jobs, but an opportunity if they have the ability and the desire, to be owners and managers, to have a piece of the action, because if they have a piece of the action, then they believe in the system rather than fighting against it.

The Sanders campaign showed that a candidate with mildly progressive programs could win the nomination, maybe the election, even without the backing of the major funders or any media support. There's good reason to suppose that Sanders would have won the nomination had it not been for shenanigans of the Obama-Clinton party managers. He is now the most popular political figure in the country by a large margin.

Most people define learning too narrowly as mere 'problem-solving', so they focus on identifying and correcting errors in the external environment. Solving problems is important. But if learning is to persist, managers and employees must also look inward. The need to reflect critically on their own behaviour, identify the ways they often inadvertently contribute to the organisation’s problems, and then change how they act.

Most people think of leaders as being these outgoing, very visible, and charismatic people, which I find to be a very narrow perception. The key challenge for managers today is to get beyond the surface of your colleagues. You might just find that you have introverts embedded within your organization who are natural-born leaders.

Our approach has worked for us. Look at the fun we, our managers, and our shareholders are having. More people should copy us. It's not difficult, but it looks difficult because it's unconventional - it isn't the way things are normally done. We have low overhead, don't have quarterly goals and budgets or a standard personnel system, and our investing is much more concentrated than average. It's simple and common sense.

Work hard and follow your dreams. I work nine and a half hours a day, five days a week; it's a lot of hard work and sacrifices, but in the end, it all comes out to be worth it. If you want to get a head-start into the entertainment business, get into a performing arts school or start performing in a theater because that's one of the main places that agents and managers look for talent.

One reason there are so many short-lived management fads is that their prescriptions were derived and advocated in precisely this way. So managers read about a fad and try it, find that it doesn't work, abandon the effort, and move on to the next thing. In reality, it is usually the case that the faddish prescription was indeed sound advice in certain circumstances, but actually was poor advice in other circumstances.

And you can tell that Britney Spears is struggling with who she is. I think she has a team of agents and managers who are saying, yes, push the envelope, kiss Madonna, take off all your clothes. And she’s doing that because she doesn’t want to sacrifice this enormous platform that she’s built. But at the same time, she is sacrificing herself and you can see that in her eyes when she talks.

In their work, designers often become expert with the device they are designing. Users are often expert at the task they are trying to perform with the device. [...] Professional designers are usually aware of the pitfalls. But most design is not done by professional designers, it is done by engineers, programmers, and managers.

I think the reason why we got into such idiocy in investment management is best illustrated by a story that I tell about the guy who sold fishing tackle. I asked him, "My God, they're purple and green. Do fish really take these lures?" And he said, "Mister, I don't sell to fish." Investment managers are in the position of that fishing tackle salesman.

It is especially important for managers to know about, neuroplasticity, the greatest discovery in neuroscience in the past 20 years. It refers to the fact that the brain is remarkably plastic. It can grow and change for the better throughout life. In fact, "plastic" denotes the brain's ability to grow and change throughout life.

Your agents and your managers will always say stuff to you like, "It's really important to make a good first impression on a casting director. And even though you didn't get that job, because you did well that means they'll keep bringing you back in." But when you really just need a job to pay your rent, that stops being very consoling.

According to most philosophers, God in making the world enslaved it. According to Christianity, in making it, He set it free. God had written, not so much a poem, but rather a play; a play he had planned as perfect, but which had necessarily been left to human actors and stage-managers, who had since made a great mess of it.

The Four Keys of Great Managers: When selecting someone, they select for talent ... not simply experience, intelligence or determination. When setting expectations, they define the right outcomes ... not the right steps. When motivating someone, they focus on strengths ... not on weaknesses. and When developing someone, they help him find the right fit ... not simply the next rung on the ladder.

Investors, of course, can, by their own behavior make stock ownership highly risky. And many do. Active trading, attempts to "time" market movements, inadequate diversification, the payment of high and unnecessary fees to managers and advisors, and the use of borrowed money can destroy the decent returns that a life-long owner of equities would otherwise enjoy. Indeed, borrowed money has no place in the investor's tool kit.

Pop managers are fixed in the dramatic stock character repertoire too, ever since the first British pop film musical, Wolf Mankowitz's 'Expresso Bongo' of 1959, with Cliff Richard as Bongo Herbert and Laurence Harvey as his manager. The key components were cast as X parts gay, X parts Jewish and triple X opportunistic.

Bobby is the Aaron Rodgers of managers in professional wrestling - Rodgers works magic on the professional football field, but Bobby Heenan did the same thing in a wrestling ring, in a television studio, on a radio program, and he could do the same thing in a newspaper layout. He was a great communicator, and he knew how to generate heat with fans.