Top 1200 Selling Stocks Quotes & Sayings - Page 4

Explore popular Selling Stocks quotes.

Last updated on December 4, 2024.

Images are no longer what they used to be. They can't be trusted any more. We all know that. You know that. When we grew up, images were telling stories and showing them. Now they're all into selling. They've changed under our very eyes. They don't even know how to do it anymore. They've plain forgotten. Images are selling out the world. And at a big discount.

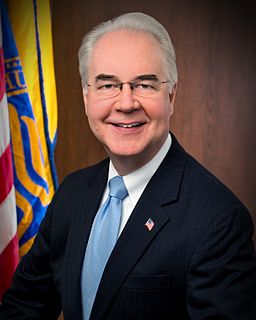

We all look in the mirror and see us a little blonder or a little thinner or a little younger, whatever that ideal might be and most of the people that I'm photographing are selling something, you know whether they're on the front of an album cover or a magazine or they're a corporate person ready to switch companies or a doctor selling a skincare line... so I want to help them achieve that.

Before that I had largely thought of selling as just a way of making a living for myself. I had dreaded to go in to see people, for fear I was making a nuisance of myself. But now I was inspired! I resolved right then to dedicate the rest of my selling career to this principle: finding out what people want, and helping them get it.

I don't care what people think of me, unless they think I'm mean or something, but I don't care if they think I'm like someone else because I know I'm not - I'm a total weirdo. I'm not selling a dream; I'm not selling fame like it is some sort of fantastic thing. I'm just trying to sell music and get on with my real life.

Brand-name growth stocks ordinarily command the highest p/e ratios. Rising prices beget attention, and vice versa - but only to a point. Eventually their growth rate can diminish as results revert towards normal. Maybe not in all cases, but often enough to make a long-term bet. Bottom line: I wouldn't want to get caught in a rush for the exit, much less get left behind. Only when big growth stocks fall into the dumper from time to time am I inclined to pick them up - and even then, only in moderation.

Successful investors like stocks better when they’re going down. When you go to a department store or a supermarket, you like to buy merchandise on sale, but it doesn’t work that way in the stock market. In the stock market, people panic when stocks are going down, so they like them less when they should like them more. When prices go down, you shouldn’t panic, but it’s hard to control your emotions when you’re overextended, when you see your net worth drop in half and you worry that you won’t have enough money to pay for your kids’ college.

Truth is the pearl without price. One cannot obtain truth by buying it-all you can do is to strive for spiritual truth and when one is ready, it will be given freely. Nor should spiritual truth be sold, lest the seller be injured spiritually. You lose any spiritual contact the moment you commercialize it. Those who have the truth would not be packaging and selling it, so anyone who is selling it, really does not possess it.

I don't make records for this medium with which we're going to sell it. The selling of it can never be more important than what you're actually making. There's too much of that in the world - in everybody's world, not just in music. There's too much, "Are you hip to this kind of stuff?" "Hey, this is cool." "Are you hip to it, because this is what we're selling today?" I think it's bullshit.

As with many teens, my first jobs included babysitting and mopping floors at McDonald's. Since then, I've held jobs a diverse as selling used cars, selling apparel, cosmetics, and real-estate, substitute-teaching six graders, teaching undergraduate creative writing, and working as an editorial assistant for a literary magazine.

The incident itself happened in London, but because we were all based at the time in Los Angeles we moved it there. Certain details are almost exactly like the true experience, but we decided to make the film more of a thriller, in the hope that it would reach a bigger audience. That's why it's called "Selling Isobel" and not "Selling Frida." We didn't want to make a dark, depressing "movie-of-the-week."

In fact, when I began selling 'Phenomenal Woman' T-shirts on International Women's Day last year, the campaign was supposed to run just through March, for Women's History Month. At the time, I hoped to sell around 500, maybe 1,000 T-shirts in total. We ended up selling 2,500 T-shirts on the first day alone.

There's only one thing that all of the central banks control and that is the base, their own liability, and they can control that in various ways. They can control it directly by open market operations, buying and selling government securities or other assets, for example, buying and selling gold, or they can control it indirectly by altering the rate at which banks lend to one another.