Top 278 Shareholders Quotes & Sayings

Explore popular Shareholders quotes.

Last updated on April 14, 2025.

With every story that TV covers, somebody - some corporation, some shareholders - are making money. That's true whether covering Libya, Iraq, the tsunami in Japan, Osama bin Laden, whatever story there is. That day, the shareholders are making money off it. Every newspaper that's sold, somebody's making a dime.

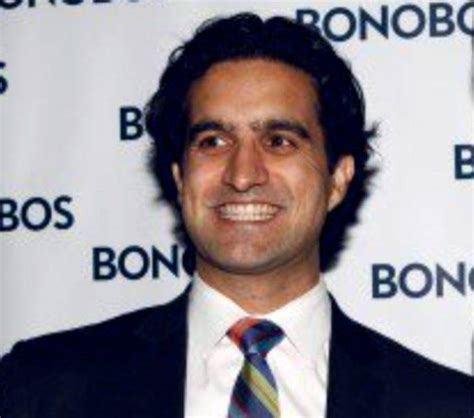

In the age of activism that is clearly not going away, it would seem that some form of engagement from directors with shareholders - rather than directors simply taking their cues from management - would go a long way toward helping boards work on behalf of all shareholders rather just the most vocal.

The British use a system where the profits a corporation reports to shareholders is what they pay taxes on. Whereas in America we require corporations to keep two sets of books, one for shareholders and one for the IRS, and the IRS records are secret. For publicly-traded companies, the British system would tend to align the interests of the government with the interests of the company because the company wants to report the biggest possible profit. Though, all wealthy countries have high taxes as wealth requires lots of common goods, from clean water to public education to a justice system.

If you were at Lehman, the same thing happened. If you were at AIG, the shareholders are getting creamed on these things. And those shareholders are not just a bunch of big shots in Wall Street. Those are pension funds, and those are investors all over the country. I wouldn't worry too much about that. Justice won't be perfect on it.

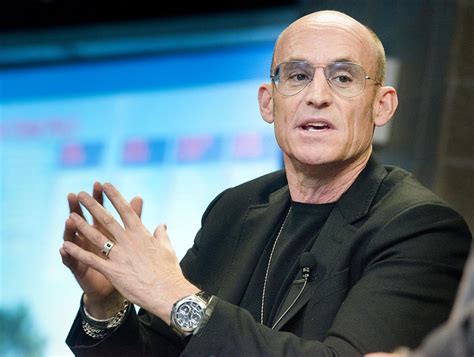

I believe Washington should be a more active participant focusing on the issue of why corporate shareholders and mutual fund shareholders are not given fair treatment by corporate management and mutual fund management. We need to develop a national standard of fiduciary duty to ensure that these agents, if you will, are adequately representing the principles - pension beneficiaries and mutual fund shareholders - whom they are duty bound to serve.

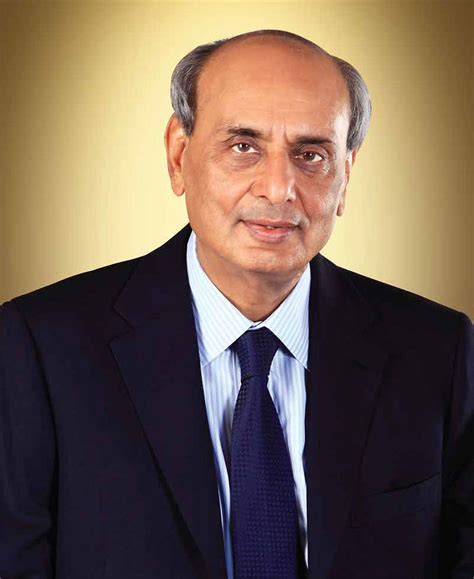

Shareholders are sort of like cats; they get herded around, and they follow the leader. With the exception of a few activist shareholders, there are a very rare number of big, important, influential shareholders that like to step up and say there's a problem here, especially when they're making money.

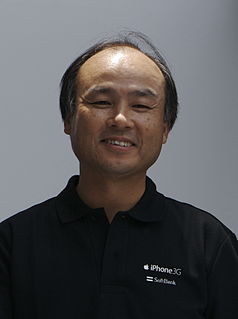

We like our current shareholders and don't want to entice anyone to become one. It would help current shareholders to hear our CEOs [of the Berkshireoperating subsidiaries], but we promised them they could spend 100% of their time on their business. We place no impediments on them running their businesses. Many have expressed to me how happy they are that they don't have to spend 25% of time on activities they didn't like.