Top 61 Tariff Quotes & Sayings

Explore popular Tariff quotes.

Last updated on April 14, 2025.

Business corporations in general are not defenders of free enterprise. On the contrary, they are one of the

chief sources of danger....Every businessman is in favor of freedom for everybody else, but when it comes to himself that's a different question. We have to have that tariff to protect us against competition from abroad. We have to have that special provision in the tax code. We have to have that subsidy.

The Barack Obama administration had been negotiating with the Canadians to come up with a permanent solution on lumber tariff. And they failed. And so even though this is being portrayed as the first salvo by Donald Trump's tough trade regime, in fact, it's quite possible that, if Hillary Clinton were president, we would be in the same place.

It's estimated that about 30 percent of the increase in grain prices could be attributed to the decision to embrace biofuels, particularly corn-based ethanol. It has done nothing for climate change and the business is in real trouble now with the collapse of oil prices. It's completely dependent on a dollar subsidy and tariff from the government.

I have ever been opposed to banks, - opposed to internal improvements by the general government, - opposed to distribution of public lands among the states, - opposed to taking the power from the hands of the people, - opposed to special monopolies, - opposed to a protective tariff, - opposed to a latitudinal construction of the constitution, - opposed to slavery agitation and disunion. This is my democracy. Point to a single act of my public career not in keeping with these principles.

The Tories must stop focusing on their ideological obsession with a hard Brexit and their internal party divisions and start focusing on what is best for our country and our economy. Their absurd proposal that the U.K. should become the E.U.'s tariff collector is neither practical nor palatable across the Channel.

We try to prevent the creation of artificial rents. Rather than setting up quotas to stop imports we levy a tariff, that would be better. Or we pay wages in the public sector which are roughly equivalent to the productivity in the private sector and we don't therefore make it a special benefit to get a bureaucratic position.

This conclusion of trade agreements that go beyond the scope of mere tariff agreements, customs agreements, are most important and I'm very pleased we were able to bring this to fruition between Canada and the E.U. We've made great progress, particularly if we look at one of the great global issues, namely climate protection, without the engagement of the current administration under the leadership of Barack Obama, this Paris agreement would never have come about.

The free-trade idea, logically applied, will abolish usury; and with usury will disappear the chief bone of contention between labor and capital. But, just at this point, free-traders go over to the enemy; and many writers on political economy, in flat contradiction of the essential principles of that science, have made elaborate arguments to prove self-government in finance, impossible! What shall we think of men who, having dethroned kings, demolished popes, destroyed slave oligarchies and assailed tariff monopoly, advise submission to the most oppressive and dishonest of despotisms, Usury?

Every increase of protective duties is necessarily followed, in the present condition of our country, by an expansion of the currency, which must continue to increase till the increased price of production, caused by the expansion, shall be equal to the duty imposed, when a new tariff will be required.

Germany has a lot of solar power. In fact, in 2005, some 55 or 57 percent of worldwide installations were photovoltaics in Germany. That's 57 percent of all worldwide solar photovoltaics. Because of the high feed-in tariff, they have a way of allowing you to produce electricity and ship it into the grid at very high prices.

John Quincy Adams ranks with Jimmy Carter on the roster of ex-presidential redemption. Instead of completing a biography of his father, he let himself be elected to the House, where he spent nine terms in Whiggish opposition to the Democrats, supporting a national bank and a protective tariff and internal improvements.

Lincoln was a modernizer, so to speak. He believed in economic development. As a Whig before the war he favored what we would call infrastructure spending, government appropriation for canals, railroads, river and harbor improvements, and a tariff to protect industry. He believed in this market revolution that was sweeping across Northern society. He himself benefited from it in his own life.

It does sound like a surprise, but it shouldn't be surprising. The Canada-U.S. trade relationship is still the world's largest. And a relationship that size always generates disputes. And this particular dispute on lumber tariff didn't fall out of a clear spring sky. It's been going on for literally decades. It's rooted in the different way Canada and the United States charges forestry companies for the trees that they cut down and turn into lumber.

Exporters monitor economic and political policies to the developing world, but the consequences of that have been to make developing countries far more sensitive to the constant fluctuations. Developing countries are not always allowed to support their farmers in the same way as the U.S. or Europe is. They're not allowed to have tariff barriers. They're forced, more or less, to shrink their social programs. The very poorest people have fewer and fewer entitlements. The consequence of this has been that there's been a chronic increase in the vulnerability of those economies to price shocks.

The "health, education, and welfare" section of government is another boondoggle. First we manufacture indigent and superfluous people by legal monopolies in land, money and idea patents, erecting tariff barriers to protect monopolies from foreign competition, and taxing laborers to subsidize rich farmers and privileged manufacturers. Then we create "social workers, " etc., to care for them and thereby establish a self-aggravating and permanent institutionalized phenomenon.

Smoot and Hawley ginned up The Tariff Act of 1930 to get America back to work after the Stock Market Crash of '29. Instead, it destroyed trade so effectively that by 1932, American exports to Europe were just a third of what they had been in 1929. World trade fell two-thirds as other nations retaliated. Jobs evaporated.

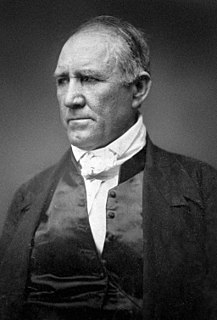

What I am anxious to do is to get the best bill possible with the least amount of friction.... I wish to avoid [splitting our party]. I shall do all in my power to retain the corporation tax as it is now and also force a reduction of the [tariff] schedules. It is only when all other efforts fail that I'll resort to headlines and force the people into this fight.