Top 1200 Tax Rates Quotes & Sayings - Page 7

Explore popular Tax Rates quotes.

Last updated on December 18, 2024.

Mr. Speaker, in 1848, Karl Marx said, a progressive income tax is needed to transfer wealth and power to the state. Thus, Marx's Communist Manifesto had as its major economic tenet a progressive income tax. Think about it, 1848 Karl Marx, Communism.... I say it is time to replace the progressive income tax with a national retail sales tax, and it is time to abolish the IRS, my colleagues. I yield back all the rules, regulations, fear, and intimidation of our current system.

There is the general belief that the corporation income tax is a tax on the "rich" and on the "fat cats." But with pension funds owning 30% of American large business-and soon to own 50%-the corporation income tax, in effect, eases the load on those in top income brackets and penalizes the beneficiaries of pension funds.

The benefits of a modest warming would outweigh the costs - by $8.4 billion a year in 1990 dollars by the year 2060, according to Robert Mendelsohn at Yale University - thanks to longer growing seasons, more wood fiber production, lower construction costs, lower mortality rates, and lower rates of morbidity (illness).

Since 2008 you've had the largest bond market rally in history, as the Federal Reserve flooded the economy with quantitative easing to drive down interest rates. Driving down the interest rates creates a boom in the stock market, and also the real estate market. The resulting capital gains not treated as income.

If we choose to keep those tax breaks for millionaires and billionaires, if we choose to keep a tax break for corporate jet owners, if we choose to keep tax breaks for oil and gas companies that are making hundreds of billions of dollars, then that means we've got to cut some kids off from getting a college scholarship.

Contrary to the rhetoric emanating from the American left, the 'rich' are currently paying a lot more than 'their fair share.' It is only a handful of mega-rich, those whose entire incomes are derived from dividends and capital gains, rather than salaries or business profits, who have the ability to pay lower tax rates than some members of the middle class. The left knows this but continues to build their 'freeloading millionaire' straw man because it makes good politics.

Congress is supposed to fund the IRS, and it has been steadily reducing the number of auditors and tax collectors the IRS has at the very time that the tax system has become vastly more complicated. And of course America continues to grow, so there's an increasing number of tax returns coming in. The IRS responds by doing exactly what Congress expects of them. That shouldn't surprise anyone. All bureaucracies do what they are told.

We need real tax reform which makes the rich and profitable corporations begin to pay their fair share of taxes. We need a tax system which is fair and progressive. Children should not go hungry in this country while profitable corporations and the wealthy avoid their tax responsibilities by stashing their money in the Cayman Islands.

In 2013 Citigroup had profits of $6.4 billion in the United States. They paid no federal income tax and, in fact, received a rebate from the IRS of $260 million. That same year J.P. Morgan had $17.2 billion in profits in the U.S. They also paid no federal income tax. Do you think it's time for tax reform?

The reason we've been growing at 1.8 percent for the last eight, ten years, which is way below the historical average, is in large part because of our tax code. It is important to us to get the biggest, broadest tax reduction, tax cuts, tax reform that we can possibly get because it's the only way we get back to 3 percent growth. That's what's driving all of this, how do you get the American economy back on that historical growth rate of 3 percent and out of these doldrums of 1.8, 1.9 that we had of the previous Barack Obama administration?

When two working people decide to marry, their federal income tax is usually increased. As soon as one spouse earns at least 20 percent of a married couple's total income, the couple pays a 'marriage tax.' ... The United States is the only major industrialized nation in the free world in which the tax cost of the second [married] earner's entry into the work force is higher than that of the first. On one hand, our government's social policy is to help working women earn equal salaries to those of men, but on the other we have a tax structure that penalizes them when they do so.

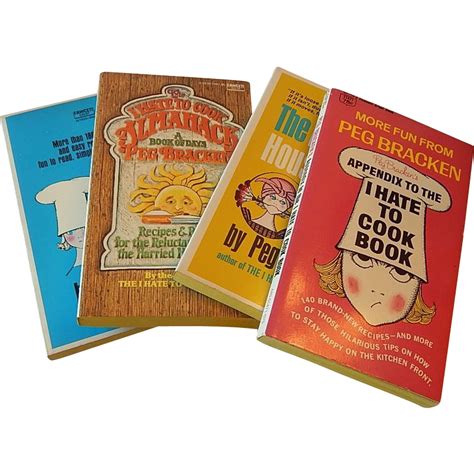

Taxing Women is a must-have primer for any woman who wants to understand how our current tax system affects her family's economic condition. In plain English, McCaffery explains how the tax code stacks the deck against women and why it's in women's economic interest to lead the next great tax rebellion.