Top 1200 Real Estate Market Quotes & Sayings - Page 13

Explore popular Real Estate Market quotes.

Last updated on October 8, 2024.

In short, Europe’s colonization of Africa had nothing to do with differences between European and African peoples themselves, as white racists assume. Rather, it was due to accidents of geography and biogeography—in particular, to the continents’ different areas, axes, and suites of wild plant and animal species. That is, the different historical trajectories of Africa and Europe stem ultimately from differences in real estate.

I don't know how you feel, but I'm pretty sick of church people. You know what they ought to do with churches? Tax them. If holy people are so interested in politics, government, and public policy, let them pay the price of admission like everybody else. The Catholic Church alone could wipe out the national debt if all you did was tax their real estate.

If you could distill this down to a single principle its that the best marketers in the world know MARKETS first and foremost, and secondly they're students of MARKETING. It's more important to know a MARKET than to know MARKETING, and I teach people MARKETING! And so, as far as this seminar is concerned, it's all about knowing a market, and it's so thorough that even if you don't have personal experience in that market you can still go into it and find out, what are the things that people will pay money for!

What is it about a work of art, even when it is bought and sold in the market, that makes us distinguish it from . . . pure commodities? A work of art is a gift, not a commodity. . . works of art exist simultaneously in two “economies”, a market economy and a gift economy. Only one of these is essential, however: a work of art can survive without the market, but where there is no gift, there is no art.

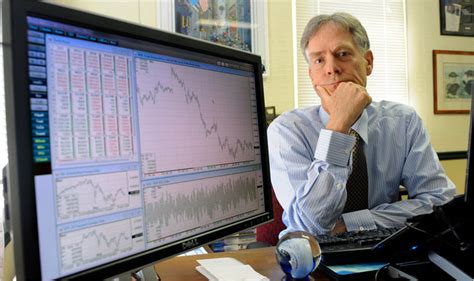

The correct method for tracking the stock market is to use semilogarithmic chart paper, since the market's history is sensibly related only on a percentage basis. The investor is concerned with percentage gain or loss, not the number of points traveled in a market average. Arithmetic scale is quite acceptable for tracking hourly waves. Channeling techniques work acceptably well on arithmetic scale with shorter term moves.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

Churches are tax exempt because they are supposed to provide a public good. To prove that good to the IRS, churches arent supposed to hoard their money. They are supposed to spend it on goods and services for the faithful. Under this pretense, the church has made massive investments in tax free real estate all over the world. And when it comes to labor costs, they are almost free.

The market has a simple way of whittling all excessive pride and overblown egos down to size. After all, the whole idea is to be completely objective and recognize what the marketplace is telling you, rather than try to prove that the thing you said or did yesterday or six weeks ago was right. The fastest way to take a bath in the stock market or go broke is to try to prove that you are right and the market is wrong.

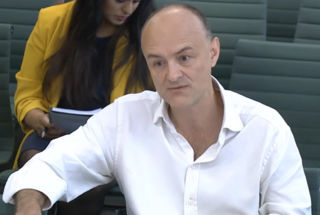

The worst loophole is what Donald Trump has talked about: the tax deductibility of interest. If you let real estate owners or corporate raiders borrow the money to buy a property or company, and then pay interest to the bondholders, you'll load the company you take over with debt. But you don't have to pay taxes on the profits that you pay out in this way. You can deduct the interest from your tax liability.

Prior to the advent of the civilization of the Third Estate (mercantilism, capitalism), the social ethics that was religiously sanctioned in the West consisted in realizing one’s being and in achieving one’s own perfection within the fixed parameters that one’s individual nature and the group to which one belonged clearly defined. Economic activity, work, and profit were justified only in the measure in which they were necessary for sustenance and to ensure the dignity of an existence conformed to one’s own estate, without the lower instinct of self-interest or profit coming first.

In the mid to late nineteenth century, the gun manufacturers recognized that they had a limited market. Remember that this is a capitalist society, you've got to expand your market. They were selling guns to the military. That's a pretty limited market. What about all the rest of the people? So what started was all kinds of fantastic stories about Wyatt Earp and the gunmen and the Wild West, how exciting it was to have these guys with guns defending themselves against all sorts of things.

Donald Trump is a - the owner of a lot of real estate that he manages, he may well pay no income taxes. We know for a fact that he didn't pay any income taxes in 1978, 1979, 1984, 1992 and 1994. We know because of the reports of the New Jersey Casino Control Commission. We don't know about any year after that.