Top 1200 Paying Taxes Quotes & Sayings

Explore popular Paying Taxes quotes.

Last updated on December 22, 2024.

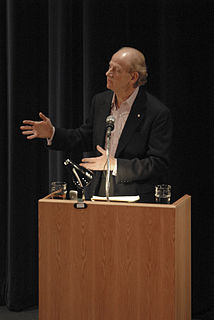

When you pay social security taxes, you are in no way making provision for your own retirement. You are paying the pensions of those who are already retired. Once you understand this, you see that whether you will get the benefits you are counting on when you retire depends on whether Congress will levy enough taxes, borrow enough, or print enough money.

People think of taxes as money just being robbed from you. They don't consider the benefits of paying taxes. The benefits that they get and also the benefit of just being a part of a large group of people: a town, or a city, or a country, or a society that allegedly should stand together and all try to help each other.

Taxes, well laid and well spent, insure domestic tranquility, provide for the common defense, and promote the general welfare. Taxes protect property and the environment; taxes make business possible. Taxes pay for roads and schools and bridges and police and teachers. Taxes pay for doctors and nursing homes and medicine.

I've never had it so good in terms of taxes. I am paying the lowest tax rate that I've ever paid in my life. Now, that's crazy. And if you look at the Forbes 400, they are paying a lower rate, accounting payroll taxes, than their secretary or whomever around their office. On average. And so I think that actually people in my situation should be paying more tax. I think the rest of the country should be paying less.

A lot of people in the western world don't realize how much taxes limit their options. You can end up paying almost half your income in taxes, which basically means you're working for the government for 180 days a year. I think I can find better ways to use the money I make for the benefit of society.

Remember that all tax revenue is the result of holding a gun to somebody's head. Not paying taxes is against the law. If you don't pay your taxes, you'll be fined. If you don't pay the fine, you'll be jailed. If you try to escape from jail, you'll be shot. ... Therefore, every time the government spends money on anything, you have to ask yourself, 'Would I kill my kindly, gray-haired mother for this?'

We are angry about paying the highest income taxes and property taxes in the nation and getting less and less for it. We are angry about our incompetent, dysfunctional government that pays no attention to the desires of the people. We are angry about the cesspool of corruption and conflicts of interests and self-dealing that is Albany.

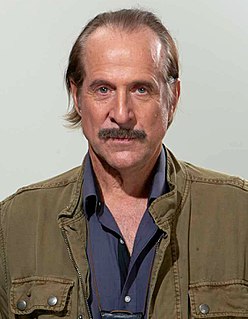

I'm making a lot of money. I should be paying a lot more taxes. I'm not paying taxes at a rate that is even close to what people were paying under Eisenhower. Do people think America wasn't ascendant and wasn't an upwardly mobile society under Eisenhower in the '50s? Nobody was looking at the country then and thinking to themselves, "We're taxing ourselves into oblivion." Yet there isn't a politician with balls enough to tell that truth because the whole system has been muddied by the rich. It's been purchased.

The government taxes you when you bring home a paycheck.

It taxes you when you make a phone call.

It taxes you when you turn on a light.

It taxes you when you sell a stock.

It taxes you when you fill your car with gas.

It taxes you when you ride a plane.

It taxes you when you get married.

Then it taxes you when you die.

This is taxual insanity and it must end.

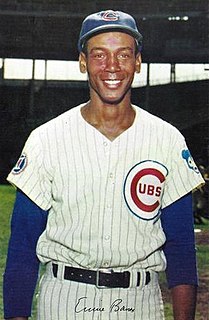

I love to tell how I'm suffering because one percent we're paying 25 percent of the total. We're not paying 25 percent of the total taxes on individuals. We're paying maybe 25 percent of the income tax, but the payroll tax is over a third of the receipts of the federal government. And they don't take that from me on capital gains. They don't take that from me on dividends. They take from the woman who comes in and takes the wastebaskets out.

The rich people are apparently leaving America. They're giving up their citizenship. These great lovers of America who made their money in this country-when you ask them to pay their fair share of taxes they run abroad. We have 19-year old kids who lost their lives in Iraq and Afghanistan defending this country. They went abroad. Not to escape taxes. They're working class kids who died in wars and now billionaires want to run abroad to avoid paying their fair share of taxes. What patriotism! What love of country!