Top 1200 Tax Cuts Quotes & Sayings - Page 2

Explore popular Tax Cuts quotes.

Last updated on April 17, 2025.

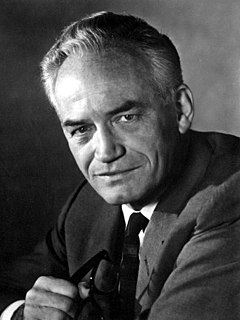

I do think that Republicans are flirting with their tax cut, which has always been the narcotic of Republicans, that they in fact have to at some point, with any remote pretense of candor, abandon any pretense of a balanced budget.I mean, they talk about - because they are going to finance the tax cut by tax cuts. That's how they're going to do it. And I do think that the will is there right now in the Congress to act. I think they will be as close to unity as you will see on Capitol Hill this year.

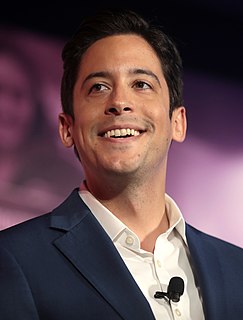

The reason we've been growing at 1.8 percent for the last eight, ten years, which is way below the historical average, is in large part because of our tax code. It is important to us to get the biggest, broadest tax reduction, tax cuts, tax reform that we can possibly get because it's the only way we get back to 3 percent growth. That's what's driving all of this, how do you get the American economy back on that historical growth rate of 3 percent and out of these doldrums of 1.8, 1.9 that we had of the previous Barack Obama administration?

All that Syrio Forel had taught her went racing through her head. Swift as a deer. Quiet as shadow. Fear cuts deeper than swords. Quick as a snake. Calm as still water. Fear cuts deeper than swords. Strong as a bear. Fierce as a wolverine. Fear cuts deeper than swords. Then man who fears losing has already lost. Fear cuts deeper than swords. Fear cuts deeper than swords. Fear cuts deeper than swords.

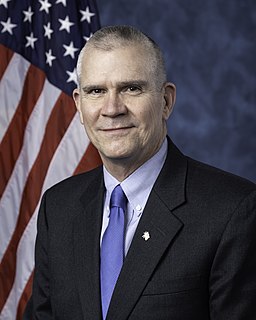

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

It's tax day and while many Americans are filing their taxes with a groan, taxpayers in the Badger State have reason to cheer. In Wisconsin, we have enacted more than $2 billion in tax cuts, giving our citizens much-needed relief, call us crazy Midwesterners but we think you know how to spend your money better than the government.

Obama and the Democrats' preposterous argument is that we are just one more big tax increase away from solving our economic problems. The inescapable conclusion, however, is that the primary driver of the short-term deficit is not tax cuts but the lack of any meaningful economic growth over the last half decade.

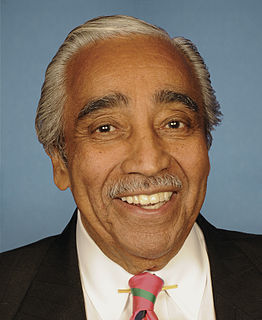

If you don't try to generate more revenues through tax reform, if you don't ask, you know, the most fortunate Americans to bear a slightly larger burden of the privilege of being an American, then you have to - the only way to achieve fiscal sustainability is through unacceptably deep cuts in benefits for middle class seniors, or unacceptably deep cuts in national security.