Top 479 Savings Quotes & Sayings - Page 8

Explore popular Savings quotes.

Last updated on November 16, 2024.

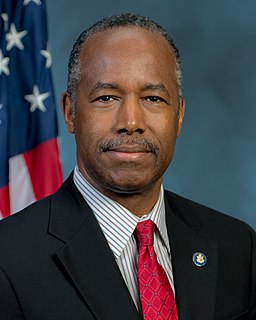

I know a lot of people in Washington would say, well, you know, indigent people can't manage their health savings account. They're too stupid. But they're not too stupid. Somebody has a diabetic foot ulcer, they learn very quickly not to go the emergency room where it costs five times more to take care of it. They go to the clinic.

The most serious problems lie in the financial sphere, where the economy's debt overhead has grown more rapidly than the 'real' economy's ability to carry this debt. [...] The essence of the global financial bubble is that savings are diverted to inflate the stock market, bond market and real estate prices rather than to build new factories and employ more labor.

Someone has described the modern American as a person who drives a bank financed car over a bond financed highway on credit card gas to open a charge account at a department store so he can fill his savings and loan financed home with installment purchased furniture. may this also be a description of many modern professed Christians? And may this not be one reason why modern Christians have so little time to pray? Importunity combined with perfect faith in unconquerable!

One of the ways the telegraph changed us as humans was it gave us a new sense of what time it is. It gave us an understanding of simultaneity. It gave us the ability to synchronize clocks from one place to another. It made it possible for the world to have standard time and time zones and then Daylight Savings Time and then after that jetlag. All of that is due to the telegraph because, before that, the time was whatever it was wherever you were.

My big "double-aha" moment came while anchoring the national news at CBS News. It was at the height of the recession, and on top of the usual negative stories, my newscasts became full of especially heart wrenching stories of people losing their homes, jobs, and retirement savings. Starting the morning off like that could leave even the most optimistic person feeling helpless and hopeless. The lightning bolt came when we changed how we talked about the negative.

We're going to come up with a great healthcare plan, whether it's healthcare savings accounts, we have a lot of different things. We're going to get rid of the lines between states, we're going to have great competitive bidding. But I say all the time, you can call it anything you want. People are not going to die in the middle of the street. People are not going to die on the sidewalk if I'm president, okay?

The problem is that you're creating a system of bubble finance where interest rates are so low that people can speculate. An asset value goes up. You put it up as collateral. You borrow against it. You buy more of the asset. You then take the rising asset. You borrow against it again. This is the nature of what's going on in the world. This isn't an excess of real savings. This is an excess of artificial credit that's being fueled by all the central banks.

At a time when going to college has never been more important, it's never been more expensive, and our nation's families haven't been in this kind of financial duress since the great depression. And so what we have is just sort of a miraculous opportunity simply by stopping the subsidy to banks when we already have the risk of loans. We can plow those savings into our students. And we can make college dramatically more affordable, tens of billions of dollars over the next decade.

No one anticipates divorce when they're exchanging vows, and it can be devastating emotionally and financially. To ease the financial side of the blow, you need to maintain your financial identity in your relationship. That means having your own credit history - you need your own credit card - and your own savings and retirement accounts.

No matter what level you're starting at, it's about not only utilizing your time, but your resources and network. For me, I started my company with a small amount of savings; I never had investors and I was lucky in the sense that I had models and connections in the fashion industry who were willing to give me advice early on. So really, for anyone starting a new business, it's really important to seek out mentors and knowledge from those who have come before you. And to not let that be discouraging, but to take that advice and really learn from it and mold it to what you're trying to do.

I admit that one should never underestimate the capacity of banks to destroy enormous amounts of accumulated capital and reduce, temporarily, the supply. After all, capital is the accumulated savings of mankind. And banks are great masters in destroying enormous amounts of capital with great regularity.

I'll give you a simple formula for straightening out the problems of the United States. First, you tax the churches. You take the tax off of capital gains and the tax off of savings. You decriminalize all and tax them same way as you do alcohol. You decriminalize . You make gambling legal. That will put the budget back on the road to recovery, and you'll have plenty of tax revenue coming in for all of your social programs, and to run the army.

Education is the lifeline of the city of Boston in a lot of ways, as far as preparing and educating young people for the future. So when we think about that - I would love to have the $25 million dollar investment we made up to close the gap on charter schools. I'd love to make that investment in a different part of the school system if we could. The money that we're trying to adjust on transportation, I would love to, if we can save money in transportation - that's not going to be a savings, that's going to come into the general fund, that's going to be reinvested in the school.

While I wholeheartedly support finding cost savings through efficiencies in all areas of the federal government, including defense, I will resist any actions that would compromise our nation’s qualitative edge when it comes to national defense. It is well known that weakness invites aggression. Threats do not always announce themselves in advance. In order to prepare for unpredictable threats, we must modernize our defense systems. We certainly cannot let them age and deteriorate.

