Top 1200 Markets Quotes & Sayings - Page 20

Explore popular Markets quotes.

Last updated on September 19, 2024.

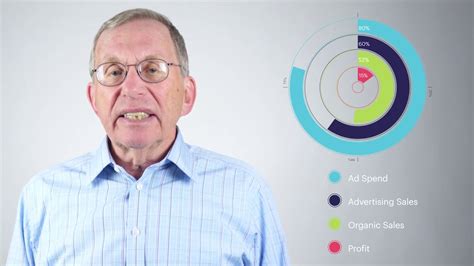

I started out by viewing the marketplace as a cruel place, where you need intervention by government and lawyers to protect people. But after watching the regulators work, I have come to believe that markets are magical and the best protectors of the consumer. It is my job to explain the beauties of the free market.

The United States as we know it today is largely the result of mechanical inventions, and in particular of agricultural machinery and the railroad. One transformed millions of acres of uncultivated land into fertile farms, while the other furnished the transportation which carried the crops to distant markets.