Top 1200 Oil Price Quotes & Sayings

Explore popular Oil Price quotes.

Last updated on November 21, 2024.

Now it will take a long time to scale biofuels, but I'm the only one in the world forecasting oil dropping in price to $35 a barrel by 2030. I'll put it on the record: Oil will not be able to compete with cellulosic biofuels. If you do it from food, the food will get so expensive you can't make fuel out of it.

We'd be better off if the whole purpose of the adventure in Iraq was, say, to protect Israel or to protect the flow of oil to America and keep it at a reasonable price and try to get some more control. If it was about oil, going into Iraq, I guess, could have made sense. But at a certain point, when the insurgency began and we were in real trouble, there would have been some awareness that we were going to jeopardize the oil.

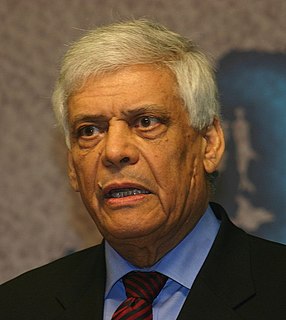

The oil companies are really making a very lucrative amount of profit from the high price of oil. I don't that they're very keen to reduce the price of oil. The consumers are those who are the victims so I think that the producers, the governments, some of them, they're enjoying the high revenue that they get.

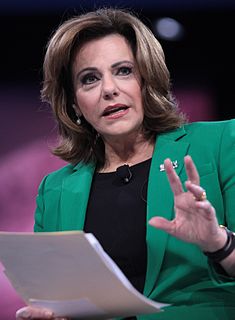

Over time, there's a very close correlation between what happens to the dollar and what happens to the price of oil. When the dollar gets week, the price of oil, which, as you know, and other commodities are denominated in dollars, they go up. We saw it in the '70s, when the dollar was savagely weakened.

About 75% of the price of gas is really dictated by crude oil. At the heart of the issue is increasing demand over a period of many years around the world. World crude oil consumption now is close to 90 million barrels a day. Most of the growth in demand is coming from China and the developing world.

I started digging and found that Israel signed a peace treaty with the United Arab Emirates after the country had diversified their economy, instead of being solely oil-based. This diversification had brought about modernization. I realized that if you land the price of oil, countries will diversify their economies and as a result, modernize.

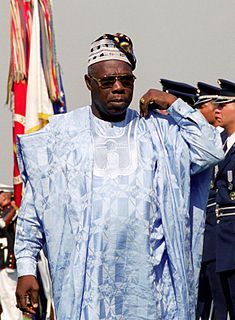

I do believe that oil production globally has peaked at 85 million barrels. And I've been very vocal about it. And what happens? The demand continues to rise. The only way you can possibly kill demand is with price. So the price of oil, gasoline, has to go up to kill the demand. Otherwise, keep the price down, the demand rises.

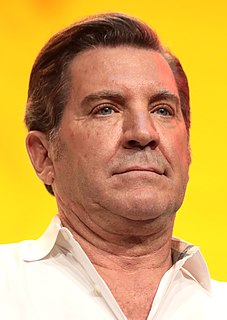

I've been saying for a long time, and I think you'll agree, because I said it to you once, had we taken the oil - and we should have taken the oil - ISIS would not have been able to form either, because the oil was their primary source of income. And now they have the oil all over the place, including the oil - a lot of the oil in Libya, which was another one of her disasters.

I can at once refute the statement that the people of the West object to conservation of oil resources. They know that there is a limit to oil supplies and that the time will come when they and the Nation will need this oil much more than it is needed now. There are no half measures in conservation of oil.

Speculation in oil stock companies was another great evil ... From the first, oil men had to contend with wild fluctuations in the price of oil. ... Such fluctuations were the natural element of the speculator, and he came early, buying in quantities and holding in storage tanks for higher prices. If enough oil was held, or if the production fell off, up went the price, only to be knocked down by the throwing of great quantities of stocks on the market.

There's a huge misconception that it's all about the oil, and the truth is there's actually not much oil left in Abyei. The misperception arose because when the peace agreement was signed in 2005, Abyei accounted for a quarter of Sudan's oil production. Since then, the Permanent Court of Arbitration in The Hague defined major oil fields to lie outside Abyei. They're in the north now, not even up for grabs, and they account for one percent of the oil in Sudan. The idea that it's "oil-rich Abyei" is out of date.