Top 1200 Tax Rates Quotes & Sayings - Page 6

Explore popular Tax Rates quotes.

Last updated on December 18, 2024.

When you consider that a steelworker who's making $40,000 a year has virtually the same tax burden as someone who's making $400,000 a year, you see that there are inequities. This administration has used the tax code to accelerate wealth to the top. Most of the tax breaks have gone to people in the top bracket.

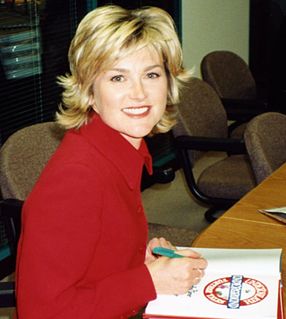

OK, so this pack - tax package includes about 50 tax breaks. None of them are new. They were all existing tax breaks. What this did was make them permanent. It gives some certainty for people when they're filing taxes that they don't have to wonder if Congress is going to renew them year after year.

Imagine if you had genuine, high-quality early-childhood education for every child, and suddenly every black child in America - but also every poor white child or Latino [child], but just stick with every black child in America - is getting a really good education. And they're graduating from high school at the same rates that whites are, and they are going to college at the same rates that whites are, and they are able to afford college at the same rates because the government has universal programs. So now they're all graduating.

The tax that was supposed to soak the rich has instead soaked America. The beneficiary of the income tax has not been the poor, but big government. The income tax has given us a government bureaucracy that outnumbers the manufacturing work force. It has created welfare dependencies that have entrapped millions of Americans in an underclass that is forced to live a sordid existence of trading votes for government handouts.

Ultimately, I would like to say yes, conditions have improved, but there is still vast room for more improvement; we are still the poorest of the poor. And we are still statistically considered to be extremely disrupted culturally, and have extreme health needs in many areas, as well as high suicide rates and infant mortality rates.

In December, I agreed to extend the tax cuts for the wealthiest Americans because it was the only way I could prevent a tax hike on middle-class Americans. But we cannot afford $1 trillion worth of tax cuts for every millionaire and billionaire in our society. We can't afford it. And I refuse to renew them again.

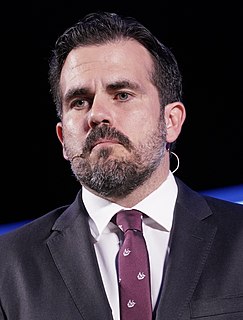

We're trying our best to develop sort of strategies. We have already turned into law a labor reform law that will allow for more opportunities to ensue. We have also established a permits law that will facilitate permits in Puerto Rico. We are about to roll out a comprehensive tax reform that will enhance the base and will reduce the rates in Puerto Rico.

Once you have an equalization instrument in place, as you have in Canada, there arise tremendous bureaucratic values - bureaucratic rent so to speak - in maintaining the system that you have. To shift to a system that paid the transfers directly to individuals, by having differential rates of federal income tax levied to adjust to provincial fiscal capacities, which would be my preference, you would have huge bureaucratic opposition. People would try to protect the rents they have in the current system of institutions.

All those predictions about how much economic growth will be created by this, all of those new jobs, would be created by the things we wanted - the extension of unemployment insurance and middle class tax cuts. An estate tax for millionaires adds exactly zero jobs. A tax cut for billionaires - virtually none.

...It is statistically irrefutable that those American cities with stringent "gun control" (e.g. N.Y.C., D.C., Chicago, L.A.) have higher crime rates. It is also irrefutable that those 31 states which have made conceal carry of handguns easy for law-abiding citizens have correspondingly enjoyed significant drops in their crime rates.

If you look at the performance of the zero-income-tax-rate states and the highest-income-tax-rate states, I believe a large amount of their difference is due to taxes. Not only is it true of the last decade, but I took these numbers back 50 years. And, there's not one year in the last 50 where the zero-income-tax-rate states have not outperformed the highest-income-tax-rate states.

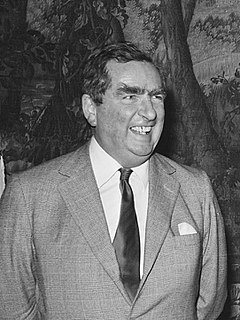

I think the Ronald Reagan tax reform proposals are a step toward distributive justice. They redistribute the tax burden more equitably and more progressively among individuals and call upon business to carry a somewhat larger proportion of the total tax load. Both of these are steps toward equity and distributive justice.

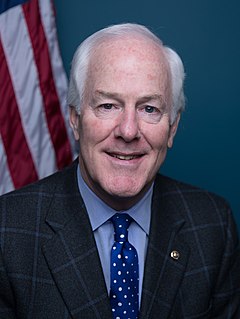

The only reason the president insists on raising [tax] rates is because he knows it will destroy Republican unity, it will cause a complete fracture of the Republican majority in the house, it will hand him a Congress that he can then manipulate for the next two years at least because the Republicans will be neutered. ... This is entirely a political action, a way to get a surrender from the Republicans.

I think we should have basically the same tax policy that Germany, Japan, the U.K., everybody else has, which is a tax rate in the mid-20s and no loopholes. Zero. The U.S. has the most antiquated tax system. And that means some people are going to pay more taxes, and some people are going to pay less.

You may have heard that Donald Trum has long refused to release his tax returns, the way every other nominee for president has done for decades. You can look at 40 years of my tax returns. I think we need a law that says, if you become the nominee of the major parties, you have to release your tax returns.