Top 559 Stocks Quotes & Sayings - Page 9

Explore popular Stocks quotes.

Last updated on December 22, 2024.

Tech stocks were the cubic zirconium of the market. They looked good and were sexy, but they just were a way for the company selling them to make money. That's always going to be transient in terms of the stock market. What's real is that companies have to compete. Technology used well is a great tool to enable that if only because most companies dont use technologies well.

The recent trading environment has felt something like walking into a place and having a sense that something is wrong and dangerous but not knowing exactly what will happen or when. “QE Infinity” has so distorted the prices of stocks and bonds that nobody can possibly determine what the investing landscape would look like, or what the condition of the economy and financial system would be, in the absence of Fed bond-buying.

Cash - in savings accounts, short-term CDs or money market deposits - is great for an emergency fund. But to fulfill a long-term investment goal like funding your retirement, consider buying stocks. The more distant your financial target, the longer inflation will gnaw at the purchasing power of your money.

The value of market esoterica to the consumer of investment advice is a different story. In my opinion, investment success will not be produced by arcane formulae, computer programs or signals flashed by the price behavior of stocks and markets. Rather an investor will succeed by coupling good business judgment with an ability to insulate his thoughts and behavior from the super-contagious emotions that swirl about the marketplace.

The history of the past fifty years, and longer, indicates that a diversified holding of representative common stocks will prove more profitable over a stretch of years than a bond portfolio, with one important provisio that the shares must be purchased at reasonable market levels, that is, levels that are reasonable in the light of fairly well-defined standards derived from past experience.

Suppose you were a real estate investor with a 1/3 interest in the best apartment complex in town, the best mall, and the best office building. Would you feel like a poor, undiversified investor? No! But as soon as you get into stocks, people feel this way. Partly, people need to justify their fees.

The strong and undeniable fundamentals of low-cost clean energy and the cheapest petrochemical feed-stocks in the world will prevail we believe and we're seeing the demand pool beginning to grow. We have continued to position ourselves in a way that will catch this very sustainable and fundamentally supported wave of volume growth and at the same time, help our customer base achieve their lofty goals of growth as well.

The model I like to sort of simplify the notion of what goes on in a market for common stocks is the pari-mutuel system at the racetrack. If you stop to think about it, a pari-mutuel system is a market. Everybody goes there and bets and the odds change based on what's bet. That's what happens in the stock market.

Small-scale fisheries should not be favoured over large-scale operations ebcause of romantic notions of rugged small operators battling both the elements and anonymous corporations. [They ought to be supported] because of the scientific evidence available to confirm the common-sense inference that local fishers, if given privileged access, will tend to avoid trashing their local stocks, while foreign fishers do not have such motivation.

I knew a guy who had $5 million and owned his house free and clear. But he wanted to make a bit more money to support his spending, so at the peak of the internet bubble he was selling puts on internet stocks. He lost all of his money and his house and now works in a restaurant. It's not a smart thing for the country to legalize gambling [in the stock market] and make it very accessible.

Nothing did more to spur the boom in stocks than the decision made by the New York Federal Reserve bank, in the spring of 1927, to cut the rediscount rate. Benjamin Strong, Governor of the bank, was chief advocate of this unwise measure, which was taken largely at the behest of Montagu Norman of the Bank of England....At the time of the Banks action I warned of its consequences....I felt that sooner or later the market had to break.

I do not use short selling. The fund has not shorted a stock since the 2002 to 2003 time frame. At that time I did short three stocks, on which I broke even on two and made money on one of them. The experience taught me that I was not going to be using short selling going forward for a slew of reasons.

[In picking stocks] You really have to know a lot about business. You have to know a lot about competitive advantage. You have to know a lot about the maintainability of competitive advantage. You have to have a mind that quantifies things in terms of value. And you have to be able to compare those values with other values available in the stock market.

One of our great strength, world capitalism, is the most successful economic system possible, but has also become one of shorter and shorter cycles of evaluation. CEOs, companies, stocks, profits and debits change at an ever more accelerated pace in response to the demands of stockholders and the market. We have already experienced some consequences of the shortening cycle of decision making in business, but those are minor in relation to the grand systemic collapse that always eventually results from such accelerating and shortening periods for leadership goals.

