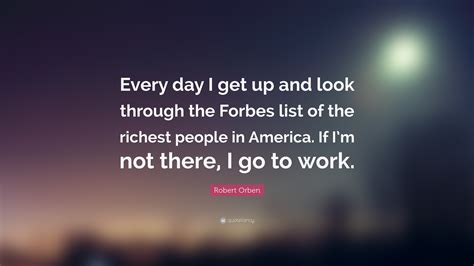

Top 1200 Paying Taxes Quotes & Sayings - Page 6

Explore popular Paying Taxes quotes.

Last updated on December 22, 2024.

Anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the treasury. There is not even a patriotic duty to increase one's taxes. Over and over again the Courts have said that there is nothing sinister in so arranging affairs as to keep taxes as low as possible. Everyone does it, rich and poor alike and all do right, for nobody owes any public duty to pay more than the law demands.

Barack Obama is talking about cutting taxes. On net, he is a tax cutter. But the difference between Obama and John McCain is that Obama is raising some taxes on families, for example, with incomes over $250,000. Now, that amounts to about 2 percent, the richest 2 percent of American households. And even with those tax changes, even with all of the tax changes Obama's talking about, taxes will be lower under Obama than they were under the Clinton years.

The left's obsession with corporations as a spawn of evil is pathological paranoia. A corporation is just one form of organizing a private business enterprise for purposes of limiting personal liability, issuing stock, filing financial reports and paying taxes. Other forms include partnerships and sole proprietorships. Are they less evil? You buy your groceries from corporations, your cars, newspapers, cellphones, clothing and exercise equipment. Your parents and children work for corporations. Are they evil?

Congress has all sorts of rules, hedge fund managers, private equity managers, executives, movie stars, fall into that allow them to escape or defer into the future not paying their taxes. And if you can defer your tax into the future, it's the best deal in the world, because you don't just get to eat your cake and have it too. You get to eat your cake and have a bigger cake.

What the Affordable Care Act started was a change in the American health care system from paying for procedures to paying for outcomes, paying for health. Other nations have already made that move. We pay for procedures and we get the best procedures in the world and we get the most procedures in the world, and then we spend a huge chunk of our GDP on health care, but we don't have the best outcomes.

Most asylum seekers do get permanent visas, so the earlier they receive the appropriate help, the faster they will become part of the community. They'll get jobs and start paying taxes too. They will see Australia as a nation with a sense of care and concern. That's so important for a cohesive society. It helps build a sense of belonging. And in terms of common decency, it's what should be happening... For God's sake, this is Australia, people should be treated with decency and humanity.

I'm not so sure liberal democracy as we know it has reached its terminus. It's clear though, that many have genuinely lost confidence in the Australian political class. One reason is that we like to place enormous burdens of expectations on modern political leaders. To be sure such expectations aren't always honest. Just as we want better public services but object to paying the higher taxes that would make them possible, we often want leadership but only if there aren't hard choices with real consequences.

A man cannot free himself by any self-denying ordinances, neither by water nor potatoes, nor by violent possibilities, by refusing to swear, refusing to pay taxes, by going to jail, or by taking another man's crops or squatting on his land. By none of these ways can he free himself; no, nor by paying his debts with money; only by obedience to his own genius.

If you're a wealthy heir with a trust fund, and you sell stocks, make your 10% gains since Donald Trump, and then you buy other stocks, you can avoid paying taxes. And if your accountant registers your wealth offshore in a Panamanian fund, like Russian kleptocrats do - and as more and more Americans do - you don't have to pay any tax at all, because it's not American income, it's foreign income in an enclave without an income tax.

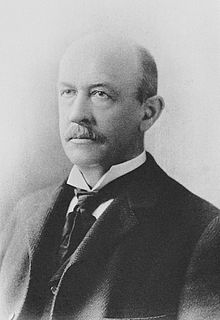

The Forgotten Man is delving away in patient industry, supporting his family, paying his taxes, casting his vote, supporting the church and the school, reading his newspaper, and cheering for the politician of his admiration, but he is the only one for whom there is no provision in the great scramble and the big divide. Such is the Forgotten Man. He works, he votes, generally he prays — but he always pays — yes, above all, he pays.