Top 1200 Student Loan Quotes & Sayings

Explore popular Student Loan quotes.

Last updated on September 17, 2024.

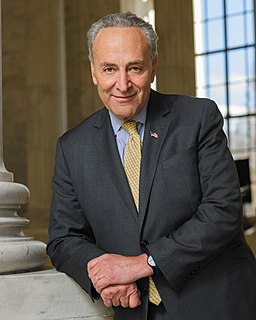

The fact that you have government-guaranteed student loans has created a whole new sector in the American economy that didn't really exist before - private for-profit universities that sell junk degrees that don't help the students. They promise the students, "We'll help you get a better job. We'll arrange a loan so that you don't have to pay a penny for this education." Their pet bank gets them the government-guaranteed loan, and the student may get the junk degree, but doesn't get a job, so they don't pay the loan.

A Student is the most important person ever in this school...in person, on the telephone, or by mail.

A Student is not dependent on us...we are dependent on the Student.

A Student is not an interruption of our work..the Studenti s the purpose of it. We are not doing a favor by serving the Student...the Student is doing us a favor by giving us the opportunity to do so.

A Student is a person who brings us his or her desire to learn. It is our job to handle each Student in a manner which is beneficial to the Student and ourselves.

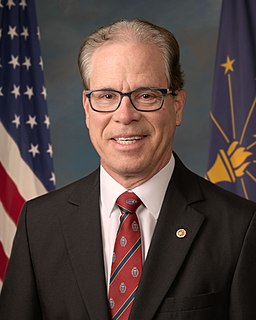

If we wanted a program to help the majority of the population, we'd offer loan guarantees to help poor people get access to reliable cars so that they could have a better shot at getting - and keeping - a well-paying job...A small amount of capital could make a much bigger difference in their lives than extra student loan relief for middle-class college kids would.

This is a derivative, if you will, of Cloward-Piven [theory]. "[Stephen] Lerner's plan is to organize a mass, coordinated 'strike' on mortgage, student loan, and local government debt payments - thus bringing the banks to the edge of insolvency and forcing them to renegotiate the terms of the loans.

Without the jobs being available to enable them to repay that [student-loan] debt in the course of their financial lifetimes, basically.We maintain that, yes, that's a significant chunk of change - it's $1.3 trillion - but what investment is more worth making than in a generation that does not have a future?

A consolidation makes sense only if you can lower your overall interest rate. Many people consolidate by taking out a home equity line loan or home equity line of credit (HELOC), refinancing a mortgage, or taking out a personal loan. They then use this cheaper debt to pay off more expensive debt, most frequently credit card loans, but also auto loans, private student loans, or other debt.