Top 1200 Payroll Tax Quotes & Sayings

Explore popular Payroll Tax quotes.

Last updated on April 14, 2025.

We were giving advice for the single-worst idea to come forward from a group that's been rife with them, it would be this: The idea is this: Let's make the tax code of America better for very rich people; let's give substantial tax relief to the richest people we can find. Forget about the person making $40,000 a year and paying Social Security payroll tax. Forget about all those other people paying income tax; we're here to give tax relief to the richest 2% of America.

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.

The Value-Added Tax, a sales tax that applies at every level of business transactions, is an easy tax for governments to collect, and a hard tax to evade. So it makes the job of raising revenue easier. The revenues from the VAT can then be used to lower taxes on income and saving and investment. The Value-Added tax doesn't penalize work or saving; it's a tax on buying stuff.

I refer the largest number of my clients to Payce Payroll because the specialize in the restaurant and contractors industries. I am pleased with the service they provide, competitive fees and responsiveness to clients. What most impressed me was that one of the founders, Gus, came to personally meet with me and a client to establish their payroll software. They truly care about their clients.

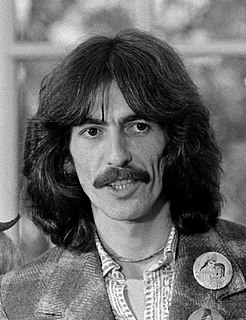

I love to tell how I'm suffering because one percent we're paying 25 percent of the total. We're not paying 25 percent of the total taxes on individuals. We're paying maybe 25 percent of the income tax, but the payroll tax is over a third of the receipts of the federal government. And they don't take that from me on capital gains. They don't take that from me on dividends. They take from the woman who comes in and takes the wastebaskets out.

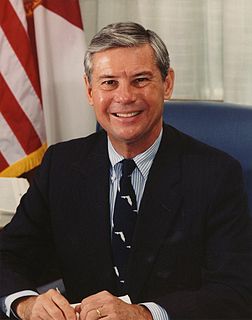

I think that Democrats have to think through answers we haven't in the past: How we are going to create those jobs? How should we restructure the entire tax code? Should we have things like a payroll tax, when jobs are so scarce? They weren't - basically the architecture of our employment law, tax law, all these things were from the 1930s - and I do think that one benefit of Donald Trump, which is not worth it, but one perverse thing is, he has widened the scope of things that we should discuss.

I think it's time we had a President who will provide the only real economic security: good jobs. A President who will provide middle class payroll tax relief to get money in the pockets of workers who will spend it, not more tax giveaways for those at the top to stimulate the economy in the Cayman Islands and Bermuda. A President who will index the minimum wage to inflation and raise it from a 30 year low, not increase the tax burden on the middle class and those struggling to join it.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

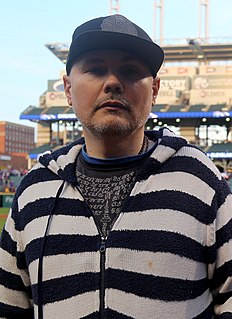

I actually once sat at the back of a payroll class in America - just me and 40 women! And I'm sitting back there, learning payroll, because I want to understand it. So that when I talk to people about payroll I know what they're talking about. And I set up and managed and ran a full payroll system myself.

I've never had it so good in terms of taxes. I am paying the lowest tax rate that I've ever paid in my life. Now, that's crazy. And if you look at the Forbes 400, they are paying a lower rate, accounting payroll taxes, than their secretary or whomever around their office. On average. And so I think that actually people in my situation should be paying more tax. I think the rest of the country should be paying less.

Unlike most government programs, Social Security and, in part, Medicare are funded by payroll taxes dedicated specifically to them. Some of the tax revenue pays for current benefits; anything that's left over goes into trust funds for the future. The programs were designed this way for political reasons.

The 9-9-9 plan would resuscitate this economy because it replaces the outdated tax code that allows politicians to pick winners and losers, and to provide favors in the form of tax breaks, special exemptions and loopholes. It simplifies the code dramatically: 9% business flat tax, 9% personal flat tax, 9% sales tax.