Top 1200 Retirement Card Quotes & Sayings

Explore popular Retirement Card quotes.

Last updated on April 14, 2025.

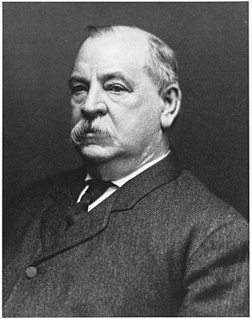

Once a little boy sent me a charming card with a little drawing on it. I loved it. I answer all my children’s letters — sometimes very hastily — but this one I lingered over. I sent him a card and I drew a picture of a Wild Thing on it. I wrote, “Dear Jim: I loved your card.” Then I got a letter back from his mother and she said, “Jim loved your card so much he ate it.” That to me was one of the highest compliments I’ve ever received. He didn’t care that it was an original Maurice Sendak drawing or anything. He saw it, he loved it, he ate it.

Social Security is the foundation stone of that kind of retirement security. It not only needs to be strengthened in order to make sure it's there for younger baby boomers and Generations X and Y, but it probably needs to be strengthened and expanded because the retirement benefits now being offered by most employers are not sufficient to support middle-income Americans in their long years of retirement.

In January we start saving money, getting out of credit card debt, funding our retirement accounts, and we're doing wonderful. Then, every single year like clockwork, starting in November, all of you fall into this trap that says, 'I have to buy this gift... I can't show up at this party and not have something for everybody.

Maybe you'll take the cash out. So a credit card company or a bank that goes into the business of saying we're going to be the broker, we're going to sell you a mortgage that you're going to be able to pay off, we're going to help you reduce your credit card debt, we're going to help you save for retirement, we're going to put you into mutual funds that have low fees rather than high fees.

No one anticipates divorce when they're exchanging vows, and it can be devastating emotionally and financially. To ease the financial side of the blow, you need to maintain your financial identity in your relationship. That means having your own credit history - you need your own credit card - and your own savings and retirement accounts.

If you do not have at least an eight-month emergency fund, and you think there's a probability you could loose your job - and it's not just losing your job; you could be in a car accident, get sick - continue to pay the minimum on your credit card every month. Everything beyond that needs to go to establish an emergency fund. And if you have an emergency fund saved, then fund your retirement account before paying down credit card debt.

In January we start saving money, getting out of credit card debt, funding our retirement accounts, and we're doing wonderful. Then, every single year like clockwork, starting in November, all of you fall into this trap that says, 'I have to buy this gift... I can't show up at this party and not have something for everybody.'

Absolutely invest in retirement. You can always get a loan to get kids through school. I do not know of any loans to get you through retirement. The markets are seriously low from where they were (even though they've gone up 30 percent recently). Now is the time to be dollar cost averaging; the more money you put in, the more shares you buy. Save for your retirement, people.

People look at things differently. Imagine going to a village in Southern Sudan and try to explain to someone there the concept of life insurance or retirement. Go to Vietnam and say retirement. Retirement in another country is your body is too racked with pain and your hands are too arthritic from the life in the rice patty fields, so you can't work anymore. So you move in with your son and his new wife takes care of you because that's how families work there.

By working toward a financial objective, you'll start to see the money add up for retirement or the credit card balance go down. But it doesn't have an immediate impact on your day-to-day life, and when it does - like when you're pinching pennies to save more - the immediate impact could feel negative.