Obviously, our most pressing need is subsistence for the most vulnerable victims of Katrina, but we should not overlook the fact that the victims of Katrina also include middle-class Americans who have saved and invested, but now face an economic crisis, .. They should be able to tap into their savings and meet this crisis without facing an unfair penalty.

The way I found time to write 'The Imperfectionists' was that I took work as a copy editor at the 'International Herald Tribune' in Paris, working full-time for approximately six months, then taking my savings from that and writing full-time, then returning after six months, and so on, until the book was done!

In terms of my profession, I'm passionate about financial literacy. I want to live in a financially literate society. I want kids to understand the importance of savings and investing. I want to try to replicate the great savers who came out of the Depression, the best savers the country has ever seen. It's crucial that people understand the importance of financial literacy, because it's actually life saving.

If top marginal income tax rates are set too high, they discourage productive economic activity. In the limit, a top marginal income tax rate of 100 percent would mean that taxpayers would gain nothing from working harder or investing more. In contrast, a higher top marginal rate on consumption would actually encourage savings and investment. A top marginal consumption tax rate of 100 percent would simply mean that if a wealthy family spent an extra dollar, it would also owe an additional dollar of tax.

The system is not intended as a substitute for private savings, pension plans, and insurance protection. It is, rather, intended as the foundation upon which these other forms of protection can be soundly built. Thus, the individual's own work, his planning and his thrift will bring him a higher standard of living upon his retirement, or his family a higher standard of living in the event of his death, than would otherwise be the case. Hence the system both encourages thrift and self-reliance, and helps to prevent destitution in our national life.

It makes no difference to a widow with her savings in a 5 percent passbook account whether she pays 100 percent income tax on her interest income during a period of zero inflation or pays no income tax during years of 5 percent inflation. Either way, she is 'taxed' in a manner that leaves her no real income whatsoever. Any money she spends comes right out of capital. She would find outrageous a 100 percent income tax but doesn't seem to notice that 5 percent inflation is the economic equivalent.

Lukewarm people do not live by faith; their lives are structured so they never have to. They don't have to trust God if something unexpected happens- they have their savings account. They don't need God to help them- they have their retirement plan in place. They don't genuinely seek out what life God would have them live- they have life figured and mapped out. They don't depend on God on a daily basis- their refrigerators are full and, for the most part, they are in good health. The truth is, their lives wouldn't look much different if they suddenly stopped believing in God.

To switch lads and lassies from quickie ceremonies back to the catered works in to-be-worm-only-once white dresses, the [wedding] garment producers have turned to sociology. Through statistics as carefully laid out as a bridal train, they are establishing a correlation showing a higher divorce rate for the informally gowned.... They may just have something there.... If a bride has sunk a bunk of savings into a dress she can't use again in a second wedding, she might think twice about having a second.

The simple index fund solution has been adopted as a cornerstone of investment strategy for many of the nation's pension plans operated by our giant corporations and state and local governments. Indexing is also the predominant strategy for the largest of them all, the retirement plan for federal government employees, the Federal Thrift Savings Plan (TSP). The plan has been a remarkable success, and now holds some $173 billion of assets for the benefit of our public servants and members of armed services.

There are wonderful low-interest loans you can take out to own your own solar and cut your energy bills down drastically. You can retrofit your home to become more energy efficient with on-bill financing, where the upgrades you make pay for themselves with the energy savings you generate. Ten years ago, there were only a few electric vehicles on the market, and today there are many, many more coming, and with each year the cost of them comes down.

In his second term, [Ronald] Reagan completed the work of his first term - the rich got really rich, everything was deregulated, advocacy programs were quashed, the Savings and Loan program was trashed, the deficit was tripled, unions were busted, Housing and Urban Developing was in shambles, banks were closing, the military got lots of new toys, the religious right was strong, and AIDS was ignored.

I will never forget who this victory truly belongs to. It belongs to you. It belongs to you. I was never the likeliest candidate for this office. We didn't start with much money or many endorsements. Our campaign was not hatched in the halls of Washington. It began in the backyards of Des Moines and the living rooms of Concord and the front porches of Charleston. It was built by working men and women who dug into what little savings they had to give $5 and $10 and $20 to the cause.

There'll be some savings from preventing double dipping by public servants which are currently able to access not one but two fully tax payer funded schemes and of course there will be out paid parental leave levy. So all up not only is this an important economic reform, an important reform to have to grow our economy more strongly, it also will leave the budget better off which will help us fix the mess that Labor has created with the budget.

I had no money. I had no savings account.So I would bring down my color TV set, a Sears TV with a cable snaked into it - they had no video-in back in those days - and hooked it up to the circuit of very few chips and then a little keyboard you could type on. And I was trying to impress people with how did he do it with fewer chips than anyone could ever imagine?