Clearly, sustained low inflation implies less uncertainty about the future, and lower risk premiums imply higher prices of stocks and other earning assets. We can see that in the inverse relationship exhibited by price/earnings ratios and the rate of inflation in the past. But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?

It's quite clear that stocks are cheaper than bonds. I can't imagine anybody having bonds in their portfolio when they can own equities, a diversified group of equities. But people do because they, the lack of confidence. But that's what makes for the attractive prices. If they had their confidence back, they wouldn't be selling at these prices. And believe me, it will come back over time.

A rentier is an investor whose relationship to a company or enterprise is strictly limited to the ownership of financial wealth (such as stocks or bonds) and the receipt of income on that wealth (such as dividends or interest). The financial system performs dismally at its advertised task, that of efficiently directing society's savings towards their optimal investment pursuits. The system is stupefyingly expensive, gives terrible signals for the allocation of capital, and has surprisingly little to do with real investment.

I agree that actually taking existing stocks of ammo away from people is problematic, but they can certainly keep people from buying any new ones. They can hoard themselves. They can buy it up themselves. They can demand the manufacturers stop selling it or they can demand the manufacturers start making new ammo for which there is no gun. There are any number of ways they can do. But the point is, don't doubt their intention here.

Occasionally we are asked whether it would make sense to modify our investment strategy to perform better in today's financial climate. Our answer, as you might guess, is: No! It would be easyfor us to capitulate to the runaway bull market in growth and technology stocks. And foolhardy. And irresponsible. And unconscionable. It is always easiest to run with the herd; at times, it can take a deep reservoir of courage and conviction to stand apart from it. Yet distancing yourself from the crowd is an essential component of long-term investment success.

It is an unfortunate fact that great and foolish excess can come into prices of common stocks in the aggregate. They are valued partly like bonds, based on roughly rational projections of use value in producing future cash. But they are also valued partly like Rembrandt paintings, purchased mostly because their prices have gone up, so far.

Investors have to remember: corporate profits are going up, but stocks are going up faster. How can that continue indefinitely? Investors can only earn what companies themselves can earn; the government or the markets themselves don't kick anything in. How can you get anything more out of a farm than what it grows?

Frequent comparative ranking can only reinforce a short-term investment perspective. It is understandably difficult to maintain a long-term view when, faced with the penalties for poor short-term performance, the long-term view may well be from the unemployment line ... Relative-performance-oriented investors really act as speculators. Rather than making sensible judgments about the attractiveness of specific stocks and bonds, they try to guess what others are going to do and then do it first.

Believing that fundamental conditions of the country are sound and there is nothing in the business situation to warrant the destruction of values that has taken place on the exchanges during the past week, my son and I have for some days been purchasing sound common stocks. We are continuing and will continue our purchases in substantial amounts at levels which we believe represent sound investment values.

If atom stocks are inexhaustible, Greater than power of living things to count, If Nature's same creative power were present too To throw the atoms into unions - exactly as united now, Why then confess you must That other worlds exist in other regions of the sky, And different tribes of men, kinds of wild beasts.

Sometimes we get wrong notions, we think we have to be in a luxurious house, in a large city, with a new car in order to be happy. Happiness isn't there. Happiness isn't in a new car, it isn't in a new and luxurious apartment. Happiness isn't in banks and stocks. Happiness is where you make it, it's up to you. It comes from within, it doesn't come from things.

The time to buy stocks is consistently over time. You should never buy your investments with the idea, 'I have to get a certain return.' You should look at the best return possible and learn to live with that. But you should not try to make your investments earn what you feel you need. It doesn't work that way. The stock doesn't know you own it.

Wall Street is being investigated, but they are not asleep while it's being done. You see where the Senate took that tax off the sales of stocks, didn't you? Saved 'em $48,000,000. Now, why don't somebody investigate the Senate and see who got to them to get that tax removed? That would be a real investigation.

It is crucial to have a strategy in place before problems hit, precisely because no one can accurately predict the future direction of the stock market or economy. Value investing, the strategy of buying stocks at an appreciable discount from the value of the underlying businesses, is one strategy that provides a road map to successfully navigate not only through good times but also through turmoil.

