Top 1200 Sales Tax Quotes & Sayings

Explore popular Sales Tax quotes.

Last updated on April 22, 2025.

It's fashionable to use terms like 'sales funnels' to describe the sales process for many companies, and it is true that the funnel design is very appropriate for the digital world, but despite all the prose written on sales funnels and the like, my question is still the same - when do you close your sales, and how long does that take?

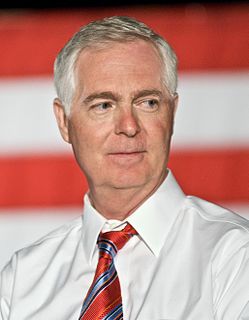

Mr. Speaker, in 1848, Karl Marx said, a progressive income tax is needed to transfer wealth and power to the state. Thus, Marx's Communist Manifesto had as its major economic tenet a progressive income tax. Think about it, 1848 Karl Marx, Communism.... I say it is time to replace the progressive income tax with a national retail sales tax, and it is time to abolish the IRS, my colleagues. I yield back all the rules, regulations, fear, and intimidation of our current system.

It is easier to start taxes than to stop them. A tax an inch long can easily become a yard long. That has been the history of the income tax. Would not the sales tax be likely to have a similar history [in the U.S.]? ... Canadian newspapers report that an increase in the sales tax threatens to drive the Mackenzie King administration out of office. Canada began with a sales tax of 2%.... Starting this month the tax is 6%. The burden, in other words, has already been increased 200% ... What the U.S. needs is not new taxes, is not more taxes, but fewer and lower taxes.

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.

Texas has no income tax, which is a big draw for corporate executives who do business there. But it's hardly tax-free. The property taxes are high for a Southern state. The sales taxes are high. One study found that the bottom 20 percent of the Texas population pays 12 percent of its income in state and local taxes.

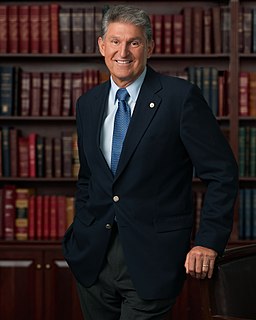

The move to tax Internet sales, clothed as a 'fairness' issue, is the typical 'wolf-in-sheep's-clothing' ploy so often used by governments unwilling to cut expenditures to match revenues. It matters not whether its proponents have a 'D' or an 'R' after their name. It is a tax increase in either case.

Millions and millions of people don't pay an income tax, because they don't earn enough to pay on one, but you pay a land tax whether it ever did or ever will earn you a penny. You should pay on things that you buy outside of bare necessities. I think this sales tax is the best tax we have had in years.

The Value-Added Tax, a sales tax that applies at every level of business transactions, is an easy tax for governments to collect, and a hard tax to evade. So it makes the job of raising revenue easier. The revenues from the VAT can then be used to lower taxes on income and saving and investment. The Value-Added tax doesn't penalize work or saving; it's a tax on buying stuff.

The 9-9-9 plan would resuscitate this economy because it replaces the outdated tax code that allows politicians to pick winners and losers, and to provide favors in the form of tax breaks, special exemptions and loopholes. It simplifies the code dramatically: 9% business flat tax, 9% personal flat tax, 9% sales tax.

New Hampshire has always been cheap, mean, rural, small-minded, and reactionary. It's one of the few states in the nation with neither a sales tax nor an income tax. Social services are totally inadequate there, it ranks at the bottom in state aid to education--the state is literally shaped like a dunce cap--and its medical assistance program is virtually nonexistent. Expecting aid for the poor there is like looking for an egg under a basilisk.... The state encourages skinflints, cheapskates, shutwallets, and pinched little joykillers who move there as a tax refuge to save money.

One measure for promoting both stability and fairness across financial market segments is a small sales tax on all financial transactions - what has come to be known as a Robin Hood Tax. This tax would raise the costs of short-term speculative trading and therefore discourage speculation. At the same time, the tax will not discourage "patient" investors who intend to hold their assets for longer time periods, since, unlike the speculators, they will be trading infrequently.

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

In 1848, Karl Marx said, a progressive income tax is needed to transfer wealth and power to the state. Thus, Marx's Communist Manifesto had as its major economic tenet a progressive income tax. ... I say it is time to replace the progressive income tax with a national retail sales tax, and it is time to abolish the IRS.

Wall Street is being investigated, but they are not asleep while it's being done. You see where the Senate took that tax off the sales of stocks, didn't you? Saved 'em $48,000,000. Now, why don't somebody investigate the Senate and see who got to them to get that tax removed? That would be a real investigation.

God forbid that the United Kingdom should take a lead and introduce a sensible tax system of its own which would probably comprise a very low level of corporation tax - tax on corporate profits - and perhaps a low level of corporate sales tax, because sales are where they are, and sales in this country are sales here, which we can tax here.