Top 1200 Property Taxes Quotes & Sayings - Page 4

Explore popular Property Taxes quotes.

Last updated on December 19, 2024.

The party should stand for a constantly wider diffusion of property. That is the greatest social and economic security that can come to free men. It makes free men. We want a nation of proprietors, not a state of collectivists. That is attained by creating a national wealth and income, not by destroying it. The income and estate taxes create an orderly movement to diffuse swollen fortunes more effectively than all the quacks.

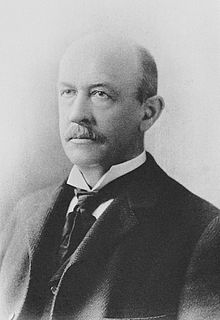

In civilized communities, property as well as personal rights is an essential object of the laws, which encourage industry by securing the enjoyment of its fruits; that industry from which property results, and that enjoyment which consists not merely in its immediate use, but in its posthumous destination to objects of choice, and of kindred affection. In a just and free government, therefore, the rights both of property and of persons ought to be effectually guarded.

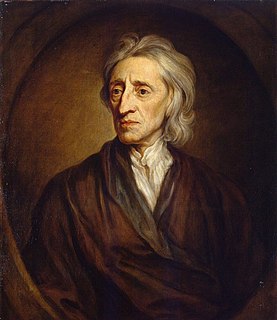

It is not the right of property which is protected, but the right to property. Property, per se, has no rights; but the individual - the man - has three great rights, equally sacred from arbitrary interference: the right to his life, the right to his liberty, the right to his property The three rights are so bound together as to be essentially one right. To give a man his life but to deny him his liberty, is to take from him all that makes his life worth living. To give him his liberty but take from him the property which is the fruit and badge of his liberty is to still leave him a slave.

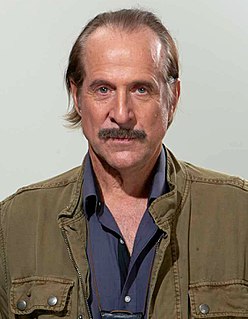

When the rich plunder the poor of his rights, it becomes an example for the poor to plunder the rich of his property, for the rights of the one are as much property to him as wealth is property to the other, and the little all is as dear as the much. It is only by setting out on just principles that men are trained to be just to each other; and it will always be found, that when the rich protect the rights of the poor, the poor will protect the property of the rich. But the guarantee, to be effectual, must be parliamentarily reciprocal.

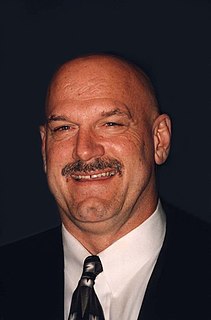

If you behave like a good citizen, and you upgrade and improve your property, your reward will be the government will take more money from you. So using that analogy, you should let your house become the shithole on the block and they'll reduce your taxes and you'll pay less. Be a bad citizen with your neighbors, right? You'll save money then.

The worst loophole is what Donald Trump has talked about: the tax deductibility of interest. If you let real estate owners or corporate raiders borrow the money to buy a property or company, and then pay interest to the bondholders, you'll load the company you take over with debt. But you don't have to pay taxes on the profits that you pay out in this way. You can deduct the interest from your tax liability.

I thought you liberals cared about people, but here you're perfectly content to get them addicted to tobacco and make them pay taxes through the nose and continue to pay taxes through the nose and raise their taxes. And then you try to make 'em think you care about 'em by running PSAs telling them how they shouldn't smoke and how they should quit. You're exactly right. If they really cared, they would ban the product, but they can't, because the revenue from tobacco taxes - I'm not kidding you - funds children's health care programs, and a number of other things as well.

And with respect to the mode in which these general principles affect the secure possession of property, so far am I from invalidating such security, that the whole gist of these papers will be found ultimately to aim at an extension in its range; and whereas it has long been known and declared that the poor have no right to the property of the rich, I wish it also to be known and declared that the rich have no right to the property of the poor.

First, the oil and gas business pays its fair share of taxes. Despite the current debate on energy taxes, few businesses pay more in taxes than oil and gas companies. The worldwide effective tax rate for our industry in 2010 was 40 percent. That's higher than the U.S. statutory rate of 35 percent and the rate for manufacturers of 26.5 percent.

The diversity in the faculties of men, from which the rights of property originate, is not less an insuperable obstacle to a uniformity of interests. The protection of these faculties is the first object of government. From the protection of different and unequal faculties of acquiring property, the possession of different degrees and kinds of property immediately results; and from the influence of these on the sentiments and views of the respective proprietors, ensues a division of the society into different interests and parties.