Top 1200 Shareholder Value Quotes & Sayings

Explore popular Shareholder Value quotes.

Last updated on April 15, 2025.

I think what's happening is companies are trying to maximize shareholder value and I think they realized that if they could hire more effectively, they would. What I'm suggesting, though, is that human resources departments in most companies have become so detached - have become such a bureaucracy - that they have become clueless. They don't realize that the processes they have put in place have very little to do with recruiting, retaining and bringing on talent.

Rather than empowering all, consumer and shareholder activism gives greatest voice to those with the most money in their pockets, those who can switch from seller to seller with relative ease. Consumer and shareholder activism is a form of protest that favours the middle classes, an outpouring of the dissatisfaction of the bourgeoisie.

Of God's love we can say two things: it is poured out universally for everyone from the Pope to the loneliest wino on the planet; and secondly, God's love doesn't seek value, it creates value. It is not because we have value that we are loved, but because we are loved that we have value. Our value is a gift, not an achievement.

It's no longer terribly sexy to own shares in certain companies; it used to be that being a shareholder in a corporation would connect you with it. The result is that people really want to invest in valuable things, and contemporary art has become a very stable material value with great growth potential.

I am a Prince," he replied, being rather dense. "It is the function of a Prince—value A—to kill monsters—value B—for the purpose of establishing order—value C—and maintaining a steady supply of maidens—value D. If one inserts the derivative of value A (Prince) into the equation y equals BC plus CD squared, and sets it equal to zero, giving the apex of the parabola, namely, the point of intersection between A (Prince) and B (Monster), one determines value E—a stable kingdom. It is all very complicated, and if you have a chart handy I can graph it for you.

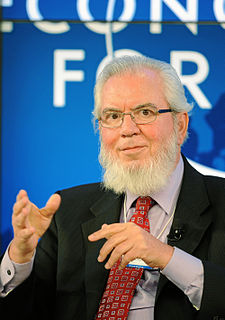

Stock ownership in the US is very highly concentrated. [Shareholder actions are] something, but it's like the old Communist Party in the USSR, it would be nice to see more protest inside the Communist Party but it's not democracy. It's not going to happen. [Shareholder actions] are a good step, but they're mostly symbolic.

Shareholder value is the result of you doing a great job, watching your share price go up, your shareholders win, and dividends increasing. What happens when you have increasing shareholder value? You're delivering better employees to their communities and they can give back. Communities are winning because employees are involved in mentoring and all these other things. Customers are winning because you're providing them new products.

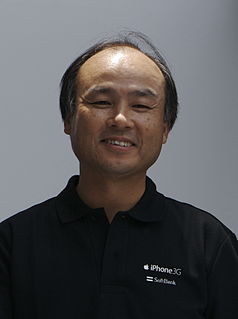

I'm a shareholder in Microsoft Corp. of some size, and while I don't work for the place anymore, I think a lot about that investment, how - as an outsider - might I add value or not add value? Do I believe that things are headed in a good direction? So I wouldn't say I spend the majority of my time on that, but I spend some time on that as well.