If you buy all the stocks selling at or below two times earnings, you will lose money on half of them because instead of making profits they will actually lose money, but you will only lose a dollar or so a share at most. Then others will be mediocre performers. But the remaining big winners will go up and produce fabulous results and also ensure a good overall result.

Almost all of the demand for oil that suddenly pushed prices up was speculative demand. People began to speculate not only in stocks and bonds and real estate, but also in commodities. The market went up for old tankers, which were used simply to store oil in. A lot of the oil was simply being stored for trading, not used.

Just as outright euphoria is often a sign of a market top, fear is for sure a sign of a market bottom. Time and time again, in every market cycle I have witnessed, the extremes of emotion always appear, even among experienced investors. When the world wants to buy only treasury bills, you can almost close your eys and get long stocks.

A price drop in a good stock is only a tragedy if you sell at that price and never buy more. To me, a price drop is an opportunity to load up on bargains from among your worst performers and your laggards that show promise. If you can't convince yourself "When I'm down 25 percent, I'm a buyer" and banish forever the fatal thought "When I'm down 25 percent, I'm a seller," then you'll never make a decent profit in stocks.

Nowadays, it is possible to perform various forms of Low-Impact listening via the telephone. The advent of technological advances such as computer games and online services (like ones that let you check stocks) have enabled Low-Impact listeners to endure family phone calls much longer than in the past. Dangers include mouse clicks, heavy typing, or a sudden loud buzzer that goes off when you have finished Boggle.

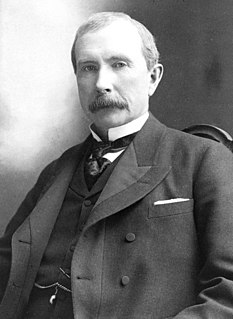

Very few of the heroes of the Golden Age of American finance had much interest in the solid realities of what underlay their structure of stocks and bonds and credits. Later on, a Henry Ford might introduce an era of intensely production-minded captains of industry, but the Harrimans, Morgans, Fricks, and Rockefellers were far more interested in the exciting manipulation of huge masses of intangible wealth than in the humdrum business of turning out goods.

Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate. It will purge the rottenness out of the system. High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up from less competent people.

President Bush announced his new economic plan. The centerpiece was a proposed repeal of the dividend tax on stocks, a boon that could be worth millions of dollars to average Americans. Well, average stock-owning Americans. Technically, Americans who own a significant amount of shares in dividend-dealing companies. Well, rich people, that's what I'm trying to say. They're going to do really well with this.

Compared with other Americans, journalists are more likely to live in upscale neighborhoods, have maids, own Mercedes and trade stocks, and less likely to go to church, do volunteer work or put down roots in a community. Journalists are over-represented in ZIP code areas where residents are twice as likely as other Americans to rent foreign movies, drink Chablis, own an espresso maker and read magazines such as Architectural Digest and Food & Wine.

Every status update you read on Facebook, every tweet or text message you get from a friend, is competing for resources in your brain with important things like whether to put your savings in stocks or bonds, where you left your passport, or how best to reconcile with a close friend you just had an argument with.

I never ask if the market is going to go up or down because I don't know, and besides it doesn't matter. I search nation after nation for stocks, asking: 'Where is the one that is lowest-priced in relation to what I believe it's worth?' Forty years of experience have taught me you can make money without ever knowing which way the market is going.

There is one thing of which I can assure you. If good performance of the fund is even a minor objective, any portfolio encompassing one hundred stocks (whether the manager is handling one thousand dollars or one billion dollars) is not being operated logically. The addition of the one hundredth stock simply can't reduce the potential variance in portfolio performance sufficiently to compensate for the negative effect its inclusion has on the overall portfolio expectation.

Being a teenager is the worst thirty years of your life. But it all changes after that. You get a great car, a great job. You got a wife, kids, you got your health. But then your company is sold out from under you, your stocks tank, your wife's sleeping with the gardener and your teenage daughter is pregnant. And you notice that you have a prostate so hard, you can actually take a hammer to it. But hey, not one zit.