A rentier is an investor whose relationship to a company or enterprise is strictly limited to the ownership of financial wealth (such as stocks or bonds) and the receipt of income on that wealth (such as dividends or interest). The financial system performs dismally at its advertised task, that of efficiently directing society's savings towards their optimal investment pursuits. The system is stupefyingly expensive, gives terrible signals for the allocation of capital, and has surprisingly little to do with real investment.

Opening a small business is a reasonable thing for you to do but should tax payer, should an ordinary worker have to pay more money in taxes because someone across the street from them opened up a business which might well go under? For a lot of people opening a business is a bad choice for them. Most small businesses fail. I understand people wanting to give it a try and everything but we're not necessarily doing them a favor to say, take all your life savings, borrow to the hilt, and then struggle for three years and end up with nothing. We're not necessarily doing them a favor.

In a speech at the just-concluded G20 summit in London, President Obama urged Americans not to let their fears crimp their spending. It would be unwise, he argued, for Americans to let the fear of job loss, lack of savings, unpaid bills, credit card debt or student loans deter them from making major purchases. According to the president, 'we must spend now as an investment for the future'....instead of saving for the future, we must spend for the future.

No matter whether it is their intention or not, almost anything that the rich can legally do tends to help the poor. The spending of the rich gives employment to the poor. But the saving of the rich, and their investment of these savings in the means of production, gives just as much employment, and in addition makes that employment constantly more productive and more highly paid, while it also constantly increases and cheapens the production of necessities and amenities for the masses.

Dreams, in their essence, include risk. This risk could be physical danger (often true in climbing big mountains like Everest), or it could be financial (leaving a comfortable job and pouring your life savings into a business venture), or it could be emotional (like the feelings of loss and questioning that comes with losing friends and coworkers to climbing accidents).

The most disappointing thing this week is that Mitt Romney picked Paul Ryan, because he was the intellectual leader of the Republican Party. Because Paul Ryan decided to join Mitt Romney's ticket, he is completely reversed himself on some of the issues he has been very strong on, like the $716 billion in savings that are in two of his budgets.

I left small businesses a little while ago and they were all complaining that Obamacare is putting them out of business. Not only the regulations, which are a disaster and the taxes, but Obamacare is putting them out of business. So you have that concept, the savings accounts, health care. What you really have are ways of getting people energized by take - you have to take down the lines between the state so you have competition.

China's accumulation of reserves is a result of the IMF's mismanagement of the Asian financial crisis a decade or so ago. If countries know they can't rely on the IMF to help them, their best defense is their own reserve cushion. In a time of spreading global recession, too much emphasis on savings in surplus countries like China can impede prospects for global growth.

Let us never forget this fundamental truth: the State has no source of money other than money which people earn themselves. If the State wishes to spend more it can do so only by borrowing your savings or by taxing you more. It is no good thinking that someone else will pay - that 'someone else' is you. There is no such thing as public money; there is only taxpayers' money.

The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit. In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. Deficit spending is simply a scheme for the hidden confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists' antagonism toward the gold standard.

The best place to have some food set aside is within our homes, together with a little money in savings. The best welfare program is our own welfare program. Five or six cans of wheat in the home are better than a bushel in the welfare granary. ... We can begin with a one week's food supply and gradually build it to a month, and then to three months. I am speaking now of food to cover basic needs.

With money we really fool ourselves. We are our biggest enemies with money and there are some things we can do about it. Automatic deductions are a wonderful thing. But ideally, you should wait until the end of the month, you can see how much extra money you had, and you should put that in your savings account. We don't do that too well, and if we did that, we would never save. So, what we do, is we take money out of our pocket into the saving account at the beginning of the month, take it outside of our control and as a consequence, we spend less and we save more.

You look at the savings health insurance, there's so many great ways you can do that. You'll get great plans at much less money, at much less money. I mean, these people are being just killed. And you know the 25% was put out by Washington 'cause the real number could be three times that amount. I mean, it's catastrophic what's going on.

I buy mainly Beatles bootlegs and stuff like that. I'm hoping I can go there today. My dad buys my drawings and he re-sells them for quite a bit more and then he puts the money in my savings. I just draw all the time and he buys and I get a lot money [laughs]. It's great. My dad's my best manager I ever had. If I get richer, I'd like to be able to buy more of the real collectible Beatles things. I just need a little more money to be a higher class collector [laughs].

Inflation is not a Robin Hood, taking from the rich to give to the poor. Rather, it deals most cruelly with those who can least protect themselves. It strikes hardest those millions of our citizens whose incomes do not quickly rise with the cost of living. When prices soar, the pensioner and the widow see their security undermined, the man of thrift sees his savings melt away; the white collar worker, the minister, and the teacher see their standards of living dragged down.

