Top 1200 Property Taxes Quotes & Sayings - Page 2

Explore popular Property Taxes quotes.

Last updated on December 19, 2024.

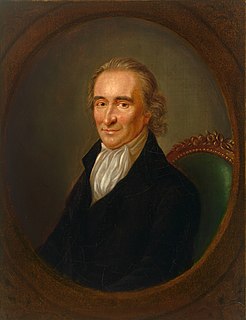

It is a moot question whether the origin of any kind of property is derived from nature at all. It is agreed by those who have seriously considered the subject that no individual has, of natural right, a separate property in an acre of land, for instance. By a universal law, indeed, whatever, whether fixed or movable, belongs to all men equally and in common is the property for the moment of him who occupies it; but when he relinquishes the occupation, the property goes with it. Stable ownership is the gift of social law, and is given late in the progress of society.

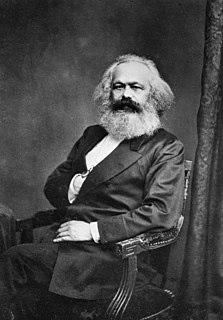

You are horrified at our intending to do away with private property. But in your existing society, private property is already done away with for nine tenths of the population; its existence for the few is solely due to its non-existence in the hands of those nine tenths. You reproach us, therefore, with intending to do away with a form of property, the necessary condition for whose existence is the non-existence of any property for the immense majority of society.

I want everyone to keep the property that he has acquired for himself according to the principle: benefit to the community precedes benefit to the individual. But the state should retain supervision and each property owner should consider himself appointed by the state. It is his duty not to use his property against the interests of others among his own people. This is the crucial matter. The Third Reich will always retain its right to control the owners of property.

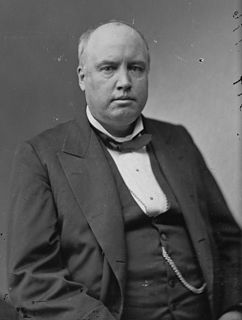

Centralize property in the hands of a few and the millions are under bondage to property - a bondage as absolute and deplorable as if their limbs were covered with manacles. Abstract all property from the hands of labor and you thereby reduce labor to dependence; and that dependence becomes as complete a servitude as the master could fix upon his slave.

I would agree that much with people who accept private property - that conscription is an unpardonable transgression, whether it be "corrupt" or not. The Spanish anarchists opposed conscription during the civil war in Spain as a gross expropriation of property, the most precious property that we have, our own physical beings themselves.

As I understand it, I am being paid only for my work in arranging the words; my property is that arrangement. The thoughts in this book, on the contrary, are not mine. They came freely to me, and I give them freely away. I have no "intellectual property," and I think that all claimants to such property are theives.

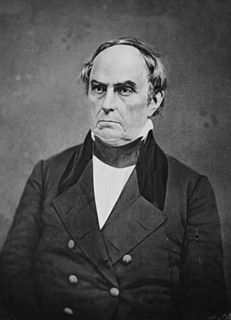

To lay taxes to provide for the general welfare of the United States, that is to say, 'to lay taxes for the purpose of providing for the general welfare.' For the laying of taxes is the power, and the general welfare the purpose for which the power is to be exercised. They are not to lay taxes ad libitum for any purpose they please; but only to pay the debts or provide for the welfare of the Union.

Suggestion of the Communist Manifesto was 'abolition of all right of inheritance.' Looking backward upon the past history of estate taxes, we have to realize that they more and more have approached the goal set by Marx. Estate taxes of the height they have already attained for the upper brackets are no longer to be qualified as taxes. They are measures of expropriation.

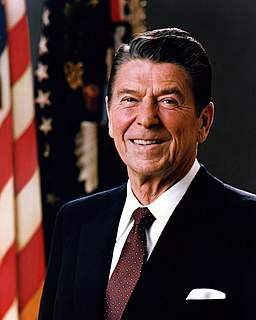

It is easier to start taxes than to stop them. A tax an inch long can easily become a yard long. That has been the history of the income tax. Would not the sales tax be likely to have a similar history [in the U.S.]? ... Canadian newspapers report that an increase in the sales tax threatens to drive the Mackenzie King administration out of office. Canada began with a sales tax of 2%.... Starting this month the tax is 6%. The burden, in other words, has already been increased 200% ... What the U.S. needs is not new taxes, is not more taxes, but fewer and lower taxes.

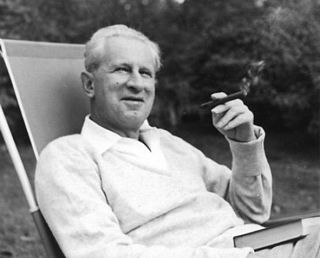

It has been the fashion to speak of the conflict between human rights and property rights, and from this it has come to be widely believed that the use of private property is tainted with evil and should not be espoused by rational and civilized men... the only dependable foundation of personal liberty is the personal economic security of private property. The Good Society.

There is something that governments care for more than human life, and that is the security of property, and so it is through property that we shall strike the enemy.... Those of you who can break windows--break them. Those of you who can still further attack the secret idol of property, so as to make the Government realize that property is as greatly endangered by women's suffrage as it was by the Chartists of old--do so. And my last word is to the Government: I incite this meeting to rebellion!

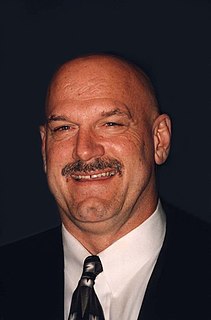

A product of your life and liberty is your property. Property is the fruit of your labor, the product of your time, energy, and talents. It is that part of nature that you turn to valuable use. And it is the property of others that is given to you by voluntary exchange and mutual consent. Two people who exchange property voluntarily are both better off or they wouldn't do it. Only they may rightfully make that decision for themselves.

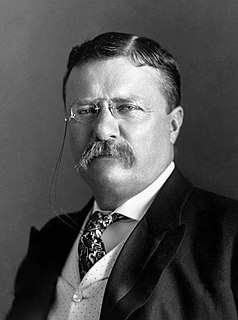

My position as regards the monied interests can be put in a few words. In every civilized society property rights must be carefully safeguarded; ordinarily and in the great majority of cases, human rights and property rights are fundamentally and in the long run, identical; but when it clearly appears that there is a real conflict between them, human rights must have the upper hand; for property belongs to man and not man to property.

In the nature of things, those who have no property and see their neighbors possess much more than they think them to need, cannot be favorable to laws made for the protection of property. When this class becomes numerous, it becomes clamorous. It looks on property as its prey and plunder, and is naturally ready, at times, for violence and revolution.