Top 1200 Retirement Years Quotes & Sayings

Explore popular Retirement Years quotes.

Last updated on April 14, 2025.

Absolutely invest in retirement. You can always get a loan to get kids through school. I do not know of any loans to get you through retirement. The markets are seriously low from where they were (even though they've gone up 30 percent recently). Now is the time to be dollar cost averaging; the more money you put in, the more shares you buy. Save for your retirement, people.

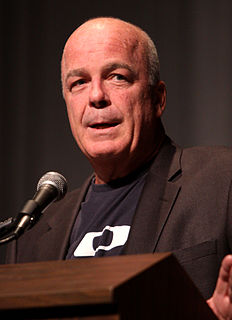

Social Security is fine for those at or near retirement today. For those receiving their checks today, don't worry. It's going to be there for you. For those that are nearing their retirement years, don't worry, it's going to be there for you. But for your kids - for your boy and my boy, and for their children, for our kids and grandkids, it's a real big question as to whether or not the system's going to be there.

People look at things differently. Imagine going to a village in Southern Sudan and try to explain to someone there the concept of life insurance or retirement. Go to Vietnam and say retirement. Retirement in another country is your body is too racked with pain and your hands are too arthritic from the life in the rice patty fields, so you can't work anymore. So you move in with your son and his new wife takes care of you because that's how families work there.

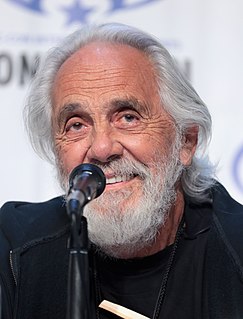

I do believe if one keeps busy it's very good for a person. In fact, people are always rushing into retirement and we read in Europe that people there are talking about their retirement age and moving it to 67 or something. Well, back when they started retirement funds and everything, the average age was 70 or 60, and then all of a sudden now it's 80, and so. [...] And so you keep in shape, you keep yourself mentally in shape. And if you keep yourself mentally in shape, chances are physically it will follow suit.

It's probably also smart to keep some money in cash to invest it. But I would resist at all costs taking a lump-sum distribution because the tendency is to spend out too fast in the early years of your retirement. The advice of professionals is to take out no more than 5% per year and that will give you 20 years of distributions, and at your age, 55, you probably have more than 20 years life expectancy.

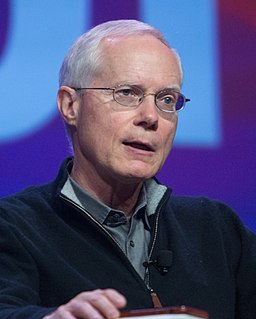

My financial adviser Ric Edelman...thinks the time to start educating people about money is when they are children. He's set up a retirement plan called the RIC-E-Trust that can provide retirement security. A $5,000 one-time tax-deferred investment at birth, with an average interest rate of ten percent compounded, means that a child would have $2.4 million when he or she is 65 years old. Who needs Social Security with that kind of nest egg?

Social Security is the foundation stone of that kind of retirement security. It not only needs to be strengthened in order to make sure it's there for younger baby boomers and Generations X and Y, but it probably needs to be strengthened and expanded because the retirement benefits now being offered by most employers are not sufficient to support middle-income Americans in their long years of retirement.

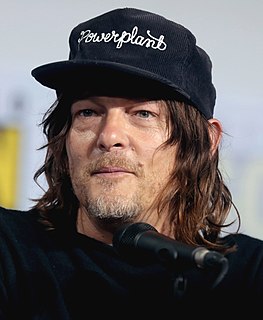

Miles Davis had been in retirement for five or six years and he was coming out of retirement and he was looking for young guys. Somebody gave him my name and he called me and said, "Can you show up at Columbia Studios in two hours?" I'm like, "Whoa, is this the real Miles Davis?" He's like, "Yeah." So I showed up and yeah, it was intimidating, but music is so important to me that the intimidation was all before the notes started.

With just an elementary school education, my father worked as a short order cook for forty years before retirement. He liked to boast that his kitchen 'never failed an inspection.' For the same forty years, my mother worked tirelessly as a housekeeper for a group of families in the affluent communities of Studio City and Sherman Oaks.