Top 1200 Tax Rates Quotes & Sayings

Explore popular Tax Rates quotes.

Last updated on December 18, 2024.

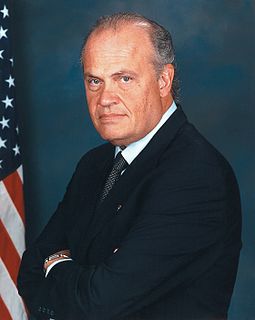

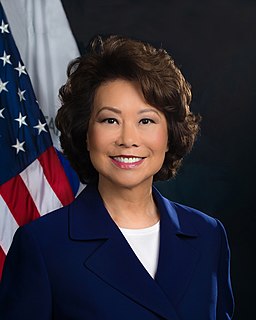

Tax reform for the 21st century means rewarding hardworking families by closing unfair loopholes, lowering tax rates across the board, and simplifying the tax code dramatically. It demands reducing the tax burden on American businesses of all sizes so they can keep more of their income to invest in our communities.

Start by scrapping the tax code. Don't fiddle with it. Junk it. Throw it out. Bury it. Replace it with a pro-growth, pro-family tax cut that lowers tax rates to 17% across the board and expands exemptions for individuals and children so that a family of four would pay no taxes on the first $36,000 of income.

You are smart people. You know that the tax cuts have not fueled record revenues. You know what it takes to establish causality. You know that the first order effect of cutting taxes is to lower tax revenues. We all agree that the ultimate reduction in tax revenues can be less than this first order effect, because lower tax rates encourage greater economic activity and thus expand the tax base. No thoughtful person believes that this possible offset more than compensated for the first effect for these tax cuts. Not a single one.

Corporate tax reform is nice in theory but tough in practice. It most likely requires lower tax rates and the closing of loopholes, which many companies are sure to fight. And whatever new, lower tax rate is determined, there will probably be another country willing to lower its rate further, creating a sad race to zero.

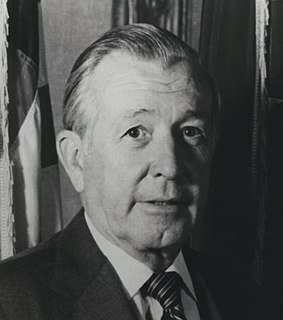

Budget deficits are not caused by wild-eyed spenders, but by slow economic growth and periodic recessions. And any new recession would break all deficit records. In short, it is a paradoxical truth that tax rates are too high today and tax revenues are too low, and the soundest way to raise the revenues in the long run is to cut the rates now.

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.

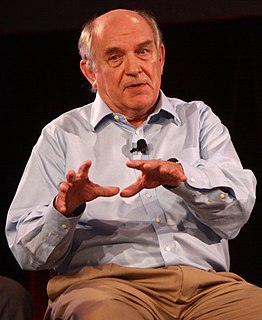

There are several states that move from Karl Marx-like policies to Adam Smith-like policies and back again in a weekend. So for the states with huge volatility in their income tax policies over time, the differences in growth rates in those periods are really amazingly consistent with tax rates really mattering.

Let's take the nine states that have no income tax and compare them with the nine states with the highest income tax rates in the nation. If you look at the economic metrics over the last decade for both groups, the zero-income-tax-rate states outperform the highest-income-tax-rate states by a fairly sizable amount.

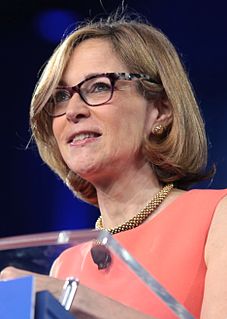

High tax rates in the upper income brackets allow politicians to win votes with class warfare rhetoric, painting their opponents as defenders of the rich. Meanwhile, the same politicians can win donations from the rich by creating tax loopholes that can keep the rich from actually paying those higher tax rates - or perhaps any taxes at all. What is worse than class warfare is phony class warfare. Slippery talk about 'fairness' is at the heart of this fraud by politicians seeking to squander more of the nation's resources.

Now, the president would like to do tax reform, which would obviously lower rates for most people in America and make the tax code fair and get rid of loopholes and special treatment. But absent tax reform, the president believes the right way to get our fiscal house in order is ask the wealthy to pay their fair share.

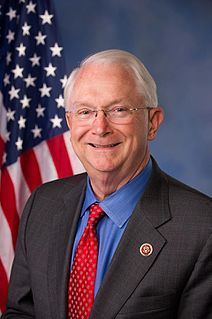

We also need to reduce corporate tax rates. This applies to small, medium and large businesses. At 35 percent, we have the second highest corporate rates in the world. It restricts the growth of small enterprises that need to plow capital back into their businesses and forces companies and jobs to move overseas.

Tax rates aren't everything with regard to incentives to work. I would probably work at a 100% tax rate next to a nude modeling studio. I'm joking, but you know what I'm saying. There's a lot more to it than just tax rates. It's economics that I do; I don't do nude modeling studio economics. People do respond to taxes.

It is a paradoxical truth that tax rates are too high and tax revenues are too low and the soundest way to raise the revenues in the long run is to cut the rates now Cutting taxes now is not to incur a budget deficit, but to achieve the more prosperous, expanding economy which can bring a budget surplus.

Arthur Laffer's idea, that lowering taxes could increase revenues, was logically correct. If tax rates are high enough, then people will go to such lengths to avoid them that cutting taxes can increase revenues. What he was wrong about was in thinking that income tax rates were already so high in the 1970s that cutting them would raise revenues.

Research has shown that middle-income wage earners would benefit most from a large reduction in corporate tax rates. The corporate tax is not a rich-man's tax. Corporations don't even pay it. They just pass the tax on in terms of lower wages and benefits, higher consumer prices, and less stockholder value.