Top 1200 Tax Returns Quotes & Sayings - Page 12

Explore popular Tax Returns quotes.

Last updated on December 18, 2024.

People in my hometown voted for President Reagan - for many, like my grandpa, he was their first Republican - because he promised that tax cuts would bring higher wages and new jobs. It seemed he was right, so we voted for the next Republican promising tax cuts and job creation, George W. Bush. He wasn't right.

It's tax day and while many Americans are filing their taxes with a groan, taxpayers in the Badger State have reason to cheer. In Wisconsin, we have enacted more than $2 billion in tax cuts, giving our citizens much-needed relief, call us crazy Midwesterners but we think you know how to spend your money better than the government.

If you can clean up the cesspool of the tax code and give us a pro-growth tax code, that is how you grow the economy. That`s how you take power and money out of Washington and give it back to the people and we are so excited. We have a president [Donald Trump] that is here to work with us in doing that.

According to the IRS, the wealthiest 400 Americans, who earned an average of roughly $270 million in 2008, paid an average tax rate of just 18.2 percent that year. That's about the same rate paid by a single truck driver in Rhode Island. It's not right, and we need to restore fairness to our tax code.

It's one thing to maintain that upper-income earners should pay higher tax rates because they are better able to shoulder the burden for essential government services. But it's constitutional blasphemy to claim that the tax code should be used as a weapon against the wealthy and that the state should be the tyrannical arbiter of how income is distributed.

The real estate lobby has prominent allies in both parties. After the last major overhaul of the tax code, in 1986 - under a Republican president, Ronald Reagan, a Republican Senate and a Democratic House - it was a Democrat, Bill Clinton, who signed legislation that restored lost real estate tax breaks seven years later.

We pursued the wrong policies. George Bush is not on the ballot. Bill Clinton is not on the ballot. Mitt Romney is on the ballot, and Barack Obama is on the ballot. And Mitt Romney is proposing tax reform, regulatory reform, a wise budget strategy and trade. The president has proposed tax increases.

There have been brilliant satires about the tax bureaucracy before, from the Beatles song ‘The Taxman’ to the film ‘Harry’s War,’ but in some ways Jim Greenfield’s The Taxman Cometh outdoes them all. His tale of a little guy who can’t take it anymore is both compelling and timely, given the tax scandals we read about in Washington almost every day.

It is a wise rule and should be fundamental in a government disposed to cherish its credit, and at the same time to restrain the use of it within the limits of its faculties, "never to borrow a dollar without laying a tax in the same instant for paying the interest annually, and the principal within a given term; and to consider that tax as pledged to the creditors on the public faith."

Labour ministers often look puzzled when reports show that Britain has one of the lowest levels of social mobility in the developed world. They just don't get it. They see poverty, inequality, fairness, as all about income. For the past 12 years, they have relied on tax credits to solve this. But tax credits do not solve poverty: they mask it.

Generally, an indie film in the U.K. is put together much like in the states. We got a tax credit. You sell the domestic rights, which can be quite low, but it's enough to push you over the line. And you get a tax credit on top of that, and then you cobble it together with private equity or gap financing and things like that.

John Marshall's warning that the power to tax is the power to destroy has taken on far greater meaning... more specifically, the power of the Internal Revenue Service is threatening to destroy the freedom of religion , guaranteed by the First Amendment. As part of that guarantee, Congress has granted tax exemptions for churches to avoid excessive interference in their religious activities.

Canada, the United States and Mexico, we developed these energy reserves that we have in this North American region. And you can see a not only driving down the cost of electricity but a major manufacturing boom in this country. Couple that with tax policy, reduction, reducing the corporate tax rate, and that I think a renaissance in manufacturing like we've never seen in this country and really drive the economy.

If one individual, or one class, can call in the aid of authority to ward off the effects of competition, it acquires a privilege and at the cost of the whole community; it can make sure of profits not altogether due to the productive services rendered, but composed in part of an actual tax upon consumers for its private profit' which tax it commonly shares with the authority that thus unjustly lent its support.

Wall Street is being investigated, but they are not asleep while it's being done. You see where the Senate took that tax off the sales of stocks, didn't you? Saved 'em $48,000,000. Now, why don't somebody investigate the Senate and see who got to them to get that tax removed? That would be a real investigation.

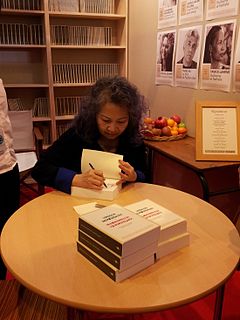

I have been privileged to write across multiple facets of my life: to write romance novels, to write memoir, to write about leadership, and to write tax and social policy articles. The act of writing is integral to who I am. I'm a writer, a politician, a tax attorney, a civic leader, and an entrepreneur. I am proud of what I've accomplished.

Political courage requires clarity. The Obama Administration chose the tortured route of arguing the legality of the individual mandate via the interstate commerce clause for one simple reason: it did not want to take the political risk of allowing opponents to call it a tax increase. That was stupid. The Republicans were calling it a tax increase anyway.

All taxes, except a 'lump-sum tax,' introduce distortions in the economy. But no government can impose a lump-sum tax - the same amount for everyone regardless of their income or expenditures - because it would fall heaviest on those with less income, and it would grind the poor, who might be unable to pay it at all.