Top 1200 Passive Income Quotes & Sayings - Page 2

Explore popular Passive Income quotes.

Last updated on November 14, 2024.

Over the period from 1988 to 2005, the income share of the top five percent has grown by about 3.5 percent of global household income, and the shares of all the other groups have diminished. The greatest relative reduction was in the bottom quarter, which lost about one third of its share of global household income, declining from 1.155 to 0.775 percent, and now is even more marginalized.

If I'm owed money, but I say, 'Don't pay me, pay my cousin. Don't pay me, pay my charity,' you can do that, but then the IRS requires that you pay income tax on that. It's your income if you earned it and you directed where it went. If you exercised control over where the money went, you have to pay income tax on that.

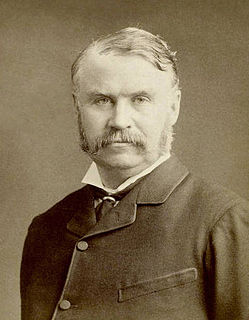

It was not until the Abraham Lincoln administration that an income tax was imposed on Americans. Its stated purpose was to finance the war, but it took until 1872 for it to be repealed. During the Grover Cleveland administration, Congress enacted the Income Tax Act of 1894. The U.S. Supreme Court ruled it unconstitutional in 1895. It took the Sixteenth Amendment (1913) to make permanent what the Framers feared -- today's income tax.

The only beneficiaries of income taxation are the politicians, for it not only gives them the means by which they can increase their emoluments, but it also enables them to improve their importance. The have-nots who support the politicians in the demand for income taxation do so only because they hate the haves; . . . the sum of all the arguments for income taxation comes to political ambition and the sin of covetousness.

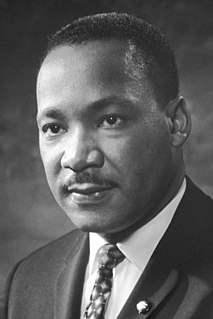

The strong man holds in a living blend strongly marked opposites. The idealists are not usually realistic, and the realists are not usually idealistic. The militant are not generally known to be passive, nor the passive to be militant. Seldom are the humble self-assertive, or the self-assertive humble. But life at it's best is a creative synthesis of opposites in fruitful harmony.

What is envy? It is nothing but passive jealousy. Maybe jealousy is too strong a phenomenon; envy is a little passive. The difference may be of degrees, but it is not of quality, it is only of quantity. Envy can become jealousy at any moment; envy is just jealousy in progress. Mind has to drop all envies and jealousies.

When women earn the money for the family, everyone in the family benefits. We also know that when women have an income, everyone wins because women dedicate 90% of the income to health, education, to food security, to the children, to the family, or to the community, so when women have an income, everybody wins.

If you're going to compare a middle-income black kid with a middle- income white kid, and, say, you control for family background, family education, and family income, and if this middle-income black kid doesn't score as well as the white kid on the test, then I say, look, you haven't taken into consideration the cumulative effect of living in a segregated neighborhood and going to a de facto segregated school. You're denying a position at Harvard or some other place to a kid that really could make it. That's why I support affirmative action that's based on both class and race.

Is it just a coincidence that as the portion of our income spent on food has declined, spending on health care has soared? In 1960 Americans spent 17.5 percent of their income on food and 5.2 percent of national income on health care. Since then, those numbers have flipped: Spending on food has fallen to 9.9 percent, while spending on heath care has climbed to 16 percent of national income. I have to think that by spending a little more on healthier food we could reduce the amount we have to spend on heath care.

I think that is so interesting. It is le Carré. There must be so much of him when he was younger. He's an interesting character. I don't want to say the word "passive" because there is something very active about the way he is passive, if that makes any sense: the nature of his watching and his listening is active. It is always so alive because he is, essentially, a spy.

If you're a wealthy heir with a trust fund, and you sell stocks, make your 10% gains since Donald Trump, and then you buy other stocks, you can avoid paying taxes. And if your accountant registers your wealth offshore in a Panamanian fund, like Russian kleptocrats do - and as more and more Americans do - you don't have to pay any tax at all, because it's not American income, it's foreign income in an enclave without an income tax.

You will learn more about Donald Trump by going down to the federal elections, where I filed a 104-page essentially financial statement of sorts, the forms that they have. It shows income - in fact, the income - I just looked today - the income is filed at $694 million for this past year, $694 million. If you would have told me I was going to make that 15 or 20 years ago, I would have been very surprised.

I prefer an income tax, but the truth is I am afraid of the discussion which will follow and the criticism which will ensue if there is an other division in the Supreme Court on the subject of the income tax. Nothing has injured the prestige of the Supreme Court more than that last decision, and I think that many of the most violent advocates of the income tax will be glad of the substitution in their hearts for the same reasons. I am going to push the Constitutional amendment, which will admit an income tax without questions, but I am afraid of it without such an amendment.

In 1848, Karl Marx said, a progressive income tax is needed to transfer wealth and power to the state. Thus, Marx's Communist Manifesto had as its major economic tenet a progressive income tax. ... I say it is time to replace the progressive income tax with a national retail sales tax, and it is time to abolish the IRS.

I would rather have strong enemies than a world of passive individualists. In a world of passive individualists nothing seems worth anything simply because nobody stands for anything. That world has no convictions, no victories, no unions, no heroism, no absolutes, no heartbeat. That world has rigor mortis.