Top 1200 Tax Reform Quotes & Sayings - Page 2

Explore popular Tax Reform quotes.

Last updated on November 27, 2024.

Reform immigration to make it easy for individuals to come over here, be documented, pay taxes - immigration reform is needed to state that its about work, its not about welfare... Set up a grace period where they can get a work permit... social security card so that they can pay income tax, social security, Medicare.

Winning control of the Senate would allow Republicans to pass a whole range of measures now being held up by Reid, often at the behest of the White House. Make it a major reform agenda. The centerpiece might be tax reform, both corporate and individual. It is needed, popular and doable. Then go for the low-hanging fruit enjoying wide bipartisan support, such as the Keystone XL pipeline and natural gas exports, most especially to Eastern Europe. One could then add border security, energy deregulation and health-care reform that repeals the more onerous Obamacare mandates.

The reason we've been growing at 1.8 percent for the last eight, ten years, which is way below the historical average, is in large part because of our tax code. It is important to us to get the biggest, broadest tax reduction, tax cuts, tax reform that we can possibly get because it's the only way we get back to 3 percent growth. That's what's driving all of this, how do you get the American economy back on that historical growth rate of 3 percent and out of these doldrums of 1.8, 1.9 that we had of the previous Barack Obama administration?

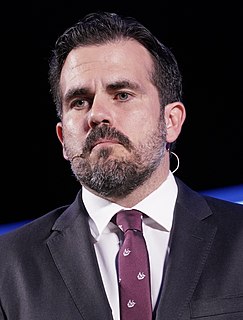

We're trying our best to develop sort of strategies. We have already turned into law a labor reform law that will allow for more opportunities to ensue. We have also established a permits law that will facilitate permits in Puerto Rico. We are about to roll out a comprehensive tax reform that will enhance the base and will reduce the rates in Puerto Rico.

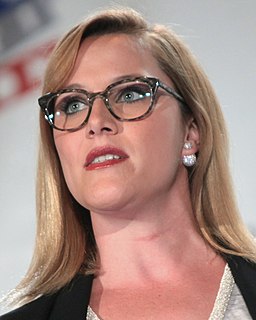

I'm not only a lawyer, I have a post doctorate degree in federal tax law from William and Mary. I work in serious scholarship and work in the United States federal tax court. My husband and I raised five kids. We've raised 23 foster children. We've applied ourselves to education reform. We started a charter school for at-risk kids.

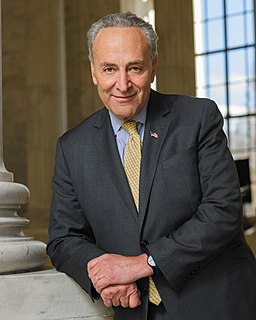

I may sound naive, since everyone's decided the next two years are going to be all about 2016, but I look at what's happened over the years when there's been divided government. That's when we've done tax reform, that's when we've done entitlement reform - to move this economy forward on these big issues.

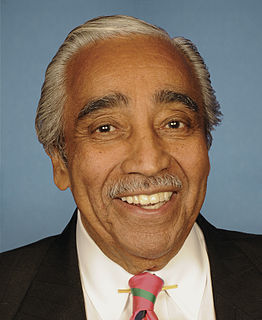

The Democrats and Republicans need to come together. I've criticized Democrats for their unwillingness to address entitlement reform and Social Security and Medicare. Republicans, on the other hand, never saw a tax that they liked, even when it meant closing tax loopholes. They don't want to in any way support any revenue enhancements.

The 9-9-9 plan would resuscitate this economy because it replaces the outdated tax code that allows politicians to pick winners and losers, and to provide favors in the form of tax breaks, special exemptions and loopholes. It simplifies the code dramatically: 9% business flat tax, 9% personal flat tax, 9% sales tax.

The day after Republicans won solid majorities in the House and Senate, House Speaker John Boehner and Senate Majority Leader-to-be Mitch McConnell outlined priorities for the newly elected Congress. High on the list is fundamental tax reform. In addition to overhauling the federal tax code, however, Congress should rein in the Internal Revenue Service.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

Fundamentally, I've always been a fan of actually looking at our whole state tax system and really figuring out how we reform our tax system so that everyone's paying their fair share but we don't have a lot of nickel and diming with 100 taxes that end up hitting people that maybe can't bear it the most.

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.

The Value-Added Tax, a sales tax that applies at every level of business transactions, is an easy tax for governments to collect, and a hard tax to evade. So it makes the job of raising revenue easier. The revenues from the VAT can then be used to lower taxes on income and saving and investment. The Value-Added tax doesn't penalize work or saving; it's a tax on buying stuff.

I think the work on tax reform, the work that's being done on regulatory reform is very important. And just having a seat at the table, I think, is so important for business today as we think about what's going to benefit the economy of this country, how we're going to create great manufacturing jobs.