Top 44 Portfolios Quotes & Sayings

Explore popular Portfolios quotes.

Last updated on April 14, 2025.

If you look at what's happened to the stock market, if you look at what's happened to housing values, if you look at what's happened to bank loan portfolios because the value of their other assets that they've already issued loans against were going down, there was a pretty good argument for trying to pass something at about this level of investment with the divisions as they were - unemployment, food stamps, and tax cuts, aid to education and healthcare, and job creation.

You know, some of the portfolios we might consider buying are portfolios which would do especially well if we have an economy-wide, or I mean, a global climate change that impacts us very negatively there are some companies that will do well, and so it might make sense to hold some of those in your portfolio.

Short-term performance envy causes many of the shortcomings that lock most investors into a perpetual cycle of underachievement. Watch your competitors not out of jealousy but out of respect and focus your efforts not on replicating others' portfolios but on looking for opportunities where they are not. The only way for investors to significantly outperform is to periodically stand far apart from the crowd, something few are willing, or able, to do.

I personally make sure that some of my investments are in foreign securities or in international commodity portfolios that are independent of the US dollar. But that's a personal preference. I do not invest in currencies because it's so complicated and so risky. I would not attempt that without excellent professional help.

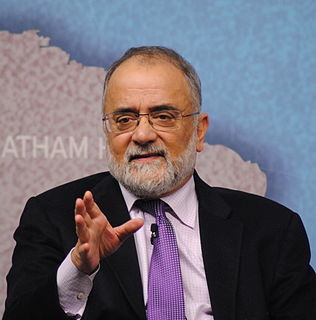

People would be a lot more skeptical if they understood that there is an incredible amount of chance in the results that you observe for active managers. So the distribution of outcomes is enormously wide - but that's exactly what you'd expect by chance with lots of active managers who hold imperfectly diversified portfolios. The really good portfolios contain a lot of really lucky picks, and the really bad portfolios contain a lot of really unlucky picks as well as some really bad ones.

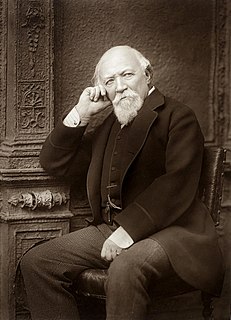

Photographers should make three or four prints from one negative and then crop them differently. When I was art director at Harper's Bazaar and at several agencies as a consultant, young photographers would bring me their portfolios and all the prints would be in the same standard proportions, either for the Leica or the Rolleiflex. Many times, by limiting themselves in this way, they missed the true potentialities of their photographs.

There's no use diversifying into unknown companies just for the sake of diversity. A foolish diversity is the hobgoblin of small investors. That said, it isn't safe to own just one stock, because in spite of your best efforts, the one you choose might be the victim of unforeseen circumstances. In small portfolios, I'd be comfortable owning between three and ten stocks.

In a world of businessmen and financial intermediaries who aggressively seek profit, innovators will always outpace regulators; the authorities cannot prevent changes in the structure of portfolios from occurring. What they can do is keep the asset-equity ratio of banks within bounds by setting equity-absorption ratios for various types of assets. If the authorities constrain banks and are aware of the activities of fringe banks and other financial institutions, they are in a better position to attenuate the disruptive expansionary tendencies of our economy.

Perhaps the most important job of a financial advisor is to get their clients in the right place on the efficient frontier in their portfolios. But their No. 2 job, a very close second, is to create portfolios that their clients are comfortable with. Advisors can create the best portfolios in the world, but they won't really matter if the clients don't stay in them.

Active management strategies demand uninstitutional behavior from institutions, creating a paradox that few can unravel. Establishing and maintaining an unconventional investment profile requires acceptance of uncomfortably idiosyncratic portfolios, which frequently appear downright imprudent in the eyes of conventional wisdom.

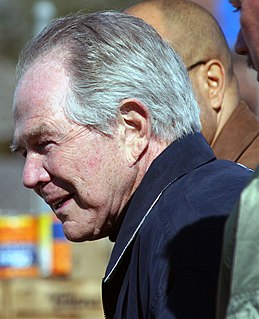

The idea that a bell rings to signal when investors should get into or out of the stock market is simply not credible. After nearly fifty years in this business, I do not know of anybody who has done it successfully and consistently. I don't even know anybody who knows anybody who has done it successfully and consistently. Yet market timing appears to be increasingly embraced by mutual fund investors and the professional managers of fund portfolios alike.