Top 1200 Real Estate Market Quotes & Sayings - Page 15

Explore popular Real Estate Market quotes.

Last updated on October 7, 2024.

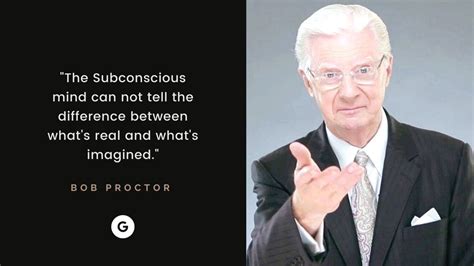

I am aware there are books that instruct you on how to manipulate the market, stocks and people... they might even help you get money. But, let me caution you... when there is no spiritual growth... there is no spiritual strength... there is no lasting happiness... and, there is no real or lasting wealth.

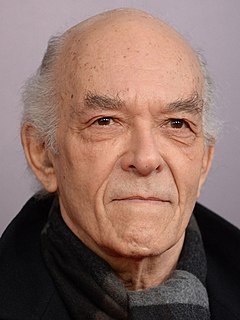

Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate. It will purge the rottenness out of the system. High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up from less competent people.

I'm sure, out of the context here of Stanley Levison's relationship with the Jewish liberal forces, that had made contributions. I remember one such contribution before they moved from Montgomery. An associate in the real estate business with Stanley had lost a son in the war, and she wanted to do something in memory of him. So, she made available certain monies to be used by the emerging leadership there in Montgomery. I'm sure other individuals did.

What I'm nostalgic for is the idea of an edge in New York. There used to be these fringes of the city where civilization sort of ended, and therefore young people could live cheaply, or open nightclubs or art galleries, or even squat. That fringe moved out to New Jersey and Brooklyn. The whole idea of the metropolis is the centralization of like-minded souls, and when the central real estate becomes too expensive, the dreamers, the young poets, and the artists will go elsewhere.

In real estate you can avoid ever having to pay a capital gains tax, decade after decade, century after century. When you sell a property and make a capital gain, you simply turn around and buy a new property. The gain is not taxed. It's called "preserving your capital investment" - which goes up and up in value with each transaction.

It can be shown that maximum diversification is achieved by holding each stock in proportion to its value to the entire market (italics added)... Hindsight plays tricks on our minds... often distorts the past and encourages us to play hunches and outguess other investors, who in turn are playing the same game. For most of us, trying to beat the market leads to disastrous results... our actions lead to much lower returns than can be achieved by just staying in the market.

Once a price move exceeds its median historical age, any method you use to analyze the market, whether it be fundamental or technical, is likely to be far more accurate. For example, if a chartist interprets a particular pattern as a top formation, but the market is only up 10% from the last low, the odds are high that the projection will be incorrect. However, if the market is up 25% to 30%, then the same type of formation should be given a great deal more weight.

Near the top of the market, investors are extraordinarily optimistic because they've seen mostly higher prices for a year or two. The sell-offs witnessed during that span were usually brief. Even when they were severe, the market bounced back quickly and always rose to loftier levels. At the top, optimism is king, speculation is running wild, stocks carry high price/earnings ratios, and liquidity has evaporated. A small rise in interest rates can easily be the catalyst for triggering a bear market at that point.

Americans have always pursued our dreams within a free market that has been the engine of our progress. It's a market that has created a prosperity that is the envy of the world, and rewarded the innovators and risk-takers who have made America a beacon of science, and technology, and discovery. But the American economy has worked in large part because we have guided the market's invisible hand with a higher principle - that America prospers when all Americans can prosper. That is why we have put in place rules of the road to make competition fair, and open, and honest.

I think an erotics of place may be one of the reasons why environmentalists are seen as subversive. There is a backlash now:... [ellipsis in source] take all the regulations away; weaken existing legislation; the endangered species act is too severe, too restrictive; let there be carte blanche for real-estate developers. Because if we really have to confront wildness, solitude, and serenity, both the fierceness and compassionate nature of the land, then we ultimately have to confront it in ourselves, and it's easier to be numb, to be distracted, to be disengaged.

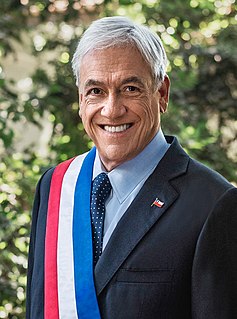

I actually do not believe that Trump is anti-trade as such. He himself was a life-long trader in his own area, the real estate sector. And hasn't he just closed an arms deal with the Saudis valuing over $100 billion? The difference is that Trump sees trade as something with a winner and a loser. This seems to be a theme of his, and that makes us different. For us, trade is something where both sides win.

"(Big name research firm) says our market will be $50 billion in 2010." Every entrepreneur has a few slides about how the market potential for his segment is tens of billions. It doesn't matter if the product is bar mitzah planning software or 802.11 chip sets. Venture capitalists don't believe this type of forecast because it's the fifth one of this magnitude that they've heard that day. Entrepreneurs would do themselves a favor by simply removing any reference to market size estimates from consulting firms.

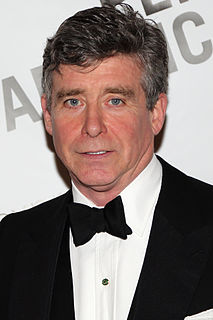

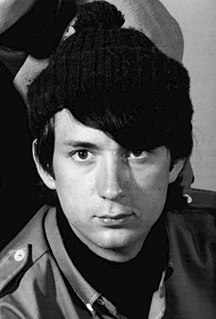

I am just a journeyman actor. Most often I take what's offered me, and I've been able to work year after year. I was in 'Scarface.' Some people think this must have done me a world of good. Truth to tell, six months after 'Scarface' I had to take a job with a real estate development friend for a few months just to get by.

The market literature, which was particularly strong in Igboland, in Onitsha, today it is no longer strong. It is one of the victims of the civil war, that market was actually destroyed and at the end of the war a new Nigeria has struggled to come into being and I believe that what is probably going to replace the market literature might be the video, which they have taken to in a big way, creating dramas. So that may be the next thing way we will see coming out of the local basic level in our society.