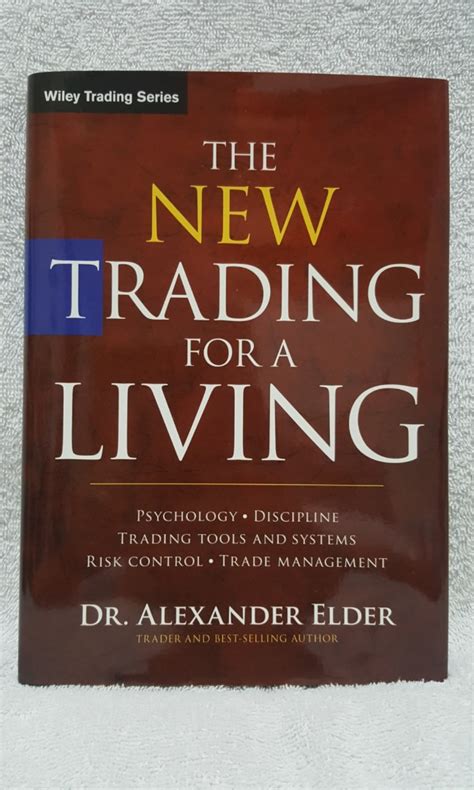

Successful trading depends on the 3M`s - Mind, Method and Money. Beginners focus on analysis, but professionals operate in a three dimensional space. They are aware of trading psychology their own feelings and the mass psychology of the markets. Each trader needs to have a method for choosing specific stocks, options or futures as well as firm rules for pulling the trigger - deciding when to buy and sell. Money refers to how you manage your trading capital.

If the investor doesn't have enough time and skill to investigate individual stocks or enough money to diversify a portfolio, the right thing to do is to invest in exchange-traded funds that give you exposure to asset classes. It does make sense for the individual investor to think in terms of holding individual asset classes.

In Sharia, nobody will be able to sell pork publicly. Nobody will be drinking alcohol. Pornography will be banned. Gambling will be banned. In terms of the economy, the wealth which is not tangible, either good or deficit, things like insurance, pension, stocks, shares, etc., they will be prohibited because you're supposed to deal with things, which are goods, which you can see, which you can trade with.

The other dynamic keeping the stock market up - both for technology stocks and others - is that companies are using a lot of their income for stock buybacks and to pay out higher dividends, not make new investment,. So to the extent that companies use financial engineering rather than industrial engineering to increase the price of their stock you're going to have a bubble. But it's not considered a bubble, because the government is behind it, and it hasn't burst yet.

Writers like Aldous Huxley and George Orwell have imagined the sort of scientific utopia which is coming to pass, but already their nightmare fancies are hopelessly out of date. A vast, air-conditioned, neon-lighted, glass-and-chromium broiler-house begins to take shape, in which geneticists select the best stocks to fertilise, and watch over the developing embryo to ensure that all possibilities of error and distortion are eliminated.

Speculation in oil stock companies was another great evil ... From the first, oil men had to contend with wild fluctuations in the price of oil. ... Such fluctuations were the natural element of the speculator, and he came early, buying in quantities and holding in storage tanks for higher prices. If enough oil was held, or if the production fell off, up went the price, only to be knocked down by the throwing of great quantities of stocks on the market.

The common fisheries policy essentially gave other European Union nations unfettered access to our fish stocks and - I would hope - that if we leave the European Union, we can once more see the ports of Peterborough and Fraserhead and Grimsby flourishing, because we will take back control of our territorial waters.

Possession properly has two faces, two aspects: we all have a right to private property, but this is accompanied by our responsibility for its righteous use. These two things (which should be inseparable) are frequently divided today. Everyone admits that the farmer who own a horse is obligated to feed and care for it, but in the case of stocks and bonds, we often forget that the same principle should prevail.

Brave old-flowers! Wall-flowers, Gilly flowers, Stocks! For even as the field-flowers, from which a trifle, a ray of beauty, a drop of perfume, divides them, they have charming names, the softest in the language; and each of them, like tiny, art-less ex-votos, or like medals bestowed by the gratitude of men, proudly bears three or four.

For sure, they don't teach you this in history class, but in colonial times, the person who got left in the stocks overnight was nothing less than fair game for everybody to nail. Men or women, anybody bent over had no way of knowing who was doing the ram job, and this was the real reason you never wanted to end up here unless you had a family member or a friend who'd stand with you the whole time. To protect you. To watch your ass, for real.