Downey Savings & Loan receives high ratings from its customers in California in areas related to personal service and for being customer focused. Downey customers are also twice as likely to visit a branch as their primary transaction method, which contributes to higher overall satisfaction levels. Multiple convenient locations and extended operating hours in supermarkets positively increase customer perceptions of convenience for Downey.

China got the local currency, the yuan which is appreciating against the dollar which means that all these Chinese people have more purchasing power. And they're willing now to spend some money after saving, you know they provided America with savings for years. Now they're going to spend some money. So this means that they are willing to allow the dollar to weaken because it means that their currency, the yuan goes up, so they're actually in a winning situation.

We believe that our truly urgent need is to make our nation secure, our economy strong and our dollar sound. For every American this matter of the sound dollar is crucial. Without a sound dollar, every American family would face a renewal of inflation, an ever-increasing cost of living, the withering away of savings and life insurance policies.

Much of American wealth is an illusion which is being secretly gnawed away and much of it will be completely wiped out in the near future....So what is the rest of your future? A grisly list of unpleasant events -- exploding inflation, price controls, erosion of your savings (eventually to nothing), a collapse of private as well as government pension programs, and eventually an international monetary holocaust which will sweep all paper currencies down the drain and turn the world upside down.

Combating climate change is absolutely critical to the future of our company,Green Cooler customers, consumers-and our world. I believe all of us need to take action now. PepsiCo has already taken actions in our operations and throughout our supply chain to 'future- proof' our company-all of which deliver real cost savings, mitigate risk, protect our license to operate, and create resilience in our supply chain.

The banker, therefore, is not so much primarily a middleman in the commodity "purchasing power" as a producer of this commodity. However, since all reserve funds and savings today usually flow to him, and the total demand for free purchasing power, whether existing or to be created, concentrates on him, he has either replaced private capitalists or become their agent; he has himself become the capitalist par excellence.

Savings represent much more than mere money value. They are the proof that the saver is worth something in himself. Any fool can waste; any fool can muddle; but it takes something more of a man to save and the more he saves the more of a man he makes of himself. Waste and extravagance unsettle a man's mind for every crisis; thrift, which means some form of self-restraint, steadies it.

When top executives get huge pay hikes at the same time as middle-level and hourly workers lose their jobs and retirement savings, or have to accept negligible pay raises and cuts in health and pension benefits, company morale plummets. I hear it all the time from employees: This company, they say, is being run only for the benefit of the people at the top. So why should we put in extra effort, commit extra hours, take on extra responsibilities? We'll do the minimum, even cut corners. This is often the death knell of a company.

People don't dream all their lives of escaping the hellish countries they live in and pay their life savings to underworld types for the privilege of being locked up in a freezing, filthy, stinking container ship and hauled like cargo for weeks until they finally arrive in Moscow or Beijing or Baghdad or Kabul. People risk their lives to come here---to New York. The greatest city in the world, where dreams become reality.

I report the assault on nature evidenced in coal mining that tears the tops off mountains and dumps them into rivers, sacrificing the health and lives of those in the river valleys to short-term profit, and I see a link between that process and the stock-market frenzy which scorns long-term investments-genuine savings-in favor of quick turnovers and speculative bubbles whose inevitable bursting leaves insiders with stuffed pockets and millions of small stockholders, pensioners, and employees out of work, out of luck, and out of hope.

When you think of policies that are going to address inequality of wealth, you have to be very thoughtful about what economists call "incidence of taxes." If most of the savings is being done by capitalists, and you tax the return on capital, then they will have less to invest. That would mean, over the long run, that the rate of interest would go up. That would therefore undo some of the intent to lower the income of capitalists.

Here’s how to know if you have the makeup to be an investor. How would you handle the following situation? Let’s say you own a Procter & Gamble in your portfolio and the stock price goes down by half. Do you like it better? If it falls in half, do you reinvest dividends? Do you take cash out of savings to buy more? If you have the confidence to do that, then you’re an investor. If you don’t, you’re not an investor, you’re a speculator, and you shouldn’t be in the stock market in the first place.

Business is about problem-solving, but it does not always have to be about maximizing profit. When I went into business, my interest was to figure out how to solve problems I see in front of me. That's why I looked at the poverty issue. I got involved in lots of things to address it, and one of them was money lending with loans and credits and savings accounts, and in the process I created Grameen Bank. So you can also have social objectives. Ask yourself these questions: Who are you? What kind of world do you want?

Use visual cues to prompt yourself to put away more. A photograph of the beach house where you and your husband can envision spending your retirement will remind you to bump up the contribution to your 401(k); a snapshot of your child in a college sweatshirt can encourage you to put more into a 529 college savings plan.