Top 1200 Progressive Tax Quotes & Sayings - Page 10

Explore popular Progressive Tax quotes.

Last updated on December 21, 2024.

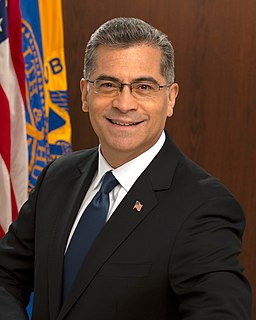

The poverty we see in America is now too widespread, and too complex, for easy fixes. But I do think we can reimagine many of our institutions and can create new ones in ways that would be effective. We could, for example, create social insurance systems, similar to social security, such as that we went through in 2008-9. We could create a financial transaction tax, oil profit taxes and a fairer estate tax system, and we could plow much of the revenue raised from these into job training programs, into better education infrastructure, into an expanded Earned Income Tax Credit.

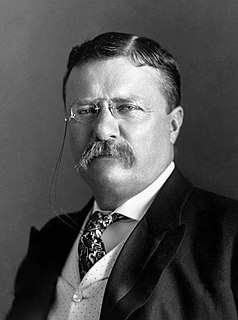

I dont believe in labels. I want to do the best I can, all the time. I want to be progressive without getting both feet off the ground at the same time. I want to be prudent without having my mind closed to anything that is new or different. I have often said that I was proud that I was a free man first and an American second, and a public servant third and a Democrat fourth, in that order, and I guess as a Democrat, if I had to takeplace a label on myself, I would want to be a progressive who is prudent.

Today it is evident that we have two political parties: the Tax and Spenders and the No-Tax and Spenders. Neither party is fiscally conservative. Is there no room at the inn for an honest conservative? A conservative who makes the case for smaller government on its merits and not just as the fallback option when fiscal bankruptcy threatens?

New Hampshire has always been cheap, mean, rural, small-minded, and reactionary. It's one of the few states in the nation with neither a sales tax nor an income tax. Social services are totally inadequate there, it ranks at the bottom in state aid to education--the state is literally shaped like a dunce cap--and its medical assistance program is virtually nonexistent. Expecting aid for the poor there is like looking for an egg under a basilisk.... The state encourages skinflints, cheapskates, shutwallets, and pinched little joykillers who move there as a tax refuge to save money.

I campaigned for [Barack] Obama for more than a year. I was in Iowa, Minnesota, California, Arizona - just traveling around to help get the word out. It was such a huge, spirited campaign, and so positive. But you travel around to cities in the U.S. now and there's just this hopelessness that has set in. It makes it hard to understand why it seems so impossible to make any kind of progressive change with an administration that is seemingly progressive, or why we keep encountering such political roadblocks to change.

Barack Obama is talking about cutting taxes. On net, he is a tax cutter. But the difference between Obama and John McCain is that Obama is raising some taxes on families, for example, with incomes over $250,000. Now, that amounts to about 2 percent, the richest 2 percent of American households. And even with those tax changes, even with all of the tax changes Obama's talking about, taxes will be lower under Obama than they were under the Clinton years.

There is no tax policy that better describes how out of touch America's liberals are with the rest of the country than the estate tax. According to the Left, government seizure of a large share of the wealth of an American taxpayer is a moral imperative that serves social justice. Most Americans disagree, big time.

The 1984 tax trials, when he appealed his New York state and New York City audits, were about Donald Trump claiming zero revenue for his consulting business and taking over $600,000 of deductions, for which he couldn't produce any documentation, no receipts, no checks, nothing, those two elements, zero income and huge deductions, combined with his own tax guy testifying under oath, that's my signature, but I didn't prepare that tax return, those are very strong badges of fraud.

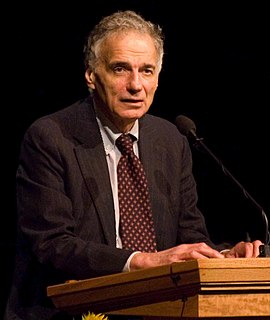

The IRS spends God knows how much of your tax money on these toll-free information hot lines staffed by IRS employees, whose idea of a dynamite tax tip is that you should print neatly. If you ask them a real tax question, such as how you can cheat, they're useless. So, for guidance, you want to look to big business. Big business never pays a nickel in taxes, according to Ralph Nader, who represents a big consumer organization that never pays a nickel in taxes. . . .

What the Trump tax plan is a plan to give tiny little tax cuts to most Americans, raise taxes on perhaps one in five families and shower benefits on people who earn millions of dollars a year. And this fits with a fundamental principle the Republicans have been pursuing for a long time. The rich aren't investing and creating jobs, because they don't have nearly enough money, and so we need to get them money. And the way the Republicans want to get it to them is tax cuts first, and then to take away help for children, the disabled, the elderly and the poor.

I think it's time we had a President who will provide the only real economic security: good jobs. A President who will provide middle class payroll tax relief to get money in the pockets of workers who will spend it, not more tax giveaways for those at the top to stimulate the economy in the Cayman Islands and Bermuda. A President who will index the minimum wage to inflation and raise it from a 30 year low, not increase the tax burden on the middle class and those struggling to join it.

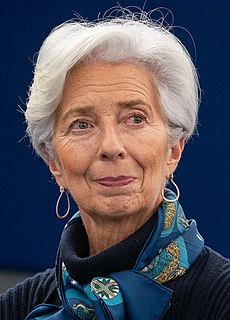

Many governments and corporations take no moral responsibility for the enslavement of migrant workers and freely do business with states built on the back of slave labour. Illicit financial flows and tax evasion are ignored in the interests of some nations and their corporations, stripping the tax base that is so vital for essential services.

There are several reasons to oppose tax increases. First, every dollar of tax increase is a dollar you didn't get in spending restraint. Two, if you walk into the Democrats' Andrews-Air-Force-Base, Lucy-with-the-Football trick for the third time in a row - they don't have have a saying for being fooled three times!

Much of the blame for the situation lies with the states themselves. They haven't been able to pass decent laws. For decades, tax authorities have been taking aim at the phenomenon of tax havens, and the most aggravating thing is that they aren't just in Bermuda or on the Cayman Islands, but right outside our front door.

In the meantime the big corporations are fleeing America for tax havens and places like Ireland, Luxembourg and the Grand Cayman Islands; the rich are finding more tax loopholes to expect; so when are the people going to basically roll up their sleeves and say, we've had enough, we're going to recapture Congress.

High tax rates in the upper income brackets allow politicians to win votes with class warfare rhetoric, painting their opponents as defenders of the rich. Meanwhile, the same politicians can win donations from the rich by creating tax loopholes that can keep the rich from actually paying those higher tax rates - or perhaps any taxes at all. What is worse than class warfare is phony class warfare. Slippery talk about 'fairness' is at the heart of this fraud by politicians seeking to squander more of the nation's resources.