Top 1200 Owing A Debt Quotes & Sayings - Page 2

Explore popular Owing A Debt quotes.

Last updated on April 15, 2025.

It took the national debt two hundred years to reach $1 trillion. Supply Side Economics quadrupled the national debt to over $4 trillion in twelve years (1980-1992) under the Republicans. Bill Clinton actually paid down the national debt. How did he do it? He raised taxes. It produced the longest sustained economic expansion in U.S. History.

The Bankruptcy Reform Act of 2005 made it harder for individuals to file bankruptcy, which is always the last resort. Unfortunately, simultaneously consumers racked up so much debt that counseling companies - which are higher up on my list if you need help managing your debt - are sometimes unable to help. So if you fall into this camp, debt settlement may be something to consider.

I don't understand how the Republican party is the party with the reputation for fiscal conservatism and fiscal sanity, when they're the ones who run up the debt. It was Reagan who ran up the debt and now Bush is doing it again, and in between, Clinton and Bush's father, I must say, worked so hard to get that deficit and that debt down.

There are two definitions of deflation. Most people think of it simply as prices going down. But debt deflation is what happens when people have to spend more and more of their income to carry the debts that they've run up - to pay their mortgage debt, to pay the credit card debt, to pay student loans.

Debt, grinding debt, whose iron face the widow, the orphan, and the sons of genius fear and hate; debt, which consumes so much time, which so cripples and disheartens a great spirit with cares that seem so base, is a preceptor whose lessons cannot be foregone, and is needed most by those who suffer from it most.

Bad karma is the spiritual debt one has accumulated for one's mistakes from all previous lives and this life. It includes killing, harming, taking advantage, cheating, stealing, and more. On Mother Earth, when you buy a house, you take out a mortgage from a bank. This mortgage is your debt to the bank. You pay every month for fifteen, twenty, or thirty years to clear your financial debt. In the spiritual realm, if you have bad karma, you may have to pay for many lifetimes to clear your spiritual debt.

The bank's product is debt, because the banks want to make sure that they can get paid for the debt. But ultimately the only party that can pay the debt is the government, because it runs the printing presses. So the debts ultimately either are paid by the government, or they're paid by a huge transfer of property from debtors to creditors - or, the debts are written off.

The companies that provide debt, what do you think their goal is? Is their goal for you to fully understand the cost of your debt? No. So they're basically creating these approaches to make you feel like it is incredibly cheap or just to think about the cost per day rather the cost per year or cost for a lifetime. So debt is very simple mistake.

Debt settlement companies work as a middleman between you and your creditor. If all goes well (and that's a big if), you should be able to settle your debts for cents on the dollar. You'll also pay a fee to the debt settlement company, usually either a percentage of the total debt you have or a percentage of the total amount forgiven.

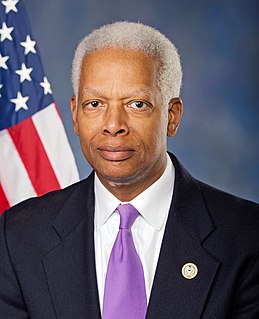

Back in 2008, candidate Obama called a $10 trillion national debt 'unpatriotic' - serious talk from what looked to be a serious reformer. Yet by his own decisions, President Obama has added more debt than any other president before him, and more than all the troubled governments of Europe combined. One president, one term, $5 trillion in new debt.

We all owe everyone for everything that happens in our lives. But it's not owing like a debt to one person--it's really that we owe everyone for everything. Our whole lives can change in an instant--so each person that keeps that from happening, no matter how small a role they play, is also responsible for all of it. Just by giving friendship and love, you keep the people around you from giving up--and each expression of friendship or love may be the one that makes all the difference.