Top 1200 Tax Rates Quotes & Sayings - Page 9

Explore popular Tax Rates quotes.

Last updated on December 19, 2024.

Eventually we'll use a CO2 tax offset by a reduction in taxes elsewhere alongside a cap-and-trade plan, but the degree of difficulty associated with a CO2 tax far exceeds that with a cap-and-trade plan. We're seeing it's hard to get a cap-and-trade plan and it's much easier to use as a basis for a global agreement than a CO2 tax.

Though tax records are generally looked upon as a nuisance, the day may come when historians will realize that tax records tell the real story behind civilized life. How people were taxed, who was taxed, and what was taxed tell more about a society than anything else. Tax habits could be to civilization what sex habits are to personality. They are basic clues to the way a society behaves.

Justice [Sonia]Sotomayor said, "Let's talk - you want to talk about the tax power."And I got like a 10-minute run on the tax power. And, boy, was I glad I did because I was able to get across this idea that, yes, this is a narrower ground on which you can affirm it. And I think everybody agrees. I think even the dissenting justices ultimately in the case agreed that, if Congress had expressly called it a tax, it would be indisputably constitutional.

Credit card companies are jacking up interest rates, lowering credit limits, and closing accounts - and people who have made timely payments are not exempt. So even if you pay off your balance - and that's tough when interest rates are insanely high - there's a good chance your credit limit will be slashed, and that will hurt your FICO score.

I don't think it's possible for the Fed to end its easy-money policies in a trouble-free manner. Recent episodes in which Fed officials hinted at a shift toward higher interest rates have unleashed significant volatility in markets, so there is no reason to suspect that the actual process of boosting rates would be any different. I think that real pressure is going to occur not by the initiation by the Federal Reserve, but by the markets themselves.

In the 10 cities with the nation's highest obesity rates, the direct costs connected with obesity and obesity-related diseases are roughly $50 million per 100,000 residents. And if these 10 cities just cut their obesity rates down to the national average, all added up they combine to save nearly $500 million in healthcare costs each year.

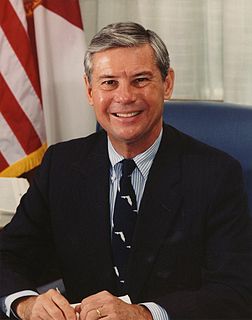

I prefer an income tax, but the truth is I am afraid of the discussion which will follow and the criticism which will ensue if there is an other division in the Supreme Court on the subject of the income tax. Nothing has injured the prestige of the Supreme Court more than that last decision, and I think that many of the most violent advocates of the income tax will be glad of the substitution in their hearts for the same reasons. I am going to push the Constitutional amendment, which will admit an income tax without questions, but I am afraid of it without such an amendment.