Top 1200 Market Failure Quotes & Sayings - Page 16

Explore popular Market Failure quotes.

Last updated on November 15, 2024.

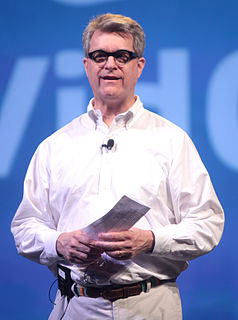

All the businesses from the beginning of history have struggled with product development (assuming there is a market, doing the market testing and so on). But now they start with customer development. Get the customer who says, "Yes. I want that. I need it. I wanna use it. I'll pay for it." And then you go back and work with your engineers. It is changing the world!

Ignorance, as well as disapproval for the natural restraints placed on market excesses that capitalism and sound markets impose, cause our present leaders to reject capitalism and blame it for all the problems we face. If this fallacy is not corrected and capitalism is even further undermined, the prosperity that the free market generates will be destroyed.

We've long felt that the only value of stock forecasters is to make fortune tellers look good. Even now, Charlie and I continue to believe that short-term market forecasts are poison and should be kept locked up in a safe place, away from children and also from grown-ups who behave in the market like children.

Individual security bargains may be located by the process of security analysis practically at any time. They can be bought with good overall results at all periods except when the general market itself is clearly in a selling range for investors. They show up to best advantage during the years in which the market remains in a relatively narrow and neutral area.

I feel as if things are falling apart within me, like so many glass partitions shattering. I walk from place to place in the grip of a fury, needing to act, yet can do nothing about it because any attempt seems doomed in advance. Failure, everywhere failure. Only suicide hovers above me, gleaming and inaccessible.

The seventh rule of the ethics of means and ends is that generally success or failure is a mighty determinant of ethics. The judgment of history leans heavily on the outcome of success or failure; it spells the difference between the traitor and the patriotic hero. There can be no such thing as a successful traitor, for if one succeeds he becomes a founding father.

It is argued by our GDP obsessed policy planners that eventually the money being made by the stock market operators or the IT industry would trickle down to the poor farmers in terms of ancillary jobs that would be created. But the fact is, that this has not happened, despite the boom in the stock market and the IT industry.

You're always on duty because you're in a constant state of observation. That's one of the challenges of being a comedian. I think one of the other challenges is that, whether we like it or not, it's a profession that requires failure. It doesn't just encourage failure. It requires it because it's all trial and error. You need to know what doesn't work to know what works.

The Fed was largely responsible for converting what might have been a garden-variety recession, although perhaps a fairly severe one, into a major catastrophe. Instead of using its powers to offset the depression, it presided over a decline in the quantity of money by one-third from 1929 to 1933 ... Far from the depression being a failure of the free-enterprise system, it was a tragic failure of government.

They'll [China] probably be a fully developed nation. The road there just is not going to be that easy. You're going from a macromanaged, top-down economy to a market-managed, micromanaged type of economy, with all the potential corruption issues, SOE [state-owned enterprise] reform, and market reform that come with it.

Embrace failure. Never never quit. Get very comfortable with that uneasy feeling of going against the grain and trying something new. It will constantly take you places you never thought you could go. This has been my mantra for years. I always remember I won't do things right on the first try. So failure is mandatory for success!

If you can predict where the market's going, just do what you can predict. If you can't, which is the presumption of dollar cost averaging or time cost averaging, either one, then you're trying to ease in. But if the market rises more than it falls most of the time, easing in is, by definition, a loser's game.

Just remember, without discipline, a clear strategy, and a concise plan, the speculator will fall into all the emotional pitfalls of the market - jump from one stock to another, hold a losing position too long, and cut out of a winner too soon, for no reason other than fear of losing profit. Greed, Fear, Impatience, Ignorance, and Hope will all fight for mental dominance over the speculator. Then, after a few failures and catastrophes the speculator may become demoralised, depressed, despondent, and abandon the market and the chance to make a fortune from what the market has to offer.

One day, when the world market is more or less fully developed and can no longer be suddenly enlarged, and if labour productivity continues to advance, then sooner or later the periodic clashes between productive forces and market barriers will begin, and because of their recurrence, these will naturally become increasingly rough and stormy.

