Top 1200 Property Taxes Quotes & Sayings - Page 3

Explore popular Property Taxes quotes.

Last updated on December 19, 2024.

Anybody who has ever owned a dog who barked when strangers came near its owner's property has experienced the essential continuity between animal territoriality and human property. Our domesticated cousins of the wolf know, instinctively, that property is no mere social convention or game, but a critically important evolved mechanism for the avoidance of violence. (This makes them smarter than a good many human political theorists.)

When a party can't think of anything else they always fall back on Lower Taxes. It has a magic sound to a voter, just like Fairyland is spoken of and dreamed of by all children. But no child has ever seen it; neither has any voter ever lived to see the day when his taxes were lowered. Presidents have been promising lower taxes since Washington crossed the Delaware by hand in a row boat. But our taxes have gotten bigger and their boats have gotten larger until now the President crosses the Delaware in his private yacht.

The suppression of unnecessary offices, of useless establishments and expenses enabled us to discontinue our internal taxes. These covering our land with officers, and opening our doors to their intrusions, had already begun that process of domiciliary vexation which, once entered, is scarcely to be restrained from reaching successively every article of produce and property.

With a congressional mandate to run the deficit up as high as need be, there is no reason to raise taxes now and risk aggravating the depression. Instead, Obama will follow the opposite of the Reagan strategy. Reagan cut taxes and increased the deficit so that liberals could not increase spending. Obama will raise spending and increase the deficit so that conservatives cannot cut taxes. And, when the economy is restored, he will raise taxes with impunity, since the only people who will have to pay them would be rich Republicans.

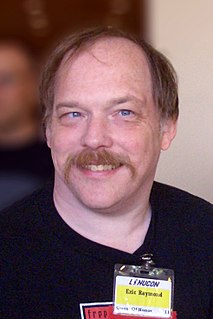

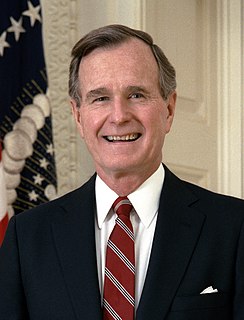

I'm the one who will not raise taxes. My opponent now says he'll raise them as a last resort, or a third resort. But when a politician talks like that, you know that's one resort he'll be checking into. My opponent, my opponent won't rule out raising taxes. But I will. And The Congress will push me to raise taxes and I'll say no. And they'll push, and I'll say no, and they'll push again, and I'll say, to them, Read my lips: no new taxes.

In too many ways, Ohio is being run for the benefit of those who have already made it, and too many of our friends and neighbors are being left behind. Nowhere is this more evident than in the cuts to police officers, firefighters, nurses, teachers, and to our local schools, while property and sales taxes are going up.

The Assembly passed a budget that makes the right choices for young students across the state by helping schools avoid cutting essential educational programs, laying off teachers and increasing local property taxes. Without a sound investment in our children and their education, New York would face crumbling school buildings, overcrowded classrooms, and few opportunities to excel.

But an opinion that it is possible for the present generation to seize and use the property of future generations has produced to both parties concerned, effects of the same complexion with the usual fruits of national errour. The present age is cajoled to tax and enslave itself, by the errour of believing that it taxes and enslaves future ages to enrich itself.

Liberalism makes this mistake in regard to private property and Marxism makes it in regard to socialized property... The Marxist illusion is partly derived from a romantic conception of human nature... It assumes that the socialization of property will eliminate human egotism... The development of a managerial class in Russia, combing economic with political power, is an historic refutation of the Marxist theory.

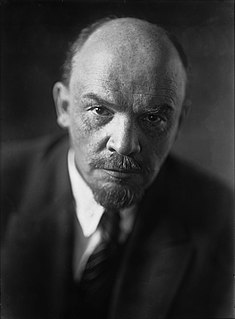

And the desire to own property, to take for ourselves things which in no way belong to us, does not stop short at the sun. The air is already bought and sold as a commodity, by health resorts. And what of water? Or waterpower? Why should the earth be parceled out into private hands? Is it any different from the sun? No; the earth belongs to the people who live on it. God intended it for them, but it has been taken over by private individuals. Privare means to steal. Thus private property is stolen property - property stolen from God and from humankind!

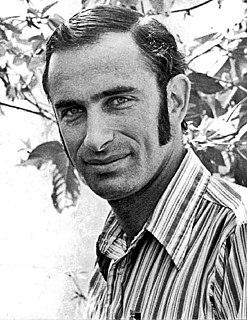

Property rights can improve a woman's ability to stand up to violence in the home. You might think education and employment are important because they give women exit options, but property is as well. Give women equal property rights to inherited land, then they have an asset they can take out of the marriage. This gives husbands strong incentives to not beat them.

The apportionment of taxes on the various descriptions of property is an act which seems to require the most exact impartiality; yet there is, perhaps, no legislative act in which greater opportunity and temptation are given to a predominant party to trample on the rules of justice. Every shilling which they overburden the inferior number is a shilling saved to their own pockets.

Property is, after all, a social convention, an agreement about someone's exclusive right to use a thing in specified ways. However, we seem to have forgotten this. We seem to think that property belongs to us in some essential way, that it is of us. We seem to think that our property is part of ourselves, and that by owning it we therefore make ourselves more, larger, greater.

What I do know is, in little more than 30 years, we have gone from a nation where the “quiet enjoyment” of one’s private property was a sacred right, to a day when the so-called property “owner” faces a hovering hoard of taxmen and regulators threatening to lien, foreclose, and “go to auction” at the first sign of private defiance of their collective will ... a relationship between government and private property rights which my dictionary defines as “fascism.”

I decided that if nobody else was going to do anything to rectify this colossal inequity in taxation, I'd have to do it myself. So I instituted a suit against the city of Baltimore demanding that the city assessor be specifically ordered to assess the Church for its vast property holdings in the city, and that the city tax collector then be instructed to collect the taxes once the assessment has been made.

It is evident that the right of acquiring and possessing property, and having it protected, is one of the natural, inherent, and unalienable rights of man. Men have a sense of property: Property is necessary to their subsistence, and correspondent to their natural wants and desires; its security was one of the objects, that induced them to unite in society. No man would become a member of a community, in which he could not enjoy the fruits of his honest labour and industry.

Whereas the property-owning middle class could win freedom for themselves on the basis of rights to property--thus excluding others from the freedom they gain--the property-less working class possess nothing but their title as human beings. Thus they can liberate themselves only by liberating all humanity.

You could not possibly maintain the current level of government taxation without the taxes being hidden, and they are hidden in two very different ways. They are hidden through withholding, but they are also hidden by being imposed on business, supposedly on business, when really, of course, business can't pay taxes, only people can pay taxes.