Top 1200 Progressive Tax Quotes & Sayings - Page 4

Explore popular Progressive Tax quotes.

Last updated on December 19, 2024.

Start by scrapping the tax code. Don't fiddle with it. Junk it. Throw it out. Bury it. Replace it with a pro-growth, pro-family tax cut that lowers tax rates to 17% across the board and expands exemptions for individuals and children so that a family of four would pay no taxes on the first $36,000 of income.

In December, I agreed to extend the tax cuts for the wealthiest Americans because it was the only way I could prevent a tax hike on middle-class Americans. But we cannot afford $1 trillion worth of tax cuts for every millionaire and billionaire in our society. We can't afford it. And I refuse to renew them again.

Corporate tax reform is nice in theory but tough in practice. It most likely requires lower tax rates and the closing of loopholes, which many companies are sure to fight. And whatever new, lower tax rate is determined, there will probably be another country willing to lower its rate further, creating a sad race to zero.

When you consider that a steelworker who's making $40,000 a year has virtually the same tax burden as someone who's making $400,000 a year, you see that there are inequities. This administration has used the tax code to accelerate wealth to the top. Most of the tax breaks have gone to people in the top bracket.

You may have heard that Donald Trum has long refused to release his tax returns, the way every other nominee for president has done for decades. You can look at 40 years of my tax returns. I think we need a law that says, if you become the nominee of the major parties, you have to release your tax returns.

All those predictions about how much economic growth will be created by this, all of those new jobs, would be created by the things we wanted - the extension of unemployment insurance and middle class tax cuts. An estate tax for millionaires adds exactly zero jobs. A tax cut for billionaires - virtually none.

I think we should have basically the same tax policy that Germany, Japan, the U.K., everybody else has, which is a tax rate in the mid-20s and no loopholes. Zero. The U.S. has the most antiquated tax system. And that means some people are going to pay more taxes, and some people are going to pay less.

Why do we fully tax some kinds of income from capital, like interest and dividends; partially tax other kinds like capital gains; defer tax on other kinds, like IRAs; and impose no tax at all on still other types of capital income, like interest on municipal bonds? This simply is not rational. These distinctions don't have any inherent logic.

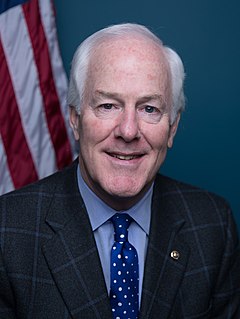

OK, so this pack - tax package includes about 50 tax breaks. None of them are new. They were all existing tax breaks. What this did was make them permanent. It gives some certainty for people when they're filing taxes that they don't have to wonder if Congress is going to renew them year after year.

We've been prepared to make the arguments for lowering corporation tax, which is all about encouraging risk takers, encouraging entrepreneurs, and I observe that for the vast majority of the Labour government we had a top rate of 40 per cent income tax. It's now higher, and I think we should look to get to a simpler, lower tax system.