If Steinitz continually took pains to discover combinations, the success or failure of his diligent search could not be explained by him as due to chance. Hence, he concluded that some characteristic, a quality of the given position, must exist that would indicate the success or the failure of the search before it was actually undertaken.

Making your mark on the world is hard. If it were easy, everybody would do it. But it's not. It takes patience, it takes commitment, and it comes with plenty of failure along the way. The real test is not whether you avoid this failure, because you won't. it's whether you let it harden or shame you into inaction, or whether you learn from it; whether you choose to persevere.

So you grow up with those messages, "You're a failure, you embarrass me, that's why I dress you in dark colors etc." or even when parents commit suicide, the child may think they were a failure as a child causing that. The majority of those people who weren't loved turn to drugs and alcohol and suicide.

You cannot achieve success without the risk of failure. And I learned a long time ago, you cannot achieve success, if you fear failure. If you're not afraid to fail, man, you have a chance to succeed. But you're never gonna get there unless you risk it, all the way. I'll risk failure. Sometimes, half the fun is failing. Learning from your mistakes, waking up the next morning, and saying 'Okay. Watch out. Here I come again. A little bit smarter, licking my wounds, and really not looking forward to getting my ass kicked the way I just did yesterday.' So now, I'm just a little more dangerous.

What type of new economical system can organize this system? There is another sector in our life, that we rely on every single day, that are absolutely essential: the social commons, the social economy. It is all the activity we engage in to create social capital. It doesn't create capital market. Social commons is growing faster than the market place. It is growing faster than the market place. The social commons include any activity that is deeply social and collaborative.

What we call the market is really a democratic process involving millions, and in some markets billions, of people making personal decisions that express their preferences. When you hear someone say that he doesn't trust the market, and wants to replace it with government edicts, he's really calling for a switch from a democratic process to a totalitarian one.

As a kid, falling was embarrassing. As I got older, I got used to falling and picking myself back up. There's not a sense of failure. It's of disappointment. You train so hard to not make mistakes. When you do, you're learning from that. How do I improve? How do I get better for the next time? Through every failure, there's something to be learned.

I don't want to talk about today's market anymore because nobody can make sense of what the market is. It's all over the map. There's a bunch of lunatics out there throwing money away. I'm sick and tired of it. It's lunacy. Punch me in the head and tell me I'm stupid, but that's the way I feel. There's no sense to it anymore.

The first reason for psychology's failure to understand what people are and how they act, is that clinicians and psychiatrists, who are generally the theoreticians on these matters, have essentially made up myths without any evidence to support them; the second reason for psychology's failure is that personality theory has looked for inner traits when it should have been looking for social context.

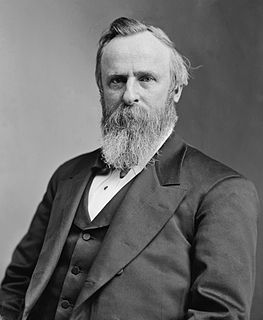

It could be clearly proved that by a practical nullification [by the South] of the Fifteenth Amendment the Republicans have for several years been deprived of a majority in both the House and Senate. The failure of the South to faithfully observe the Fifteenth Amendment is the cause of the failure of all efforts towards complete pacification. It is on this hook that the bloody shirt now hangs.

Life is an endless, truly endless struggle. There's no time when we're going to arrive at a plateau where the whole thing gets sorted. It's a struggle in the way every plant has to find it's own way to stand up straight. A lot of the time it's a failure. And yet it's not a failure if some enlightenment comes from it.

Scott Adams is not only a world-famous cartoonist, he's also a world-class failure. And he's the first to admit it. In his new book, 'How to Fail at Almost Everything and Still Win Big,' the Dilbert creator explains how failure can lead to success if you develop the right skills to make the most of your mistakes.

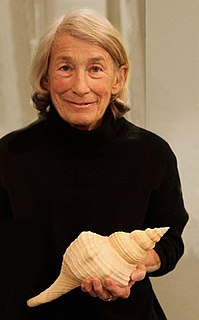

And it is exceedingly short, his galloping life. Dogs die so soon. I have my stories of that grief, no doubt many of you do also. It is almost a failure of will, a failure of love, to let them grow old-or so it feels. We would do anything to keep them with us, and to keep them young. The one gift we cannot give.