Top 1200 Paying Taxes Quotes & Sayings - Page 4

Explore popular Paying Taxes quotes.

Last updated on December 22, 2024.

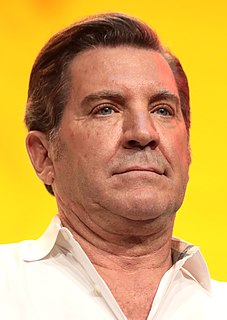

The people who are working, paying their taxes are put into the system so that affordable housing could be built in neighborhoods that they probably live in that. That they may not want to, they may pay a premium so that they could live where they want to live and you end up with just another massive redistribution of wealth.

It is easier to start taxes than to stop them. A tax an inch long can easily become a yard long. That has been the history of the income tax. Would not the sales tax be likely to have a similar history [in the U.S.]? ... Canadian newspapers report that an increase in the sales tax threatens to drive the Mackenzie King administration out of office. Canada began with a sales tax of 2%.... Starting this month the tax is 6%. The burden, in other words, has already been increased 200% ... What the U.S. needs is not new taxes, is not more taxes, but fewer and lower taxes.

I think the American people are gonna be reasonable with what do you do with someone who has been in this country for 10 or 12 years who hasn't otherwise violated our laws - because if they're a criminal they can't stay. They'll have to undergo a background check, pay a fine, start paying taxes. And ultimately, they'll given a work permit and that's all they're gonna be allowed to have for at least 10 years.

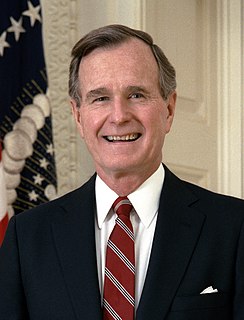

I'm the one who will not raise taxes. My opponent now says he'll raise them as a last resort, or a third resort. But when a politician talks like that, you know that's one resort he'll be checking into. My opponent, my opponent won't rule out raising taxes. But I will. And The Congress will push me to raise taxes and I'll say no. And they'll push, and I'll say no, and they'll push again, and I'll say, to them, Read my lips: no new taxes.

Let's at least acknowledge who is working in America right now and what our needs are, as well as the moral question of somebody who's been here 20 years, paying taxes to which they probably do not receive a refund, and not committing any crimes, working hard, and supporting an industry. Shouldn't there be some middle ground here? Shouldn't there be a way for them to be welcome in this country?

You could not possibly maintain the current level of government taxation without the taxes being hidden, and they are hidden in two very different ways. They are hidden through withholding, but they are also hidden by being imposed on business, supposedly on business, when really, of course, business can't pay taxes, only people can pay taxes.

With a congressional mandate to run the deficit up as high as need be, there is no reason to raise taxes now and risk aggravating the depression. Instead, Obama will follow the opposite of the Reagan strategy. Reagan cut taxes and increased the deficit so that liberals could not increase spending. Obama will raise spending and increase the deficit so that conservatives cannot cut taxes. And, when the economy is restored, he will raise taxes with impunity, since the only people who will have to pay them would be rich Republicans.

Fannie Mae is owned by shareholders but operates under a federal charter that exempts it from paying state or local taxes. As a result, many professional investors think the government would repay the debt that Fannie Mae had issued if the company could not, although Fannie Mae explicitly says that its bonds do not carry a federal guarantee.

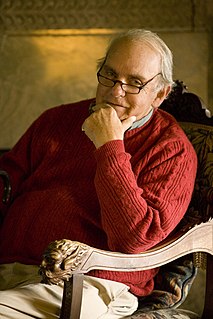

We often think about happiness as trying to increase our joy, but it's also about decreasing our worry. So what you get for paying those high taxes is, if you're a parent thinking about putting your child through school, you don't have to worry about it, because all education through college is free.

I understand the stress of finding quality and affordable childcare while paying high taxes. I also understand that many working moms struggle to make ends meet and balance their family and work life. These moms are the hard-working Americans who want to keep their jobs but also do the best they can for their children.

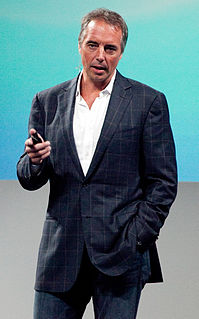

The easiest way to figure out who the customer is in an online space is to figure out who is paying for the thing. Usually, the people paying are the customers. So on Facebook, the people paying are marketers. That makes them the customers. And it means we are the product being delivered to those customers.

Look at what I am proposing, and we [wih Bernie Sanders] have a vigorous agreement here. We both want to reign in the excesses of Wall Street. I also want to reign in the excesses of Johnson Controls that we bailed out when they were an autoparts company, and we saved the auto industry, and now they want to avoid paying taxes.

The oil industry is hardly free to operate as efficiently as it could or to be as responsive to consumer demands as it would like. It has become, in essence, a quasi-state-run enterprise, because it cannot drill, transport, refine, and store fuel without receiving government permission, complying with government regulations, and paying taxes at every level or production.

Those who create the wealth naturally want to keep it and devote it to their own purposes. Those who wish to expropriate it look for ever more-clever ways to acquire it without inciting resistance. One of those ways is the spreading of an elaborate ideology of statism, which teaches that the people are the state and that therefore they are only paying themselves when they pay taxes.

Texas has no income tax, which is a big draw for corporate executives who do business there. But it's hardly tax-free. The property taxes are high for a Southern state. The sales taxes are high. One study found that the bottom 20 percent of the Texas population pays 12 percent of its income in state and local taxes.

Because U.K. artists aren't compensated when their music is played on U.S. radio stations, U.S. artists aren't compensated when their records are played on U.K. stations based on the fact that there's no reciprocity. If that income came in, our artists would be paying income taxes on it. So if we can get a lot of policy on the radar, that may have some positive influence.

I would just say it's not good for the country to have 11 million people here who we don't know who they are, where they're living. They're not paying taxes, but they're showing up in emergency rooms. They're driving up the cost of auto insurance 'cause they don't have driver's licenses and are getting into accidents. They're having children, which are US citizens. So, I mean, it's an issue that needs to be dealt with.

When a party can't think of anything else they always fall back on Lower Taxes. It has a magic sound to a voter, just like Fairyland is spoken of and dreamed of by all children. But no child has ever seen it; neither has any voter ever lived to see the day when his taxes were lowered. Presidents have been promising lower taxes since Washington crossed the Delaware by hand in a row boat. But our taxes have gotten bigger and their boats have gotten larger until now the President crosses the Delaware in his private yacht.

We need a wealth tax that on a one-time basis is going to take back at least some small fraction of the great windfall that the upper 1 percent, or 5 percent and pay down the government debt, pay back the federal debt because we can't put this on the next generation or they're going to be buried paying taxes.

Fundamentally, I've always been a fan of actually looking at our whole state tax system and really figuring out how we reform our tax system so that everyone's paying their fair share but we don't have a lot of nickel and diming with 100 taxes that end up hitting people that maybe can't bear it the most.

The only role other than paying their taxes, whatever those are, the only role for philanthropy broadly - of which the rich should give disproportionately - the more, the better - and I think there is a positive trend in that direction - there are certain risk-taking things, like trying out a new type of charter school or funding a new kind of medicine.

The appropriation of public money always is perfectly lovely until some one is asked to pay the bill. If we are to have a billion dollars of navy, half a billion of farm relief, etc... the people will have to furnish more revenue by paying more taxes. It is for them, through their Congress, to decide how far they wish to go.